Whale Flow to Binance Hits Six-Month Low at $3.27 Billion | Weekly Whale Watch

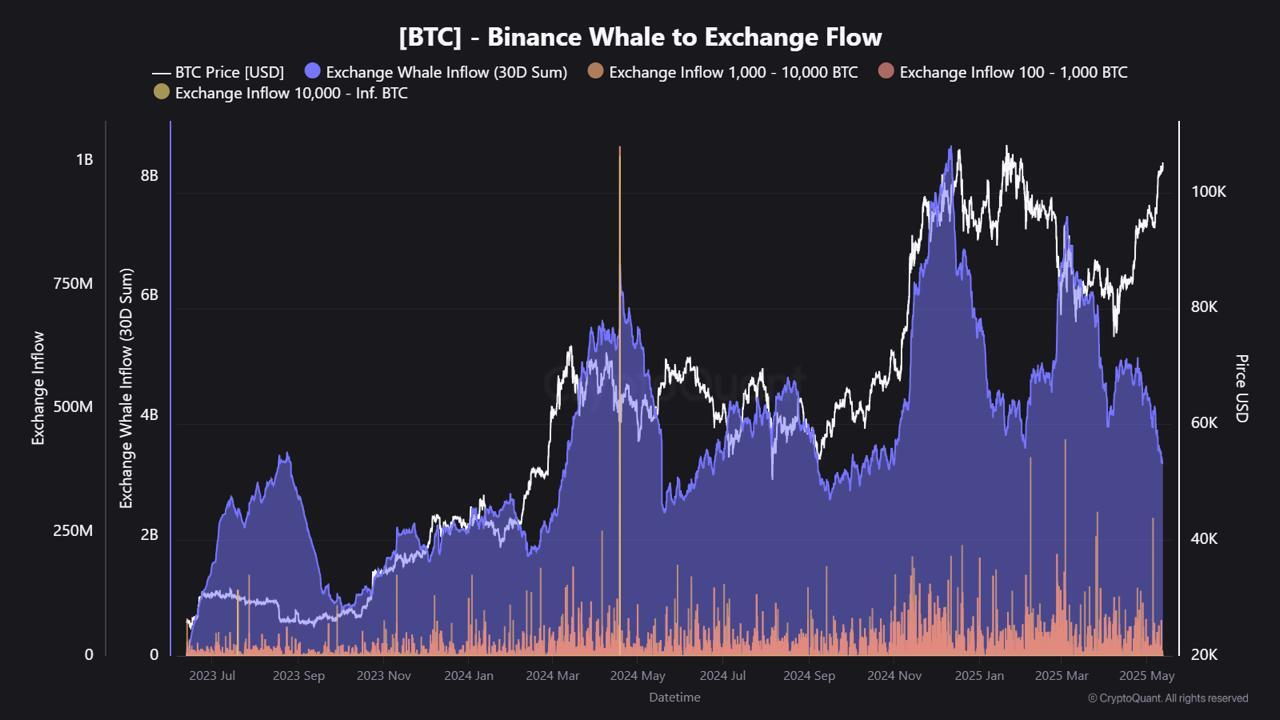

Bitcoin whales have moved just $3.27 billion of BTC to Binance over the past 30 days. This figure marks the lowest whale inflow since November 2024, according to CryptoQuant.

Consequently, this drop signals declining sell-pressure from major holders. Fewer coins entering exchange order books often underpin stronger price support.

Bitcoin Whales Continue Holding

CryptoQuant analyst JA Maartunn explains that during March and November 2024 rallies, whale inflows surged above $6.17 billion and $8.44 billion. Those peaks coincided with sharp pullbacks, as whales locked in gains at higher prices.

Furthermore, subdued whale deposits suggest holders now prefer to retain or relocate coins off-exchange. Many may move BTC into cold storage or over-the-counter venues, reducing visible supply.

Binance Whale Flow Chart. Source: CryptoQuant

Binance Whale Flow Chart. Source: CryptoQuant

As a result, the market faces tighter liquidity. Lower sell-walls on Binance create room for price advances. Traders often view this as a bullish backdrop.

On the price front, Bitcoin recently climbed to about $104,000. That rally found support partly because large-scale sell orders failed to materialize. Last week, CryptoQuant data showed that ‘new Bitcoin whales’ hold most of the capital.

These whales bought at an average price of $91,922, so they likely aim for a much higher selling price.

However, macro factors still influence market direction. Fed policy decisions, regulatory shifts and geopolitical events can trigger sudden supply surges.

In addition, on-chain metrics show long-term holders increasing their positions. Such accumulation often precedes sustained up-moves, as coins effectively vanish from the circulating supply.

Nonetheless, subdued whale activity does not guarantee uninterrupted gains. Retail sentiment, derivatives positioning, and institutional flows can reignite volatility.

Ultimately, the six-month low in Binance whale inflows reflects tentative confidence among large holders.

If whales maintain this restraint, Bitcoin may find firmer footing above $100,000. Yet market watchers will track any shift in whale behavior for early warning of changing sentiment.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.