Could Buying Microsoft Stock Today Set You Up for Life?

Key Points

Microsoft could produce market-beating returns moving forward.

The stock is valued at a recent low.

- 10 stocks we like better than Microsoft ›

Microsoft (NASDAQ: MSFT) has had a rough 2026. Its stock is down over 25% from its October highs, with the majority of that decline occurring in 2026. It's not often you see a well-established tech player like Microsoft decline so much, and it's even more rare to see it occur for no obvious reason.

This opens up a great buying opportunity for one of the most dominant tech companies out there. I think an investment now could help set you up for life, as it could provide market-beating returns over the next few years.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

All you need is a couple of extra percentage points over the S&P 500

The gold standard for comparing individual investing performance is the S&P 500. If you're beating the S&P 500, then you're doing a great job. Historically, the S&P 500 has returned around 10% annually. So, if you invest $500 a month in the S&P 500 and compound it over 29 years, congratulations, you're a millionaire.

Now, what happens if you can beat the S&P 500 by three percentage points annually? Well, now you've reduced that time to 25 years. While that may not sound like a lot, the difference becomes even more stark if you increase that 13% rate of return to 29 years. At the end of 29 years, the 10% rate of return yields $1.017 million, while the 13% return yields $1.915 million. That's nearly double the money, so finding stocks that can consistently beat the market can be a winning investing strategy.

A big part of this is finding stocks that are on sale for no good reason. I believe Microsoft falls into this category.

Its base software business continues to thrive, as does its approach to artificial intelligence (AI). Microsoft is acting more as an AI facilitator and offers several different generative AI models on its cloud computing platform, Azure. Azure also continues to grow at a rapid pace, and has a massive backlog of workloads it's trying to bring online.

In Q2 of fiscal year (FY) 2026 (ending Dec. 31), Microsoft delivered an impressive 17% year-over-year revenue growth. That doesn't sound like a company that deserves to be down more than 25% from its all-time high, especially when it doesn't have a premium valuation.

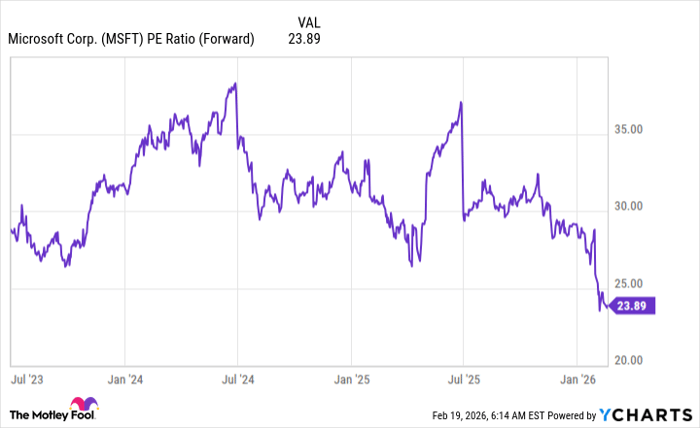

Microsoft now trades for 24 times forward earnings, the cheapest it has been in nearly three years. It's also not far off the S&P 500, which trades for 21.9 times forward earnings.

MSFT PE Ratio (Forward) data by YCharts

Deals like this don't come around often, and I think buying here is a great way to lock in mid-teens returns for the foreseeable future. This could accelerate your timeline to becoming a millionaire and help set you up for life.

Should you buy stock in Microsoft right now?

Before you buy stock in Microsoft, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Microsoft wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $424,262!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,163,635!*

Now, it’s worth noting Stock Advisor’s total average return is 904% — a market-crushing outperformance compared to 194% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 22, 2026.

Keithen Drury has positions in Microsoft. The Motley Fool has positions in and recommends Microsoft. The Motley Fool has a disclosure policy.