Nio Touts First Adjusted Profit -- Here's What It Isn't Saying

Key Points

Nio has recorded strong delivery growth supported by two new sub-brands.

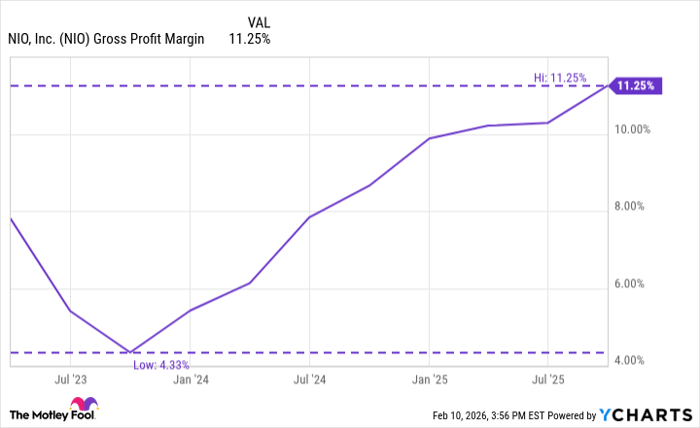

In addition to top-line growth, Nio's gross profit margins have been on the rise.

Nio expects its first adjusted profit from operations during the fourth quarter.

- 10 stocks we like better than Nio ›

Over the past four months Nio (NYSE: NIO) has shed roughly 35% of its value, giving risk-tolerant investors an opportunity to scoop up shares of a promising Chinese electric vehicle (EV) maker. The great news for potential investors is that Nio is turning a corner and is about to post its first adjusted profit thanks to consistently improving margins. Despite the great news, and it is, there is a downside that comes with Nio and its margins.

Turning the corner

Nio is taking a big step forward for investors as it anticipates, based on preliminary data, to report its first-ever adjusted profit from operations between $100 million and $172 million for the fourth quarter of 2025. It's a big step and sets the stage for the company to reach its goal of achieving at least breakeven for the full-year 2026.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Nio.

Getting to this point was made possible by Nio's rising margins and consistent growth in sales volume, especially as its two newer sub-brands Onvo and Firefly gain traction. Nio ended on a high note with sales surging 54.6% in December compared to the prior year, to a new monthly high of 48,135 deliveries. Fourth-quarter 2025 sales jumped an even stronger 71.7% compared to the prior year, to nearly 125,000 vehicles.

Despite its newer brands often selling at lower prices than its namesake premium Nio brand, and an ongoing price war in China's EV industry, its gross margins have made consistent progress over recent years.

NIO Gross Profit Margin data by YCharts

Nio recently announced it would report an adjusted profit from operations for the first time and investors should be more optimistic about its path forward. However, there is also more for investors to consider.

What's the catch?

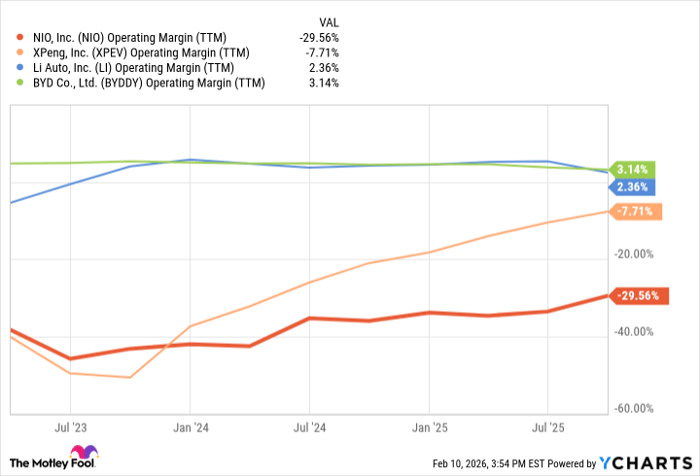

While Nio has consistently improved its gross profit margins, and should continue to do so, it's also true that it consistently trails its nearest competitors in operating margin.

NIO Operating Margin (TTM) data by YCharts

One reason Nio comes up short compared to competitors is the financial drain of its battery swapping network. The difference is essentially that gross profit margin will indicate product profitability while operating profit margin goes a step further and includes indirect operating expenses, such as rent, salaries, or marketing.

The simple premise was to swap fully charged batteries out to consumers needing to recharge, essentially done as quickly as refilling a gasoline tank. The drawback is that the battery swap network is vast and requires significant upfront capital investment, as well as ongoing operating costs such as rent, maintenance, and battery inventory, which have weighed on the company's financials.

It's true that Nio's battery swap network could one day become a significant competitive advantage, but currently it's mostly a high-cost pile of uncertainty. Right now due to the low number of Nio vehicles on the road opting for battery-as-a-service (BaaS) and the increasing quality of substitute products such as fast-charging options, Nio's battery swap network will have a tough time pushing toward profitability. Ultimately, Nio's announcement of its first adjusted profit is great news, so long as investors keep the big picture in mind and understand that Nio may trail its competitors' operating margin for the long term.

Should you buy stock in Nio right now?

Before you buy stock in Nio, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nio wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $414,554!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,120,663!*

Now, it’s worth noting Stock Advisor’s total average return is 884% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 15, 2026.

Daniel Miller has no position in any of the stocks mentioned. The Motley Fool recommends BYD Company. The Motley Fool has a disclosure policy.