Is Netflix Stock a Buy, Sell, or Hold in 2026?

Key Points

Netflix's share price fell after it announced a deal to acquire part of Warner Bros. Discovery.

The company had to take on debt to fund the purchase.

Netflix is growing revenue with sales up 16% year over year.

- 10 stocks we like better than Netflix ›

While Netflix (NASDAQ: NFLX) generated media excitement with its intention to acquire Warner Bros. Discovery (NASDAQ: WBD), Wall Street was not thrilled with the news. The streaming leader's stock is down 18% in 2026 through the week ending Feb. 13, plunging to a 52-week low of $75.23.

Contributing to the sinking share price was activist investor Ancora Holdings' insistence that WBD walk away from the Netflix merger. Ancora holds $200 million in WBD stock and believes the Netflix offer is inferior to the hostile takeover bid from rival Paramount Skydance.

Will AI create the world's first trillionaire? Our team just released a report on the one little-known company, called an "Indispensable Monopoly" providing the critical technology Nvidia and Intel both need. Continue »

With Netflix stock struggling, could this be the time to buy or for shareholders to follow Wall Street's lead and sell? Perhaps the best choice is to stand pat if you own shares. Here's a look into Netflix to evaluate a course of action.

Image source: NETFLIX.

Wall Street's worries with Netflix

One concern driving Wall Street's selling spree is the enormous debt Netflix took on for the deal. To be clear, the streaming giant is not buying all of Warner Bros. Discovery. It's only purchasing the Warner Bros. portion, which includes the iconic movie studio and HBO brand.

Even so, it had to secure financing to do it. If Netflix prevails in gaining Warner Bros., the combined company will be burdened with an estimated $85 billion in debt. And the chances for the acquisition to go through is another sticking point for Wall Street.

Government approval may be hard to obtain. HBO possesses one of the top-ten streaming services in the U.S., and with Netflix the leader in the space, the acquisition could be viewed as harmful to a competitive marketplace.

If regulatory hurdles sink the deal, Netflix must pay a staggering $5.8 billion break-up fee, one of the largest in history. No wonder Wall Street's worried. But now isn't the time to sell.

Reasons to own Netflix stock

If the acquisition goes through, Netflix's position as an entertainment behemoth increases. It would add HBO's streaming subscribers to its total, which passed 325 million paid members for the first time in 2025.

It also gains a new revenue stream through Warner's theatrical film releases. To date, subscription fees are Netflix's only material source of sales.

Moreover, Netflix is a major industry player with excellent financials. In 2025, the company generated $45.2 billion in revenue, representing strong 16% year-over-year growth.

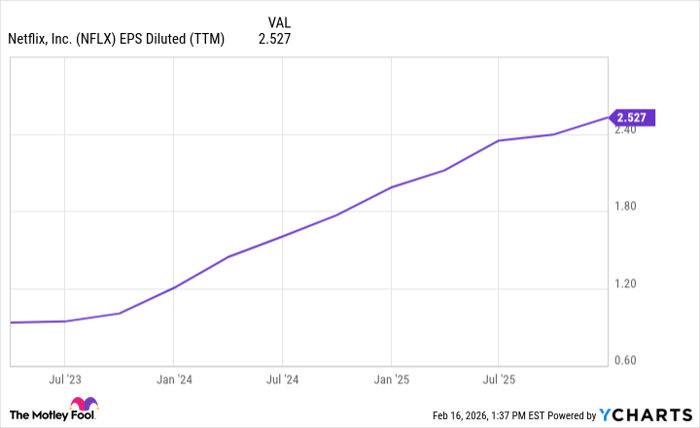

The entertainment titan has rewarded shareholders with rising diluted earnings per share (EPS). Its 2025 diluted EPS of $2.53 is nearly a 30% increase over 2024's $1.98.

Data by YCharts.

Also, Netflix is a tech company at heart. That strength enabled its streaming success to revolutionize the entertainment industry. Now, it's using artificial intelligence (AI) to streamline operations. For instance, AI is reducing expenses for visual effects and dubbing content into different languages.

Weighing if now is the time to buy

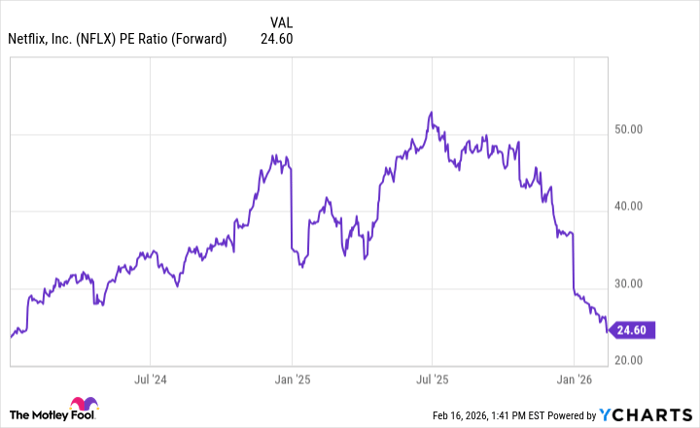

With Netflix stock falling so much, its share price valuation has reached an attractive level, as evidenced by its forward price-to-earnings ratio.

Data by YCharts.

The chart shows Netflix's forward earnings multiple is at a multiyear low, suggesting it's at a compelling valuation. Combined with the company's growing revenue and EPS, Netflix stock looks like it's in buy territory.

For investors willing to hold onto Netflix shares for the long haul, the company is well positioned to deliver returns that make it a worthwhile investment.

Should you buy stock in Netflix right now?

Before you buy stock in Netflix, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Netflix wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $420,595!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,152,356!*

Now, it’s worth noting Stock Advisor’s total average return is 901% — a market-crushing outperformance compared to 194% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 19, 2026.

Robert Izquierdo has positions in Netflix, Paramount Skydance, and Warner Bros. Discovery. The Motley Fool has positions in and recommends Netflix and Warner Bros. Discovery. The Motley Fool has a disclosure policy.