Here is what you need to know on Tuesday, July 22:

The US Dollar (USD) started the week under pressure and registered large losses against its major rivals on Monday. Although the USD holds its ground early Tuesday, investors refrain from positioning themselves for a steady recovery, while keeping a close eye on headlines surrounding the ongoing feud between United States (US) President Donald Trump and Federal Reserve (Fed) Chairman Jerome Powell.

US Dollar PRICE This week

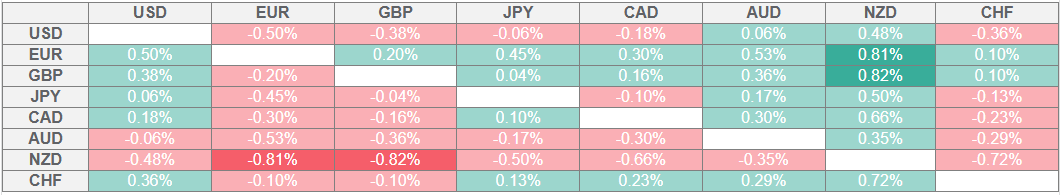

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the weakest against the Euro.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Citing a letter sent to the Department of Justice (DoJ), Fox News reported late Monday that Representative Anna Paulina Luna has referred Fed Chairman Jerome Powell to the DoJ for criminal charges, accusing him of perjury on two occasions. Earlier in the day, Treasury Secretary Scott Bessent told CNBC that they need to review the entire Fed institution and its performance, citing the Fed's "fear-mongering over tariffs" amid a lack of significant signs of inflation as justification. The USD Index lost more than 0.6% on Monday and erased almost all the gains it registered in the previous week. Early Tuesday, the USD Index fluctuates in a tight channel at around 98.00. Meanwhile, US stock index futures trade flat after Wall Street's main indexes closed mixed on Monday.

The US economic calendar will feature Richmond Fed Manufacturing Index for July later in the day. Fed Chairman Jerome Powell and Fed Vice Chair for Supervision Michelle Bowman are scheduled to speak during the American trading hours. Since the Fed is in the blackout period, however, they are unlikely to comment on the monetary policy outlook.

EUR/USD stays in a consolidation phase slightly below 1.1700 after posting strong gains on Monday. The European Central Bank (ECB) will publish the Bank Lending Survey in the European session.

The Reserve Bank of Australia (RBA) published the Minutes of its July monetary policy meeting on Tuesday, highlighting that the board agreed further rate cuts warranted over time and focus was on timing and extent of easing. After closing in positive territory on Monday, AUD/USD corrects lower and trades at around 0.6500 in the European morning on Tuesday.

Japan's top trade negotiator, Ryosei Akazawa, said on Tuesday that he met US Commerce Secretary Howard Lutnick for two hours in Washington on Monday, seeking an agreement benefiting both Japan and the US. Following Monday's sharp decline, USD/JPY recovers toward 148.00 early Tuesday.

GBP/USD benefited from the broad-based USD weakness and rose abut 0.6% on Monday. The pair edges lower but holds above 1.3450 in the European session on Tuesday.

Gold gathered bullish momentum and gained more than 1% on Monday to touch its strongest level in a month. After coming within a touching distance of $3,400, XAU/USD stages a technical correction and declines toward $3,380 in the European morning.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.