Should You Buy Bitcoin While It's Under $100,000?

Key Points

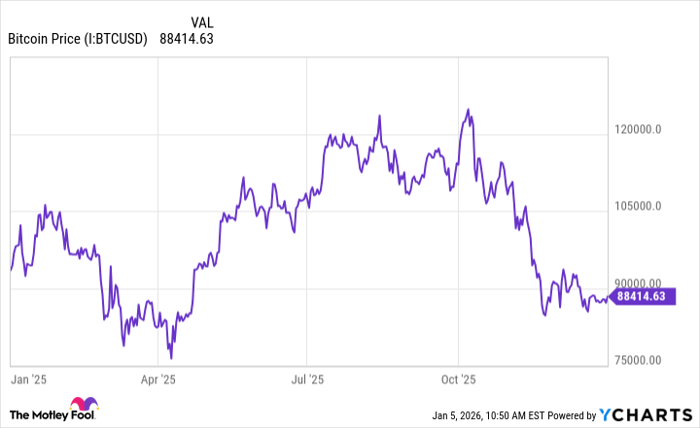

Bitcoin's price movements were extremely volatile throughout 2025.

During the past few months, Bitcoin has experienced meaningful selling pressure.

Bitcoin has started 2026 with some momentum, which could be the spark to a more prolonged rally.

- 10 stocks we like better than Bitcoin ›

Whatever your opinion is on Bitcoin (CRYPTO: BTC), bulls and bears can certainly agree on one point: Investing in cryptocurrency comes with a high degree of volatility, much more than stocks or bonds.

Bitcoin's price performance throughout 2025 featured more highs and lows than the most tear-jerking Hollywood drama. With the crypto hovering at less than $100,000 per coin, some investors may be curious if now is an opportunity to buy the dip.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Let's assess what influenced Bitcoin's volatility last year to help determine how we got here. From there, I'll break down whether adding some exposure to the king of the crypto realm is a wise choice for your portfolio right now.

Bitcoin had a turbulent 2025

After starting 2025 with some notable momentum, the price of Bitcoin plummeted in spectacular fashion during the remainder of the first quarter -- eventually bottoming in April following the announcement of President Donald Trump's "Liberation Day" tariffs.

Bitcoin Price data by YCharts

However, throughout the spring and summer, Bitcoin bounced back and experienced a prolonged rally. Some of the catalysts behind this upswing include pro-crypto legislation such as the Guiding and Establishing National Innovation for U.S. Stablecoins (Genius) Act, rising interest in spot Bitcoin exchange-traded funds (ETFs) from institutional investors, as well as anticipation of easing monetary policy and interest rate cuts from the Federal Reserve.

After reaching an all-time high of roughly $126,000 in October, Bitcoin entered a downward spiral. From the beginning of October through the end of last year, Bitcoin's price declined 22%.

The core component behind this sell-off was that the actions from the Fed weren't as aggressive as investors had expected. In other words, despite lowering interest rates, the Fed's reductions were viewed as relatively modest compared to what growth investors had broadly anticipated.

Under these conditions, liquidity inflows toward higher-risk assets such as cryptocurrency weren't as robust as some anticipated. In addition, some investors surely took profits after Bitcoin reached an all-time high in the early fall -- adding downward pressure.

Image source: Getty Images.

What price is Bitcoin headed to next?

Trying to predict Bitcoin's price is a daunting task. Cryptocurrencies are not the same as an actual company -- there is no leadership team, no corporate governance, and no earnings reports to gauge business performance. This makes the idea of fundamental analysis completely moot.

And while its current price of about $93,000 (as of Jan. 6) could be viewed as something of a support zone, employing technical analysis to Bitcoin is likely an exercise in false precision.

Nevertheless, we can still take a more macro-oriented approach to discern which direction Bitcoin could be headed in the near term.

Perhaps the most compelling reason to own Bitcoin is its fixed supply of 21 million coins. These structural dynamics are a key reason a rising number of banks and hedge funds increasingly view Bitcoin as a store of value.

While some investors decided to take gains during the fourth quarter, both institutional and retail capital could very well begin to flow back into Bitcoin given rising concerns around fiat currency debasement amid the current economic picture.

Against this backdrop add: uncertainty surrounding economic indicators including lingering inflation and rising unemployment; geopolitical tensions in Europe, the Middle East, and now Venezuela; and persistent tensions around trade policy with China. All could fuel meaningful capital movement toward alternative assets such as cryptocurrency. This is a key reason longtime safe assets like gold and silver have witnessed outsize enthusiasm during the last few weeks.

Should you buy Bitcoin right now?

Despite its volatility and unpredictability, Bitcoin's long-term price appreciation speaks for itself -- rising more than 21,000% during the past 10 years.

All told, Bitcoin is a resilient asset as far as cryptocurrency is concerned. In my eyes, the current uptick to begin 2026 could be the initial jolt to a greater, more prolonged spark throughout the year.

Over time, I think more institutions will adopt Bitcoin as part of their portfolio composition -- adding new levels of credibility and validation to an otherwise speculative asset class.

Investors can use sell-offs to begin accumulating a position in Bitcoin to complement existing exposure to traditional vehicles such as stocks. For these reasons, I would consider adding a small allocation to Bitcoin at its current price point.

Should you buy stock in Bitcoin right now?

Before you buy stock in Bitcoin, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Bitcoin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $488,653!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,148,034!*

Now, it’s worth noting Stock Advisor’s total average return is 971% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 8, 2026.

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin. The Motley Fool has a disclosure policy.