2 Dividend Stocks to Buy and Hold Forever

Key Points

These companies have increased their dividend payments for more than 50 straight years.

Dividends strengthen your portfolio in any market environment.

- 10 stocks we like better than Target ›

As the S&P 500 struggles to take a clear direction in the early days of 2026, you might be thinking more and more about dividend stocks. No matter what the market is doing, these players offer you recurrent passive income -- the only thing you have to do is buy them and hold on for the long term to truly maximize the benefits of these payments.

You may appreciate these players the most when the market is rocky or stagnant, but even during times of market gains, they will work for you, offering your portfolio an extra burst of momentum. Which players make good additions to your portfolio right now? Let's check out two dividend stocks to buy, and they're such dividend stalwarts that you'll want to hold onto them forever.

Will AI create the world's first trillionaire? Our team just released a report on the one little-known company, called an "Indispensable Monopoly" providing the critical technology Nvidia and Intel both need. Continue »

Image source: Getty Images.

1. Target

Target (NYSE: TGT) is a Dividend King, meaning it's raised its dividend payment for at least the past 50 years. This is great because it shows the company is committed to dividend growth -- and therefore, it's likely to continue along this path.

The retailer pays a dividend of $4.56, which represents a 4% dividend yield. That's well above the 1.1% dividend yield of the S&P 500.

Though Target has disappointed investors in recent years from a revenue growth perspective, now could represent a key turning point. The company has been making efforts to turn things around, and just recently, longtime Target executive Michael Fiddelke took on the role of chief executive officer. Target stock looks cheap at 14x forward earnings, estimates, down from more than 17x a year ago, so right now may be a great moment to get in on a potential Target recovery story, and in the meantime, benefit from passive income.

2. Coca-Cola

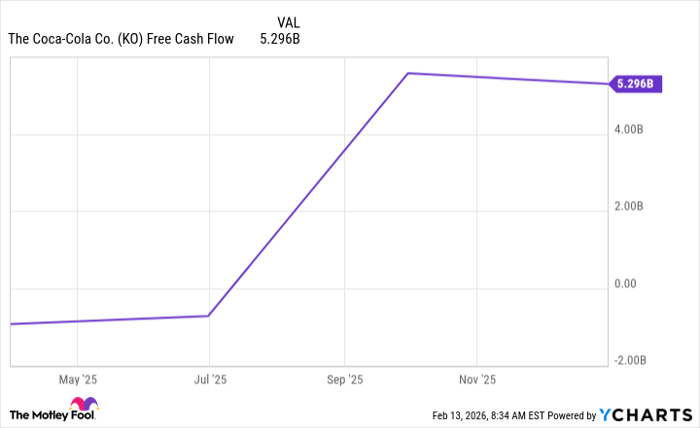

Coca-Cola (NYSE: KO), like Target, is also a Dividend King, meaning you likely can count on this company for passive income over the long term. And the beverage giant's massive level of free cash flow shows that it has the financial ability to keep these payments going.

KO Free Cash Flow data by YCharts

Coca-Cola pays a dividend of $2.04, for a yield of 2.5% -- and like Target, this surpasses the yield of the major benchmark.

Investors will like this company's long track record of earnings growth thanks to a solid moat, or competitive advantage. This is the company's brand strength, as consumers often opt for a Coca-Cola when they want a cola drink -- and many of the company's other brands, such as Sprite and Minute Maid, have the same power.

Coca-Cola trades for about 24x forward earnings estimates, a level that has remained steady over the past few years -- and a reasonable price for this market giant that pays you just for owning it.

Should you buy stock in Target right now?

Before you buy stock in Target, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Target wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $414,554!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,120,663!*

Now, it’s worth noting Stock Advisor’s total average return is 884% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 16, 2026.

Adria Cimino has positions in Target. The Motley Fool has positions in and recommends Target. The Motley Fool has a disclosure policy.