Why AeroVironment Stock Lost 13% in December

Key Points

AeroVironment came up short in its second-quarter report.

The company is benefiting from U.S. military policy.

It's off to a strong start in 2026.

- 10 stocks we like better than AeroVironment ›

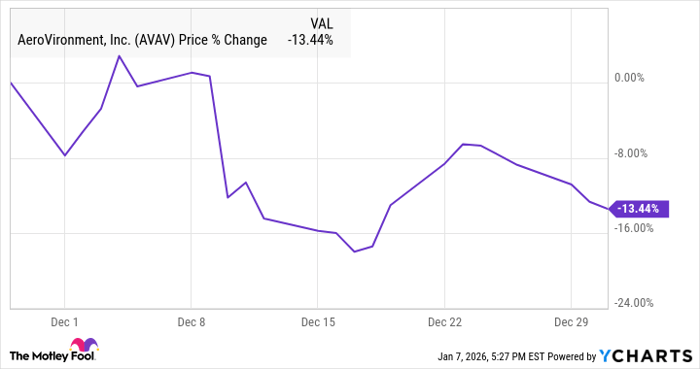

Shares of AeroVironment (NASDAQ: AVAV) were among the losers last month as the drone-maker posted a disappointing second-quarter earnings report and cut its guidance for the full year.

Later in the month, the stock recouped some of those losses on favorable analyst commentary and as the Federal Communications Commission (FCC) announced a ban on some foreign drones, favoring domestic companies like AeroVironment.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

By the end of the month, the stock was down 13% according to data from S&P Global Market Intelligence. As you can see from the chart below, the stock fell early in the month on the earnings report before recovering some of those losses in the second half.

AVAV data by YCharts

AeroVironment misses the mark

The biggest news out on the drone stock last month was its earnings report. While AeroVironment continues to deliver strong growth, the numbers missed the mark on the bottom line. Revenue jumped 151% to $472.5 million, primarily driven by its acquisition of BlueHalo earlier in the year. Organic revenue was up 21% to $227.4 million, showing the core business is still delivering solid growth, and its revenue topped the consensus of $465.6 million.

The company also said that its funded backlog rose from $726.6 million to $1.1 billion. On the bottom line, the company flipped to a generally accepted accounting principles (GAAP) operating loss due to the BlueHalo acquisition. Adjusted earnings per share fell from $0.47 to $0.44, which was well below the consensus at $0.79. A mix of factors drove the decline in profit, including costs and inefficiencies to implement a new ERP system and unfavorable sales mix, shifting from higher-margin product sales to lower-margin service sales.

The company also cut its guidance, disappointing investors, as it now sees full-year adjusted earnings per share of $3.40-$3.55, down from an earlier range of $3.60-$3.70.

However, Wall Street analysts remained bullish on the stock with mostly positive commentary following the report, and the stock was also seen as a winner following the foreign drone ban later in the month.

In general, AeroVironment looks well-positioned to benefit from military policy under the Trump administration.

Image source: Getty Images.

What's next for AeroVironment

After pulling back in December, AeroVironment got off to a blistering hot start in 2026, up 31% through Jan. 7, and that doesn't include an after-hours gain today after Trump tweeted that the 2027 military budget should be $1.5 trillion, not $1 trillion.

The company is a leader in an emerging technology and is poised for more growth in the current geopolitical environment. Despite the pullback last year, it looks set up to be a winner in 2026.

Should you buy stock in AeroVironment right now?

Before you buy stock in AeroVironment, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AeroVironment wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $488,653!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,148,034!*

Now, it’s worth noting Stock Advisor’s total average return is 971% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 7, 2026.

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends AeroVironment. The Motley Fool has a disclosure policy.