The Best S&P 500 ETF to Invest $5,000 in as 2026 Begins

Key Points

Five S&P 500 ETFs stand out as top alternatives for investors.

One offers a lower annual expense ratio than the others and appears to be the best pick.

However, an equal-weighted S&P 500 ETF could outperform if the AI boom wanes in 2026.

- 10 stocks we like better than State Street SPDR Portfolio S&P 500 ETF ›

You might have noticed that the S&P 500 (SNPINDEX: ^GSPC) is on a roll. The widely followed index just wrapped up three consecutive years of gains of 16% or more. Such a streak has occurred only five times in the last 98 years. The S&P 500 is off to a good start in the new year as well.

Investors seeking to capitalize on the S&P 500's momentum have several exchange-traded funds (ETFs) to choose from. But what's the best S&P 500 ETF to invest $5,000 in as 2026 begins?

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

Top contenders

Let's first introduce the top contenders in the S&P ETF market.

First on the list is the SPDR S&P 500 ETF Trust (NYSEMKT: SPY). Managed by State Street (NYSE: STT), this ETF is the most popular S&P 500 ETF based on trading volume. It's also the oldest ETF in the U.S., with its inception dating back to January 1993.

The SPDR S&P 500 ETF Trust isn't the largest S&P 500 ETF based on assets under management (AUM), though. That honor belongs to the Vanguard S&P 500 ETF (NYSEMKT: VOO), with an AUM of over $840 billion.

Financial services giant BlackRock (NYSE: BLK) manages the iShares Core S&P 500 ETF (NYSEMKT: IVV). This fund also has more AUM than the SPDR S&P 500 Trust and runs neck-and-neck with the Vanguard S&P 500 ETF based on average daily trading volume over the last three months.

State Street offers investors another S&P 500 ETF option, the State Street SPDR Portfolio S&P 500 ETF (NYSEMKT: SPYM). It's a much smaller sibling to the SPDR S&P 500 ETF Trust.

The Invesco S&P 500 Equal Weight ETF (NYSEMKT: RSP) offers a distinct approach. This ETF owns the same S&P 500 stocks as the other ETFs discussed. However, each stock is equally weighted, rather than being weighted by market capitalization.

How they compare

As you might expect, these five S&P 500 ETFs are quite similar. The biggest differentiating factors between them are annual expense ratios and liquidity. Here's how they compare on these two fronts:

|

ETF |

Annual Expense Ratio |

Average Trading Volume Last 3 Months |

|---|---|---|

|

SPDR S&P 500 ETF Trust |

0.0945% |

80,222,453 |

|

Vanguard S&P 500 ETF |

0.03% |

9,060,471 |

|

iShares Core S&P 500 ETF |

0.03% |

9,111,643 |

|

State Street SPDR Portfolio S&P 500 ETF |

0.02% |

10,488,768 |

|

Invesco S&P 500 Equal Weight ETF |

0.20% |

16,873,428 |

Data sources: ETF websites, ETFDb.

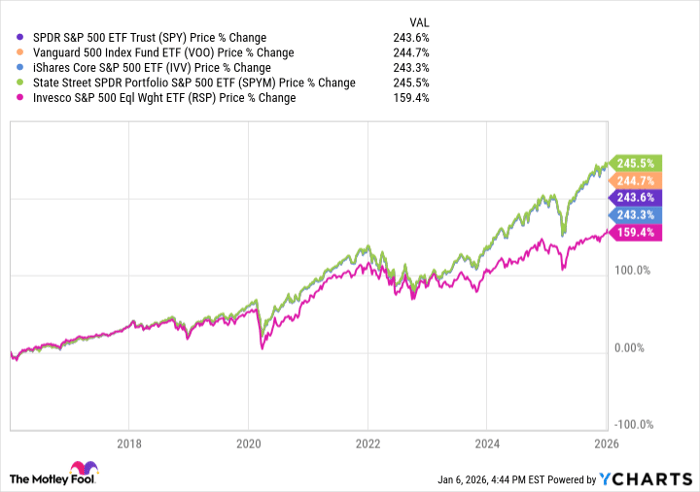

There's also a significant gap in performance between the four market-cap-weighted and the Invesco S&P 500 Equal Weight ETF. Over the last decade, market-cap-weighted funds have delivered similar returns. However, the equal-weighted ETF's returns have been much lower. This is primarily due to the sizzling gains generated by the so-called "Magnificent Seven" stocks and other large growth stocks.

SPY data by YCharts

The best of the bunch

Which of these S&P 500 ETFs is the best pick? My vote goes to the State Street SPDR Portfolio S&P 500 ETF.

This fund boasts the lowest expense ratio of the five ETFs. Even a tiny advantage can make a difference financially over the long term. Liquidity isn't an issue for the State Street SPDR Portfolio S&P 500 ETF, either. (Actually, it isn't an issue for any of these S&P 500 ETFs.)

There is at least one scenario, though, where the Invesco S&P 500 Equal Weight ETF could outperform the rest of the pack in 2026. If the artificial intelligence (AI) boom wanes, stocks such as Nvidia (NASDAQ: NVDA), Apple (NASDAQ: AAPL), Microsoft (NASDAQ: MSFT), Amazon (NASDAQ: AMZN), and Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) will likely underperform. Because these stocks comprise significant percentages of the market-cap-weighted ETFs' portfolios, a softening of AI demand could give the equal-weighted S&P ETF, which has less exposure to these megacap stocks, an advantage.

Should you buy stock in State Street SPDR Portfolio S&P 500 ETF right now?

Before you buy stock in State Street SPDR Portfolio S&P 500 ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and State Street SPDR Portfolio S&P 500 ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $488,653!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,148,034!*

Now, it’s worth noting Stock Advisor’s total average return is 971% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 8, 2026.

Keith Speights has positions in Alphabet, Amazon, Apple, and Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Microsoft, Nvidia, and Vanguard S&P 500 ETF. The Motley Fool recommends BlackRock and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.