This Might Be the Most Underrated Artificial Intelligence Stock to Own in 2026

Key Points

Amazon spending on capital expenditures is cutting into its free cash flow.

However, the investment in data centers and AI architecture could help it have a tremendous 2026.

- 10 stocks we like better than Amazon ›

Artificial intelligence (AI) continues to be a major driver in the stock market -- AI stocks were among the best performers in 2025, and they started 2026 strong as investors anticipate extended gains in the field.

I'm among those who believe in the AI story. And despite global tensions that could weigh on the market, such as the U.S. action on Jan. 3 in Venezuela, I think in the long term, AI will continue its run-up and achieve Nvidia CEO Jensen Huang's prediction that AI infrastructure will be a $4 trillion market by 2030.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

There are several interesting stocks that are taking leading roles in the AI buildout, but Amazon (NASDAQ: AMZN) stands out to me as one that is particularly underrated right now. Here's why Amazon could be a huge surprise in 2026.

Amazon is cheaper than its peers

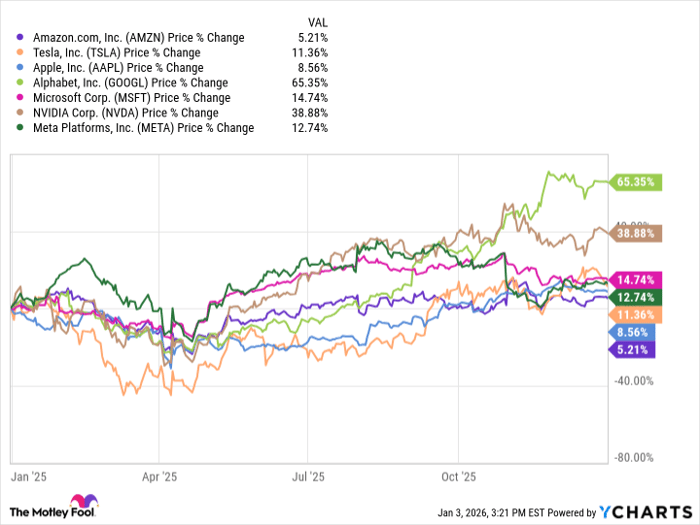

Amazon didn't have the greatest 2025. Shares took a big stumble in the first quarter as President Donald Trump's tariff policy shook the markets. Amazon's international e-commerce network relies heavily on moving goods around the world, and it took months for the stock to recover.

In the end, Amazon finished 2025 up 5% on the year -- not disastrous, but below the S&P 500's 16% gain.

Meanwhile, the other members of the "Magnificent Seven" group of stocks all had better years. All of them scored double-digit gains in the year except for Apple, which is not monetizing AI like the rest of the Magnificent Seven, but still managed a better gain than Amazon.

AMZN data by YCharts

But Amazon is monetizing AI. Its Amazon Web Services (AWS) cloud computing service is the largest in the world by market share, and growing quickly. As more companies seek cloud and hybrid environments to run and train AI programs, cloud computing will become a more critical component of AI infrastructure.

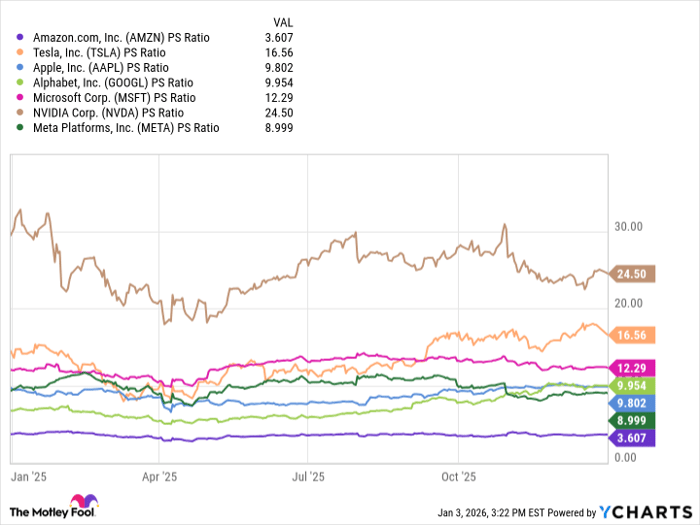

But despite this, Amazon's price-to-sales ratio is the lowest of the Magnificent Seven, indicating that it could be a tremendous bargain in 2026.

AMZN PS Ratio data by YCharts

Why is Amazon stock so cheap?

The weakness to Amazon stock lies in what we already touched on -- the e-commerce business. Amazon brings in enormous revenue on the e-commerce side, with $106.27 billion in North America revenue in the third quarter of 2025, and $40.9 billion from the international segment.

But at the same time, Amazon's profit margins from e-commerce are paltry -- just 4.5% from North America and 2.9% from the international segment, even though sales were up by 11% in North America and 14% from international.

Meanwhile, AWS brought in $33 billion in revenue in the third quarter, up 20% from the previous year, and it has a robust profit margin of 34.6%.

And then there's the capital expenses. Amazon is investing heavily in building out its AI infrastructure, including constructing data centers and developing its Trainium custom AI chips. That investment will benefit both AWS and the e-commerce business as Amazon incorporates more machine learning and automation into its fulfillment network. But the result as of now is its capex spending is way up -- and its free cash flow is falling.

|

Metric |

Q2 2024 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

Q2 2025 |

Q3 2025 |

|---|---|---|---|---|---|---|

|

Capital expenditures (trailing 12 months) |

$53.97 billion |

$64.95 billion |

$77.65 billion |

$87.98 billion |

$102.95 billion |

$115.90 billion |

|

Free cash flow (trailing 12 months) |

$52.97 billion |

$47.74 billion |

$38.21 billion |

$25.92 billion |

$18.18 billion |

$14.78 billion |

Source: Amazon

When looking at the numbers, it's easy for bears to be concerned that Amazon may be spending too much, too fast. But I don't think that's the case at all.

You have to spend money to make money

AI is a rapidly growing field -- and it's expensive. There's no getting around it. But the rewards make the risk worthwhile, and Amazon already has a leading position in the cloud computing space.

It's also taking strides at reducing its reliance on data center chips made by Nvidia -- and if that effort is successful, it would go a long way to not only reducing its capex spending but creating a new revenue stream. Amazon unveiled its latest chips, the Trainium3 in December, which it says can handle some AI tasks at lower prices. Amazon claims that developers building AI products can save up to 40% by using Trainium3 chips instead of Nvidia's chips.

The AI space is going to continue to evolve this year. But Amazon has a dirt cheap valuation today and it's making important moves to not only solidify its position in the cloud computing space, but also to reduce its reliance on Nvidia and create another revenue stream. It's underrated as we begin 2026, and I think it could be a nice surprise for shareholders.

Should you buy stock in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $488,653!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,148,034!*

Now, it’s worth noting Stock Advisor’s total average return is 971% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 7, 2026.

Patrick Sanders has positions in Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.