Here's Why Berkshire Hathaway Stock Is a Buy Before Nov. 1

Wall Street tracks the moves of Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) very closely. Every nuance is dissected to get a sense of what Chief Executive Officer Warren Buffett, who is usually pretty private about what he's doing and why, is thinking.

But there's definitely something big happening, and the third-quarter earnings update, which will likely take place in early November, will show investors just how big.

What does Berkshire Hathaway do?

It is actually quite difficult to describe Berkshire Hathaway's business because the company has its fingers in so many different industries. To simplify, it is an enormous, sprawling conglomerate. But the real truth is that the company is the investment vehicle of Buffett.

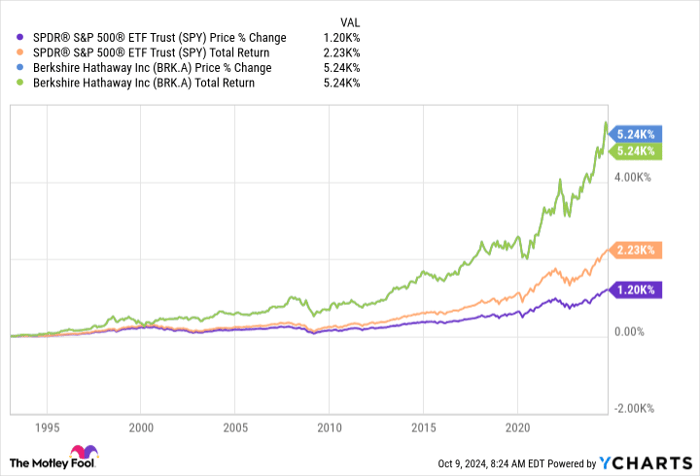

SPY data by YCharts

Given the incredible price advance of Berkshire Hathaway under his command, it makes sense that investors would want to pay close attention to the investment decisions he makes. That's actually a more descriptive statement than it seems because, in some ways, Berkshire Hathaway is more like a mutual fund than an operating company. Buffett likes to buy well-run companies while they are cheap, and then let the management teams of those businesses build them over time. It's the same approach that a stock investor would take -- only Buffett usually buys entire companies.

That said, Buffett is also a disciplined investor. If there's nothing he likes, he'll just sit on cash. With the market near all-time highs today, there's clearly nothing that Buffett likes right now because the cash is piling up on the company's balance sheet.

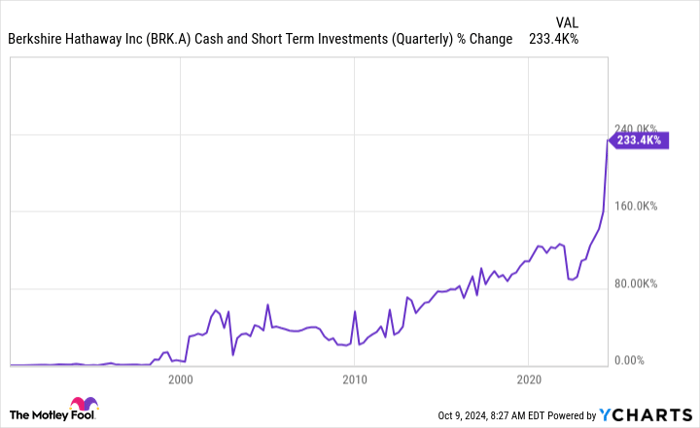

BRK.A Cash and Short Term Investments (Quarterly) data by YCharts

More cash is coming at Berkshire Hathaway

At the end of the second quarter, Berkshire Hathaway had a huge cash hoard. Cash alone tallied as much as $36.8 billion at the company's insurance operation and $5.4 billion in its railroad, utilities, and energy division.

That's big enough, but it isn't the entire picture, because Buffett invests in Treasury bills to earn interest on its cash. The insurance division held $234.6 billion in Treasury bills at the end of the second quarter, bringing the total cash and short-term investment figure up to a gigantic $277 billion or so.

And that number is only set to get bigger. Berkshire Hathaway has been taking profits in Apple (NASDAQ: AAPL) and Bank of America (NYSE: BAC) stock.

But don't look at this cash pileup as a negative. While it is true that Buffett clearly doesn't see anything he wants to buy right now, that is really a time-dependent issue. If there's a bear market, he's very likely to start putting that money to work.

What's interesting here is that Berkshire Hathaway is a monster of a company, with a market cap of nearly $1 trillion. It will take a monster of an acquisition to move the needle for the company. And that's just what it looks like Berkshire Hathaway is gearing up to make.

There's better and worse times, but no right time

Here's the thing: There's really no right or wrong time to hire Warren Buffett to manage your money, which is basically what you are doing when you buy Berkshire Hathaway. Sure, there are better and worse times, but if you want to benefit from the services of the Oracle of Omaha, now is as good a time as any to buy.

That said, given the profits Buffett is taking to bulk up his cash store, now might be a better time than you think, and you'll find out just how much better when the company reports on its balance sheet again in early November.

It's true that you might have to suffer some paper losses when the market crashes if you buy Berkshire today, but that's when the cash hoard being built will get put to work. Unless you have the investment fortitude to invest when everyone else is selling, which is a highly difficult emotional task and something that Buffett has proven he can do, buying now while you watch Buffett prepare for something big very well might be the best investment decision for you to make.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 7, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Bank of America, and Berkshire Hathaway. The Motley Fool has a disclosure policy.