3 Top Dividend Stocks to Buy in January

Key Points

The insurance industry is resilient in the long run, even if it suffers the occasional stumble.

Utility name NextEra Energy is prepared for the future in a way its peers aren’t.

Brookfield Asset Management largely limits its focus to the best of the very best investment opportunities.

- 10 stocks we like better than Progressive ›

Are you looking to start out the new year with more investment income than you ended the previous year with? Dividend stocks are the obvious choice. But not just any dividend stocks. You'll want to make a point of owning the best of the best.

With that as the backdrop, here's a closer look at three of your top dividend stock prospects to buy before we move any deeper into the first month of the new year.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

1. Progressive

The past few months have been relatively disappointing for Progressive's (NYSE: PGR) stockholders. Shares of the property insurer are down more than 20% from their June peak, with investors pricing in a sizable one-time cost that caused the company's third-quarter revenue and earnings reported in October to end up falling short of expectations.

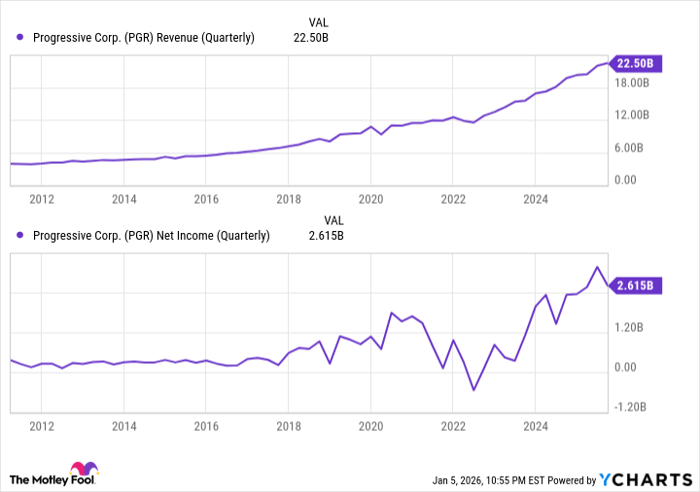

However, there's a reason the stock began bouncing back right after that bad news was posted. The insurance business is an incredibly resilient one -- this year's premiums are based on last year's costs. Consumers and corporations pay these new prices because they have little choice but to do so. That's why Progressive's revenue has grown at least a little bit in every quarter for the past decade. Profit growth hasn't been nearly as steady, but even more impressive, more than doubling during this stretch.

Data by YCharts.

This longer-term trend isn't in any real immediate danger of ending anytime soon, either. Neither is its dividend payment. You'd be plugging in while this stock's forward-looking dividend yield stands at a healthy 6.1%.

Just don't tarry if you want in. This insurance stock's recovery effort from its October low seems to be picking up steam as more and more investors recognize Progressive's long-term resiliency.

2. NextEra Energy

Utility stocks make great dividend payers. People might postpone the purchase of a new car or cancel a streaming service. They keep the lights on and keep the water running by faithfully paying their monthly utility bills. A piece of these recurring payments is easily passed along to shareholders. The trade-off is modest growth and relatively low yields. See, in exchange for their consistent income, most utility names offer very little of either.

Every now and then, one of these stocks offers more of all of these attributes than any of its peers. NextEra Energy (NYSE: NEE) is one such name right now.

With nothing more than a passing glance, NextEra more or less looks like any other outfit in the utilities business. It provides power to 12 million Floridians, and it's also an energy wholesaler.

NextEra is different, though. Over half of its 76 gigawatts' worth of electricity production comes from renewables, while another one-third of it comes from clean natural gas. Still another 8% of its portfolio is nuclear power. Simply put, NextEra Energy is the kind of utility company you would create if you were building one from scratch today in preparation for the regulatory change that socioeconomic pressures are driving. It's better prepared for the future than most other utility outfits with legacy operations are.

Perhaps more important to interested investors, you'd be plugging into this stock while its forward-looking dividend yield stands at a respectable 2.8%. That's based on a quarterly per-share dividend, by the way, that's not only been paid like clockwork for decades now, but has been increased every year for over 30 years, and has nearly tripled in size over the course of the past decade.

3. Brookfield Asset Management

Last but not least, add Brookfield Asset Management (NYSE: BAM) to your list of top dividend stocks to buy in January, while its forward-looking yield is just under 3.3%.

Brookfield Asset Management offers a handful of investment services to individuals and institutions. Its core business, however, is managing Brookfield Infrastructure Partners, Brookfield Renewable Partners, and Brookfield Business Partners. Like more conventional mutual funds and ETFs, Brookfield Asset Management collects recurring fees for managing these focused investment vehicles.

Although this business model is one that supports reliable dividends, the investment management industry isn't exactly known for its massive growth. Aside from being extremely competitive, it's largely limited to the broad market's overall growth rate.

Brookfield's different than most of the other options like it, however. It specifically manages businesses in high-growth and predictable high-demand industries like real estate, alternative energy (including nuclear power), artificial intelligence, and private equity. It offers investment opportunities that aren't available any other way. For example, in July of last year, Alphabet agreed to purchase $3 billion worth of electricity from a Brookfield-owned hydroelectric plant.

And this is key. Given the nature of the assets it manages, this company's long-term growth target of between 15% and 20% per year is not only plausible, but seemingly likely. And of the profits its recurring management fees will generate, Brookfield expects to continue passing along at least 90% of them to shareholders.

Although this ticker's young age means it doesn't have much of a dividend growth track record yet, last year's 15% year-over-year increase in its per-share quarterly payment is not only impressive, but it sends a message about what to expect going forward. This growth potential makes the stock's just-average yield and relatively high forward-looking price/earnings ratio of around 30 well worth it for investors who can remain patient enough to stick with it for the long haul.

Should you buy stock in Progressive right now?

Before you buy stock in Progressive, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Progressive wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $489,300!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,159,283!*

Now, it’s worth noting Stock Advisor’s total average return is 974% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 8, 2026.

James Brumley has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, Brookfield Asset Management, NextEra Energy, and Progressive. The Motley Fool recommends Brookfield Infrastructure Partners, Brookfield Renewable, and Brookfield Renewable Partners. The Motley Fool has a disclosure policy.