Should You Buy the Invesco QQQ ETF With the Nasdaq at an All-Time High? Here's What History Says

Key Points

The Nasdaq is usually the exchange of choice for early-stage technology companies looking to go public.

The Nasdaq-100 hosts 100 of the largest nonfinancial companies listed on the Nasdaq, many of which are from the tech sector.

The Invesco QQQ ETF tracks the performance of the Nasdaq-100, and it could be a great buy right now even with the index at a record high.

- 10 stocks we like better than Invesco QQQ Trust ›

More than 3,500 companies have chosen to go public by listing their shares on the Nasdaq (NASDAQ: NDAQ) stock exchange. It's typically the destination of choice for early-stage technology companies, because it offers lower fees and fewer barriers compared to alternatives like the New York Stock Exchange.

The Nasdaq-100 is an index featuring 100 of the largest nonfinancial companies listed on the Nasdaq. It's dominated by the technology sector with a weighting of more than 60%, because many of the early-stage companies that listed on the Nasdaq decades ago are now worth trillions of dollars. Nvidia, Apple, and Microsoft are just a few examples.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

The Nasdaq-100 is coming off a 20% gain in 2025, and it's currently trading near an all-time high. The Invesco QQQ Trust (NASDAQ: QQQ) is an exchange-traded fund (ETF) that tracks the performance of the index by holding the same stocks and maintaining similar weightings, so is it a good buy right now? Here's what history says.

Image source: Getty Images.

A high degree of exposure to the fast-moving tech sector

A company's market capitalization (value) determines its weighting in the Nasdaq-100, meaning larger companies have a greater influence over its performance than smaller companies. However, there is a cap to ensure no single company represents more than 24% of the index, because excessive portfolio concentration can lead to volatility.

With that said, the Nasdaq-100 is still very top heavy. The 10 largest positions in the Invesco QQQ ETF have a combined weighting of 51.7%, so they are far more influential than its other bottom 90 holdings.

|

Stock |

Invesco ETF Portfolio Weighting |

|---|---|

|

1. Nvidia |

9.04% |

|

2. Apple |

8.01% |

|

3. Microsoft |

7.17% |

|

4. Alphabet |

7.01% |

|

5. Amazon |

4.92% |

|

6. Tesla |

3.97% |

|

7. Meta Platforms |

3.87% |

|

8. Broadcom |

3.26% |

|

9. Palantir Technologies |

2.24% |

|

10. Netflix |

2.19% |

Data source: Invesco. Portfolio weightings are accurate as of Jan. 1, 2026, and are subject to change.

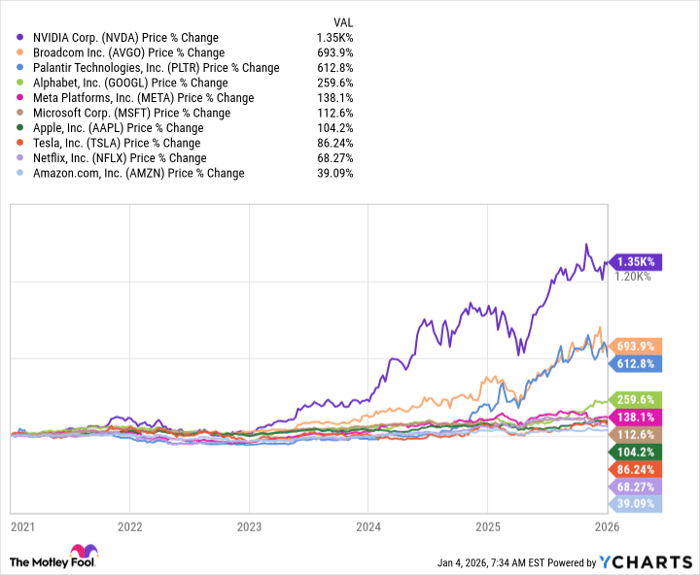

The above companies operate in some of the most exciting and fastest-growing segments of the technology industry, including artificial intelligence (AI), robotics, autonomous vehicles, and even quantum computing. The 10 stocks have delivered an average return of 346% over the last five years, which is a key reason why the Nasdaq-100 has consistently outperformed the more diversified S&P 500 (SNPINDEX: ^GSPC).

NVDA data by YCharts

I also want to make special mention of Advanced Micro Devices and Micron Technology, which sit just outside the Invesco ETF's top 10 holdings. They had a breakout year in 2025, with their shares soaring by 77% and 239%, respectively. They are shaping up to be two of the most important AI semiconductor companies alongside Nvidia and Broadcom.

Although the technology sector is at the heart of the Nasdaq-100, the index does offer a splash of diversification with non-technology holdings like Costco Wholesale, Linde PLC, PepsiCo, and Starbucks. They won't be able to offset a tech-specific market crash on their own, but they can help reduce some of the general volatility in the index.

It's always a good time to invest for the long term

The Invesco QQQ ETF has produced an average annual return of 10.5% since it was established in 1999. But it delivered accelerated annual returns of 19.3% over the last decade specifically, thanks to the widespread adoption of technologies like enterprise software, cloud computing, electric vehicles, and of course, AI.

Those returns account for every sell-off in the Nasdaq-100 along the way, including five bear markets since 1999 (a peak-to-trough decline of 20% or more), which were triggered by economic shocks like the dot-com crash in 2000, the global financial crisis in 2008, the COVID-19 pandemic in 2020, the inflation surge in 2022, and President Trump's "Liberation Day" tariffs in 2025.

Volatility is a normal part of the investing journey -- it's the price we pay for the opportunity to earn enormous compounding returns over the long term. The secret to success is to stay the course, and to always maintain a long-term investment horizon of five years or more, which will smooth out the market's wild swings.

Therefore, even though the Nasdaq-100 is trading near an all-time high right now, history suggests it might still be a great time to buy the Invesco QQQ ETF for anyone seeking long-term returns.

Should you buy stock in Invesco QQQ Trust right now?

Before you buy stock in Invesco QQQ Trust, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Invesco QQQ Trust wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $493,290!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,153,214!*

Now, it’s worth noting Stock Advisor’s total average return is 973% — a market-crushing outperformance compared to 195% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 7, 2026.

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Costco Wholesale, Meta Platforms, Microsoft, Netflix, Nvidia, Palantir Technologies, Starbucks, and Tesla. The Motley Fool recommends Broadcom, Linde, and Nasdaq and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.