Prediction: These Could Be the Best-Performing Bank Stocks Through 2030

Key Points

Nu is expanding in many directions, and it just got a bank charter in the U.S.

SoFi added record new members in the 2025 fourth quarter, but it's still a small operation.

- 10 stocks we like better than Nu Holdings ›

Bank stocks as a group aren't typically known for high growth. However, when you add technology to the mix for serious fintech power, there are some top bank stocks that could drive your portfolio higher.

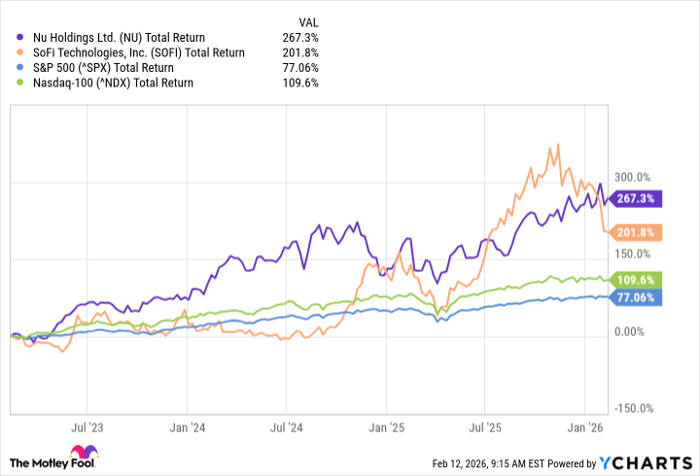

Consider Nu Holdings (NYSE: NU) and SoFi Technologies (NASDAQ: SOFI). Both of these stocks aren't just beating other bank stocks, they've crushed both the S&P 500 and even the Nasdaq 100 over the past three years.

Will AI create the world's first trillionaire? Our team just released a report on the one little-known company, called an "Indispensable Monopoly" providing the critical technology Nvidia and Intel both need. Continue »

NU Total Return Level data by YCharts.

Here's why they should continue to be the best bank stocks to own through 2030.

Image source: Getty Images.

1. Nu

Nu is an all-digital bank based in Brazil, and it's changing how people manage their finances in its three markets of Brazil, Mexico, and Colombia. Before it got started, even affluent people who could engage with the banking system had high barriers to access, and lower-income customers were largely shut out. Nu has operated until recently as a non-bank financial company, which is how it's been able to offer its limited assortment of services.

Growth has been explosive, and Nu has more than 60% of the adult population in Brazil on the platform, attracting business from all socio-economic demographics. And while that might sound like it's near saturation, there's still a huge opportunity in a number of ways. Beyond getting more customers in Brazil, where it still onboards about 1 million new members every month, it's monetizing its user base. Customers often have only NuBank product, and many have a different primary bank.

It also has tons of room to add users in Mexico, where it has 14% of the adult population as customers, and Colombia, where that's 10%. Management has also implied that it will open in new markets, and it recently applied for a banking charter in the U.S.

Nu is just getting started, and it should reward investors well over the next five years and longer.

2. SoFi

SoFi is similar to Nu, but it operates in the U.S. and has a focus on lending. It's also launching many new blockchain-based products, and it's angling to become a top-10 U.S. financial institution.

Like Nu, the basis of the company's great success is its growing membership base. SoFi added a record 1 million new customers in the 2025 fourth quarter, a 35% year-over-year increase for a total of nearly 13.7 million. That's a fast rate, but SoFi is still a small bank, leaving a long growth runway.

Since interest rates have come down, SoFi's lending business, which still accounts for about half of total revenue, has bounced back. As the company gets bigger and has more experience in different types of economies, it's in a better position for future hiccups.

However, the major growth is happening in the financial services segment, which includes non-lending services like bank accounts and investing. Revenue increased 78% year over year in Q4, and contribution profit doubled.

The third segment, tech platform, isn't growing as fast, but SoFi is now leveraging it to create innovative financial products like its new all-in-one Smart Card.

SoFi is brimming with opportunity, and it should keep outperforming other bank stocks for the foreseeable future.

Should you buy stock in Nu Holdings right now?

Before you buy stock in Nu Holdings, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nu Holdings wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $414,554!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,120,663!*

Now, it’s worth noting Stock Advisor’s total average return is 884% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 16, 2026.

Jennifer Saibil has positions in Nu Holdings and SoFi Technologies. The Motley Fool recommends Nu Holdings. The Motley Fool has a disclosure policy.