Microsoft FY25Q1 Earnings Preview: Will Concerns Over Copilot’s AI Returns Ease?

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

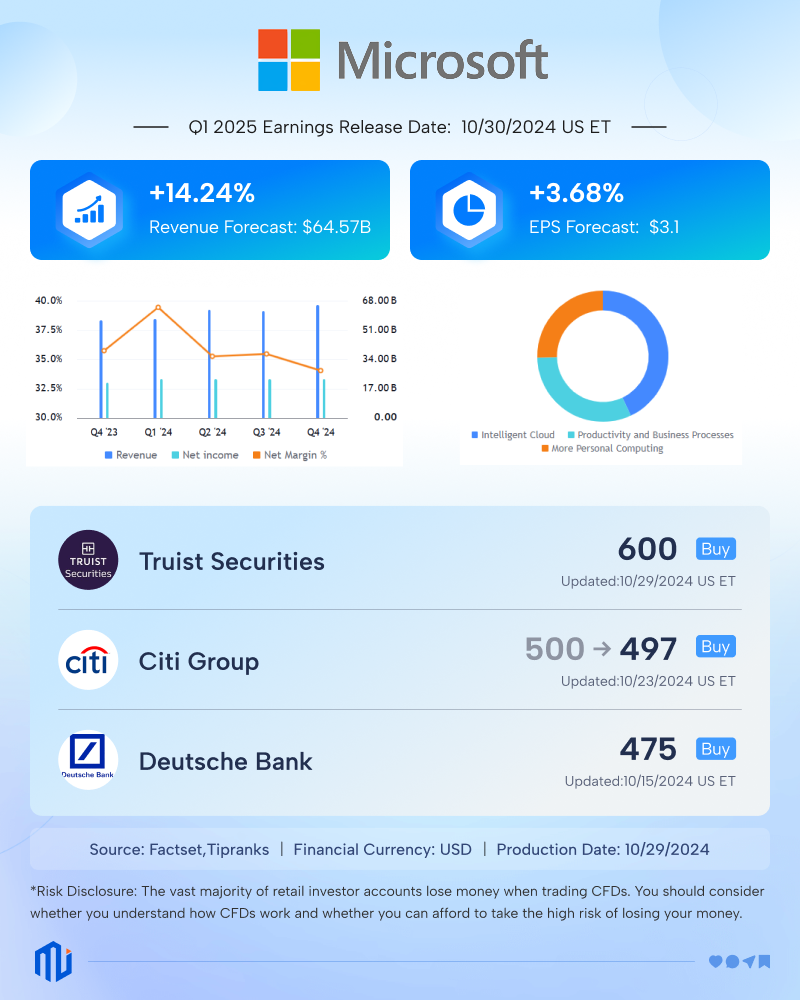

Insights - Microsoft (MSFT) is set to announce its Q1 FY2025 earnings after the market closes on October 30, 2024. While Microsoft leads the AI narrative with its investment in ChatGPT developer OpenAI, the development of its own AI tool, Copilot, has faced challenges. Will this earnings report bring any surprises?

According to FactSet, analysts expect Microsoft’s 25Q1 revenue to grow by 14.24% year-over-year to $64.57 billion, with earnings per share (EPS) increasing by 3.68% to $3.10.

Past Stock Performance After Earnings

Notably, Microsoft has exceeded market expectations for EPS in the past eight quarters and surpassed revenue expectations in the last six quarters. However, despite these strong earnings, Microsoft’s stock has only risen 37.5% of the time (3 out of 8 times) on the first trading day after earnings announcements.

For example, after reporting Q4 FY2024 results in late July, Microsoft’s stock fell 1% due to weaker-than-expected cloud performance.

Source: Tipranks, Microsoft Stock Performance Before and After Earnings

Key Focus: Cloud Growth and AI Spending

Investors are keenly focused on Microsoft’s cloud growth and AI-related spending and returns.

Morgan Stanley analysts have expressed concerns about Microsoft’s earnings, citing increased capital expenditures, margin pressures, a lack of clear returns from AI investments, and confusion following the financial reorganization.

According to Visible Alpha, analysts expect Microsoft’s Azure cloud division to grow by 33% year-over-year in Q1, aligning with the company’s August forecast of $23.8 billion to $24.1 billion, though slightly below Q4’s growth.

Deutsche Bank analysts suggest that to meet high investor expectations, Microsoft must deliver strong Azure performance and guidance, with no signs of a slowdown.

Analysts also expect Microsoft’s capital expenditures for FY2025 to surge by 71.7% to $19.23 billion. In July, Microsoft informed investors that it would continue to make significant AI investments, raising concerns about whether increased spending will yield returns, which has weighed on the stock.

Goldman Sachs remains optimistic, viewing Microsoft’s spending as a necessary investment ahead of a structural shift toward generative AI, which could unlock significant revenue opportunities across various AI technology layers.

Copilot's Slow Progress

Despite heavy investment, adoption of Microsoft’s $30-per-month Copilot has been slow, with a Gartner survey showing most companies still in the pilot phase. However, analysts see growth potential as Microsoft explores AI agents. This month, the company introduced AI-powered tools for automating tasks like filtering sales leads.

CEO Satya Nadella mentioned that the company is approaching a significant advancement in AI agents. Microsoft also revealed that 60% of Fortune 500 companies are using Microsoft 365 Copilot to boost productivity.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.