ServiceNow: Strength Meets Valuation Gravity

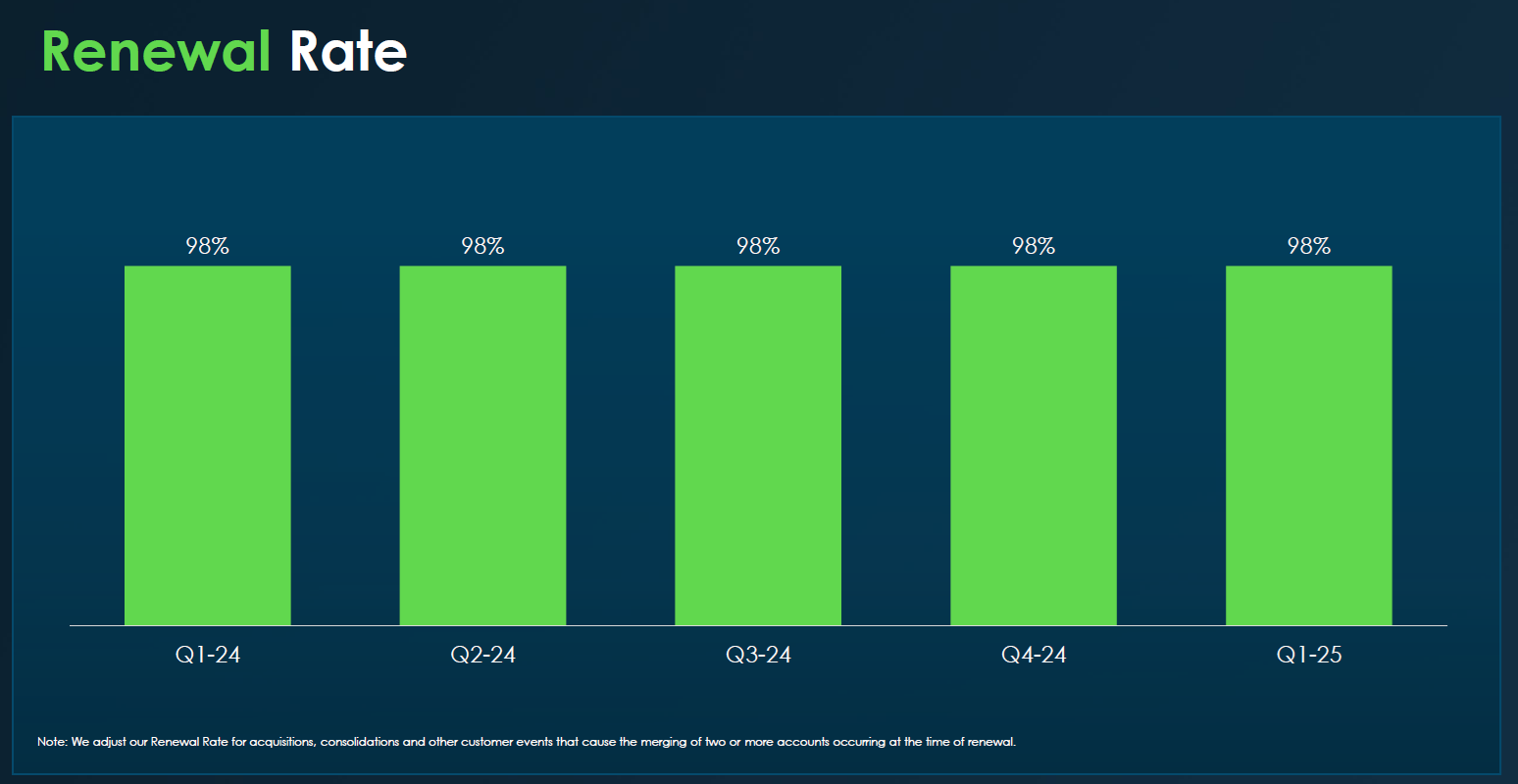

- ServiceNow reported $3.005 billion in Q1 2025 subscription revenue, up 19% year-over-year, with a 98% renewal rate.

- Valuation stands at 57x non-GAAP and 109x GAAP forward earnings, with limited upside priced for near-perfect execution.

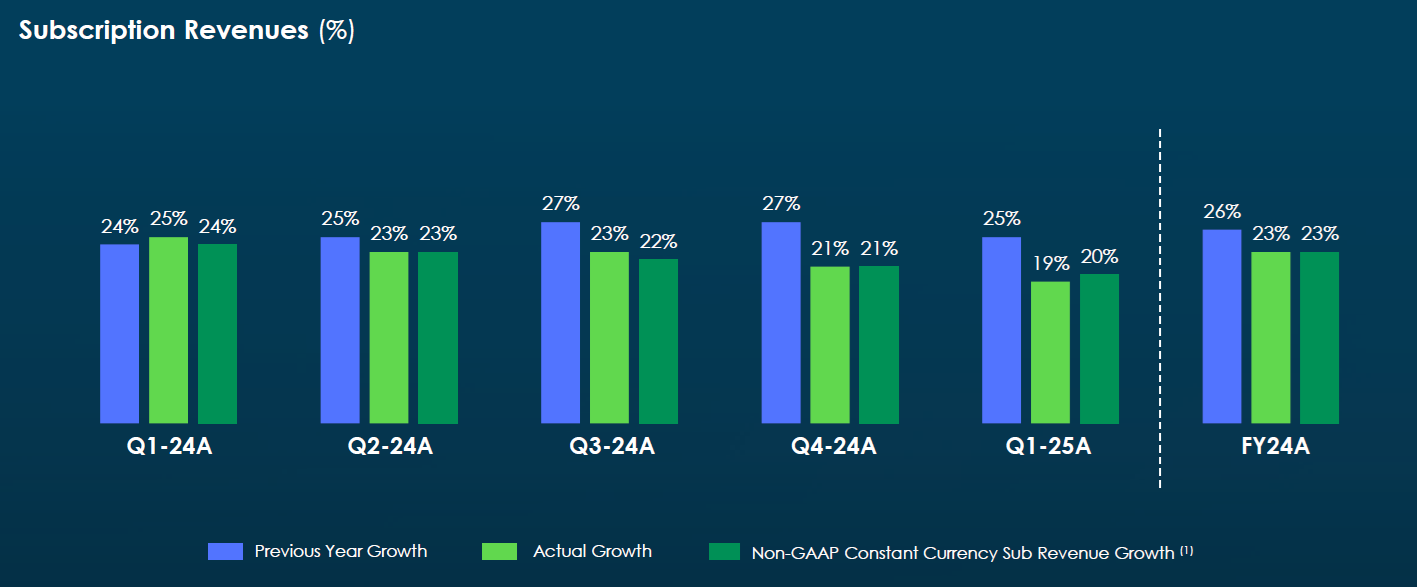

- Free cash flow reached $3.5 billion in 2024, with a 32% margin, but growth is slowing from 25% to 19%.

- Rising competition from Microsoft and Salesforce, combined with macro uncertainty, adds risk to ServiceNow’s premium pricing model.

TradingKey - ServiceNow's (NOW) rise from a niche provider of IT service management software to the "AI Platform for Business Transformation," by its own admission, is more than just a branding evolution. It represents a profound re-architecture of the company on a deep level.

As digital transformation strategies mature and AI transforms operational processes, ServiceNow finds itself at the center of the industry's automation pivot. But this positioning comes at a tremendous cost.

Trading at a forward price-to-earnings ratio of 57x on non-GAAP measures and a staggering 109x on GAAP measures, ServiceNow's stock embeds vast expectations at a time of macro uncertainty and intensifying competition.

Whether the operational excellence and platform entrenchment of ServiceNow are powerful enough to run past valuation gravity or if mean reversion will get the better of the stock at some point, remains the central question facing investors.

This piece analyzes the heart of the ServiceNow investment thesis: a company aligned with strong secular trends and rising strategic importance, even as it confronts significant fundamental and valuation risks.

The AI Engine Behind ServiceNow's Ambitions

ServiceNow's business model is built on a common cloud-based platform, the Now Platform, which unites workflows across technology and key business operations such as HR, finance, purchasing, CRM, and custom-built enterprise software. This design makes it possible for ServiceNow to realize key scale efficiencies as well as customer lock-ins since the customer constructs mission-critical process layers on its hyperautomation and low-code tools.

Source: ServiceNow

ServiceNow reported first quarter 2025 subscription revenue of $3.005 billion, a 19% year-over-year increase, with cRPO up 22%. Customer stickiness remains very high, as the renewal rate stands at 98% and 508 accounts are currently generating over $5 million of annual contract value; a 20% year-over-year gain.

Source: ServiceNow IR

ServiceNow's strategic turn toward agentic AI marks a fundamental evolution. New features such as AI Agent Studio, AI Agent Orchestrator, and industry-vertical AI agents for telecom signal the platform's migration from workflow automation to smart orchestration. The recent acquisitions of Moveworks and Logik.ai reinforce its leadership at the convergence point of enterprise search, CRM, and customer service automation.

Internally, ServiceNow is leveraging AI to fuel profound operational efficiencies, expand margins and cash flow, and accelerate ROI for its customers. These forces underpin the company’s goal of being the defining enterprise software company of the 21st century.

Frontlines: Friendships Today, Battlefields Tomorrow

Though ServiceNow’s alliances with Nvidia, Google Cloud, Vodafone Business and the like demonstrate the strength of its ecosystem, such ties exist uncomfortably alongside the harsher reality of growing competition. Competitors such as Salesforce, Microsoft, and Workday are aggressively integrating AI functionality into the platforms at a breakneck speed.

Salesforce’s Einstein 1 Platform integrates AI into sales, service, and marketing workflows, directly challenging ServiceNow’s CRM and service management strengths.

Microsoft's Power Platform, enhanced with Copilot AI, competes head-on in the no-code/low-code automation market. Meanwhile, public cloud behemoths drive native AI workflows, threatening the third-party layers of platforms like ServiceNow.

In the face of these pressures, ServiceNow’s differentiation lies in its deep integration, unified data models, and customizable low-code environment. Its capacity to orchestrate complex workflows across IT, HR, finance, and customer service within a single solution provides a joined-up experience that siloed competitors cannot match.

However, its premium pricing and high-touch model expose it to discretionary cost-cutting during downturns, a threat that remains relevant amid the prevailing global uncertainty.

Unraveling the Growth Drivers: Long-Lasting, But Not Risk-Free

ServiceNow's near-term growth drivers are based on strong secular trends: the need for digital transformation, AI-based enterprise workflows, and cloud-native business processes.

The company anticipates full-year 2025 subscription revenues of $12.64 to $12.68 billion, representing approximately 19% constant-currency growth. Free cash flow margin is expected to reach 32%, reflecting strong operating leverage despite continued investment in AI.

That said, the growth curve is maturing. Subscription revenue growth decelerated from 25% in 2023 to a projected 19% in 2025. Even among customers spending over $5 million annually, expansion rates remain strong but are becoming more incremental.

Source: ServiceNow IR

ServiceNow’s profitability remains robust. Non-GAAP gross margin on subscriptions continues to be at 84.5%, and non-GAAP operating margin stood at 31% in the most recent quarter. Free cash flow was $3.5 billion in 2024, with a margin above 30%.

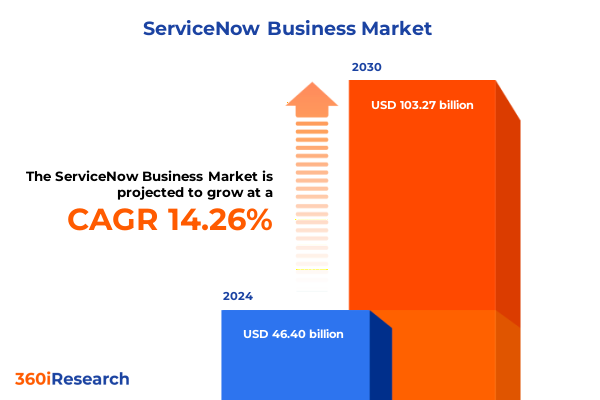

Strategically, ServiceNow's expansion into sectors such as government and telecom providers broadens the company's addressable market and diversifies its revenues away from its historical roots in traditional IT workflows. Acquiring sales and service capabilities increases platform stickiness and deepens wallet share.

Source: 360iresearch

However, execution risk is rising. AI cycles are shortening, customer expectations are climbing, and lower-cost competitors are gaining ground. ServiceNow’s ability to maintain rapid innovation without alienating its installed base will be key to sustaining leadership.

Valuation: The Truth Behind the Glaze

ServiceNow's operational performance is outstanding, but its valuation paints a more nuanced picture. With a forward price multiple of 57x on non-GAAP earnings and 109x on GAAP, the stock commands a significant premium over its SaaS peers. Its forward EV/Sales of 14x is well above the industry average.

Although the stock’s valuation is below pandemic-era highs, the current premium reflects assumptions of near-flawless execution: 18–20% revenue growth compounded over five years, along with expanding margins and resilient free cash flow.

Even under optimistic DCF estimates at 10% discount rates and modestly growing margins, fair estimates cluster between $760 and $820 a share. With the stock trading around $945, it already reflects a best-case scenario, leaving little room for error.

By comparison, peers such as Salesforce and Workday have lower forward multiples, suggesting that the market's lofty expectations regarding differentiation and durability of the company. Whether those expectations hold up amid rising competition and macro uncertainty remains a central concern

Risk Radar: AI disintermediation, macro sensitivity, execution complexity

A number of risks might disturb ServiceNow’s growth story. The sudden commoditization of AI agent functionality would weaken the premium that the platform currently enjoys. Businesses might increasingly turn towards open-source or lower-priced AI orchestration tools under cost-sensitive conditions.

Macro uncertainty also hangs over the company, especially within international markets that account for more than a third of ServiceNow’s revenues. While Q1 results are resilient, historic declines indicate that even mission-critical SaaS providers may suffer from deferred purchasing and slowing expansion rates amid economic duress.

Organizational complexity represents another challenge. Assimilating acquisitions like Moveworks and Logik.ai without fragmenting the unified Now Platform will test ServiceNow’s operational discipline.

Ultimately, a stretched valuation exaggerates the effects of even modest underperformance. Any short-term deviation from anticipated top-line growth or margin improvement may provoke severe multiple compression, disproportionately hurting returns for new investors.

Conclusion: An Ace Gemstone, But Adorned with Precaution

ServiceNow continues to be a structurally advantaged compounder, riding some of the strongest trends in enterprise tech.

But its elevated valuation, rising competition, and growing execution risk mean upside appears limited from current levels.

Institutional investors may want to wait for a deeper market correction or a company-specific dislocation before initiating or adding at a more attractive risk-reward setup.