The Smartest Dividend ETF to Buy With $2,000 Right Now

Key Points

The JEPQ ETF employs a covered call strategy to generate a dividend yield from top technology stocks.

The actively managed fund yields more than 10%.

- 10 stocks we like better than JPMorgan Nasdaq Equity Premium Income ETF ›

I follow two consistent themes in my investments. First, I tend to favor high-performing tech stocks because of their enormous potential. Tech stocks, particularly those involved in the growth of artificial intelligence, have been among the best performers over the last several quarters. These companies are at the forefront of innovation, making possible societal changes that will impact every sector in the market. I enjoy being part of that, and I consistently outperform the market with those picks.

Second, I love dividend stocks and reinvesting those payouts back into my portfolio. Dividend stocks are a great way to amplify an investor's returns -- and to be honest, there's also something satisfying about getting that quarterly notification that funds have been deposited into my account.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

The problem -- at least for me -- is that a lot of tech stocks don't pay great dividends. They are too focused on scaling up, investing heavily in infrastructure and resources, and developing their next great products. Others are just stingy -- for instance, Nvidia had $77.3 billion in free cash flow over the last 12 months, but its dividend is a pitiful 1 penny per quarter per share.

However, I've found a way around this problem with an exchange-traded fund that focuses on top tech stocks and still pays out a mammoth yield. It's the JPMorgan Nasdaq Equity Premium Income ETF (NASDAQ: JEPQ).

About the JEPQ ETF

The JPMorgan Nasdaq Equity Premium Income ETF is managed by J.P. Morgan Asset Management, a division of JPMorgan Chase. It's an actively managed fund that invests in Nasdaq-100 stocks using a covered call strategy through equity-linked notes. Fund managers sell out-of-the-money call options on the stocks in the index, with the proceeds paid out to shareholders in the form of a monthly dividend.

For investors who are uncomfortable with options, don't worry. First, the covered call strategy is one of the safest option strategies. And secondly, because you're investing in the ETF, you never have to worry about being assigned shares or owing money if an options trade doesn't pan out.

Currently, the JEPQ ETF has a dividend yield of 10.1%. The yield won't be consistent on a month-to-month basis, but you can count on it being higher than other asset classes. Here's a comparison using the 30-day SEC yield, a standardized rate of income calculated over the last 30 days.

| Investment Type | Current Yield |

|---|---|

| U.S. equities (average) | 1.17% |

| Global Real Estate Investment Trusts (REITs) | 4.23% |

| U.S. 10-year bond | 4.15% |

| U.S. high-yield bonds | 6.7% |

| JEPQ ETF | 9.45% |

Data source: J.P. Morgan Asset Management

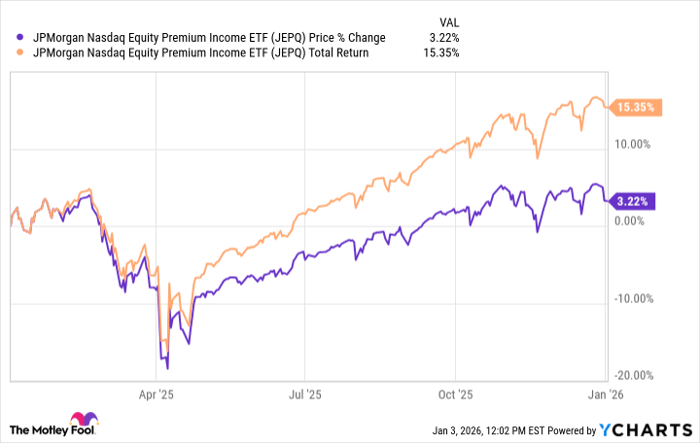

And that yield pays off in a big way. The JEPQ ETF is trading up only 3.2% in the last year. But when you add in the total return, you're getting a 15.3% increase.

Data by YCharts.

That also means a lot when it comes to your dividend payout as well. A $2,000 investment in the JEPQ ETF at today's prices gets you a little more than 34 shares. If the dividend yield remains around 10% as it is today, that means you're getting just under $200 back annually in dividends. This is literally an investment that pays for itself in just a decade.

What stocks are in the JEPQ ETF?

This is the part that I love. Because now we're getting into some of the best stocks in the market. The Nasdaq-100 comprises 100 of the largest non-financial companies listed on the Nasdaq exchange -- and it is dominated by technology stocks. The top 10 holdings comprise 43% of the fund and include a who's who of the world's largest tech stocks.

| Stock | Portfolio Weight | Stock | Portfolio Weight |

|---|---|---|---|

| 1. Nvidia | 7.90% | 6. Meta Platforms | 3.41% |

| 2. Apple | 6.77% | 7. Tesla | 3.05% |

| 3. Microsoft | 6.11% | 8. Broadcom | 2.50% |

| 4. Alphabet | 5.51% | 9. Netflix | 1.94% |

| 5. Amazon | 4.34% | 10. Micron Technology | 1.89% |

Data source: J.P. Morgan Asset Management (weightings as of Jan. 2, 2026).

Information technology stocks comprise a substantial 43% of the fund as of this writing. However, don't get too attached to any of the names in this fund -- the JEPQ ETF has a turnover ratio of 168% on the last 12 months, so there is a lot of movement as fund managers seek out-of-the-money call options.

What should you expect from the JEPQ ETF?

First, it's important to recognize that this is not a fund to invest in if you want to profit from a huge future gain by Nvidia, Microsoft, or the rest of the top tech stocks. If you want that, I suggest the Invesco QQQ Trust ETF, which simply tracks the Nasdaq-100. The JEPQ ETF is purely a way to get dividend growth, but the covered call strategy means that you don't get the benefit of a massive run-up in tech stocks.

Secondly, no investor is perfect -- even the fund managers who run the JPMorgan Nasdaq Equity Premium Income ETF. Management noted in its commentary following the third quarter that the fund underperformed because of poor performance from Chipotle Mexican Grill and Warner Bros. Discovery.

However, analysts at J.P. Morgan say they are "cautiously optimistic" about 2026, and managers have proven that they can execute the covered call strategy successfully over a period of time. They have a proven track record of success.

All that said, the JEPQ ETF is my favorite dividend investment at the moment, and I will continue to add to my position regularly for the foreseeable future.

Should you buy stock in JPMorgan Nasdaq Equity Premium Income ETF right now?

Before you buy stock in JPMorgan Nasdaq Equity Premium Income ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and JPMorgan Nasdaq Equity Premium Income ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $488,653!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,148,034!*

Now, it’s worth noting Stock Advisor’s total average return is 971% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 7, 2026.

JPMorgan Chase is an advertising partner of Motley Fool Money. Patrick Sanders has positions in Invesco QQQ Trust, JPMorgan Nasdaq Equity Premium Income ETF, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Chipotle Mexican Grill, JPMorgan Chase, Meta Platforms, Microsoft, Netflix, Nvidia, Tesla, and Warner Bros. Discovery. The Motley Fool recommends Broadcom and Nasdaq and recommends the following options: long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short March 2026 $42.50 calls on Chipotle Mexican Grill. The Motley Fool has a disclosure policy.