2 Value Stocks With Dividend Yields Over 5% to Buy Near 52-Week Lows

Key Points

General Mills slashed its full-year guidance, sending shockwaves throughout the packaged food industry.

Campbell’s is also facing earnings declines and margin pressure.

Both stocks are dirt cheap and can afford their generous dividends.

- 10 stocks we like better than General Mills ›

General Mills (NYSE: GIS) fell 7% on Feb. 17 after unexpectedly cutting its full-year fiscal 2026 guidance.

General Mills now expects organic net sales to decline between 1.5% and 2%, compared to a previous range of down 1% to up 1%. Meanwhile, adjusted diluted earnings per share (EPS) are now expected to fall by 16% to 20%, down from a previous range of a 10% to 15% decline.

Will AI create the world's first trillionaire? Our team just released a report on the one little-known company, called an "Indispensable Monopoly" providing the critical technology Nvidia and Intel both need. Continue »

The update was startling, given that General Mills reaffirmed its prior guidance just two months ago when it reported its second-quarter fiscal 2026 earnings.

General Mills and fellow packaged foods company Campbell's (NASDAQ: CPB) are now hovering around multiyear lows, with both stocks down more than 50% from all-time highs.

Here's why these value stocks are under pressure but worth buying now.

Image source: Getty Images.

A sectorwide slowdown

Consumer staples was the worst-performing sector in 2025. But the packaged food portion of the sector had an especially abysmal performance as many large companies hit multiyear or even multidecade lows.

Consumer preferences remain consistent for household and personal products, but they are changing for packaged foods. Consumers are increasingly interested in meals and snacks that taste good and are good for them. So companies like General Mills and Campbell's are getting hit with a one-two punch of a sectorwide slowdown and deteriorating brand value that could extend beyond the current cycle.

In its Feb. 17 press release, General Mills said, "Weak consumer sentiment, heightened uncertainty, and significant volatility have weighed on category growth and impacted consumer purchase patterns, resulting in a slower pace and higher cost of volume recovery than initially expected."

General Mills is well known for its cereal brands like Cheerios and Cinnamon Toast Crunch, but it also owns popular snack brands like Chex Mix and Gardetto's, Fiber One, Betty Crocker, Annie's, and premium pet food brand Blue Buffalo.

Thanks to its 2018 acquisition of Snyder's-Lance -- Campbell's also has a sizable snack focus with brands like Goldfish, Lance, Snyder's of Hanover, Pepperidge Farm, Cape Cod, and Kettle. But it focused more on lunch and dinner meals than General Mills, with its flagship Campbell's soup brands, Prego, Rao's Homemade tomato sauce, Pace, V8, and more.

General Mills and Campbell's are far better positioned to adapt to changing consumer preferences toward healthier snacks and meals than packaged food companies that depend heavily on ultra-processed, high-sugar, and high-sodium products like Kraft Heinz and Conagra Brands.

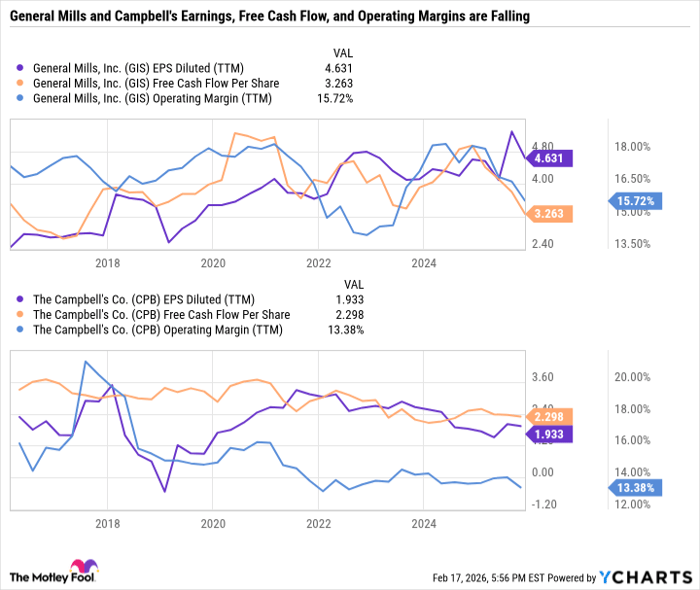

Despite their strong brands, General Mills and Campbell's are facing earnings and margin compression.

GIS EPS Diluted (TTM) data by YCharts

Both companies have implemented cost-saving strategies to improve efficiency and help offset consumer weakness. But so far, those efforts haven't translated into meaningful results, which is partly why both stocks are under so much pressure.

However, General Mills is forecasting $100 million in efficiency savings in fiscal 2026. Meanwhile, Campbell's predicts $70 million in fiscal 2026 enterprise cost savings.

Reliable dividends with high yields

General Mills has one of the best dividend track records among U.S. publicly traded companies. When factoring in its predecessor firm, the Washburn-Crosby Company, General Mills has paid dividends without interruption for 127 years and has never cut its dividend. However, there have been several periods in which General Mills hasn't raised its payout, so it isn't a part of the elite category of Dividend Kings, which are companies that have paid and raised their dividends for at least 50 consecutive years.

Campbell's has a decent, but less impressive, dividend track record. It cut its payout by around 30% in 2001, but has since increased its dividend by 70% from the pre-cut price.

The sell-off in both stocks has pushed General Mills' yield up to 5.4% and Campbell's to 5.6%. Investors can rest easy knowing that both companies should be able to afford their dividends -- even when earnings decline.

General Mills reported $4.21 in adjusted fiscal 2025 EPS. The midpoint of its updated guidance calls for an 18% decline in adjusted EPS with 95% free cash flow (FCF) conversion -- leaving around $3.28 in FCF per share to cover its $2.44 annual dividend. Even with lower earnings and FCF, General Mills can still support its dividend with cash.

Similarly, Campbell's current guidance suggests earnings should easily cover its dividend. Despite higher capital expenditures, Campbell's continues to generate free cash flow to cover its dividend and stock buybacks.

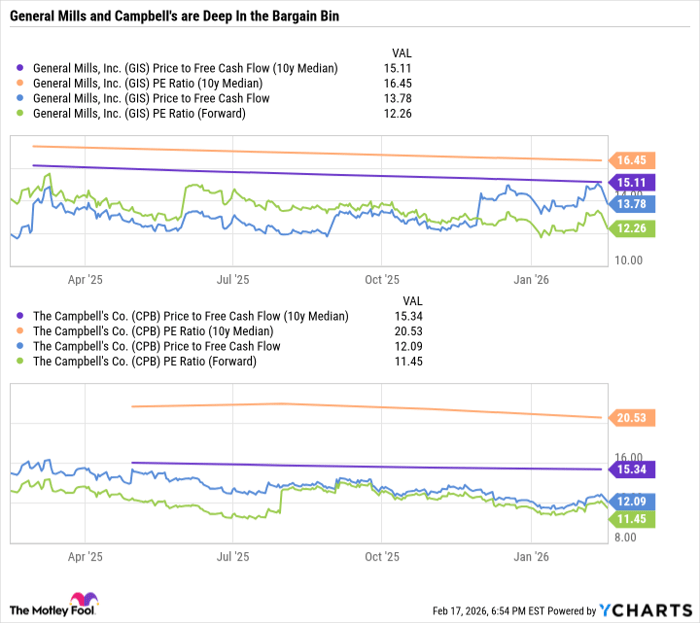

General Mills' and Campbell's growth are both slowing, but each remains highly profitable. Since both stocks are declining faster than their earnings, their valuations are dirt cheap.

GIS Price to Free Cash Flow (10y Median) data by YCharts

Both stocks are trading at substantial discounts to their 10-year median price-to-earnings and price-to-free-cash-flow ratios. And that's even when factoring in weak forward earnings estimates.

Top value stocks to buy for patient investors

General Mills and Campbell's are two high-yield deep value stocks to buy now. Investor expectations are low given weak near-term guidance. So even mediocre results could be cause for celebration.

For long-term investors, the focus should be on brand durability, dividend reliability and affordability, and valuation.

General Mills and Campbell's check all three boxes and stand out as arguably the two best buys in the packaged food industry for passive-income investors.

Should you buy stock in General Mills right now?

Before you buy stock in General Mills, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and General Mills wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $424,262!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,163,635!*

Now, it’s worth noting Stock Advisor’s total average return is 904% — a market-crushing outperformance compared to 194% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 22, 2026.

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool recommends Campbell's and Kraft Heinz. The Motley Fool has a disclosure policy.