Does Philippe Laffont Know Something Wall Street Doesn't? The Billionaire Investor Just Sold Nvidia and AMD, and Bought These Other Chip Stocks Instead

Key Points

During the third quarter, Coatue Management reduced its exposure to GPU leaders Nvidia and AMD.

At the same time, the firm dramatically increased its stakes in Alphabet and Marvell Technology.

Philippe Laffont is making sure his fund has positions across the entire semiconductor landscape.

- 10 stocks we like better than Alphabet ›

Within 45 days of the end of each quarter, every institutional investor managing over $100 million is required to file a Form 13F with the Securities and Exchange Commission (SEC). These filings itemize which stocks they bought and sold during that quarter. This provides everyday investors with a glimpse -- though a delayed one -- into what the "smart money" on Wall Street is doing.

During the third quarter, Philippe Laffont's firm, Coatue Management, made a number of interesting moves. It trimmed its exposure in semiconductor leaders Nvidia (NASDAQ: NVDA) and Advanced Micro Devices (NASDAQ: AMD) by 14% and 19%, respectively. In addition, Laffont more than tripled the fund's stakes in Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG) and Marvell Technology (NASDAQ: MRVL).

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Let's break down what may have influenced these decisions and assess if Laffont could be onto something big.

Image source: Nvidia.

Nvidia and AMD dominate the AI chip market

Nvidia and AMD are the two leading designers of graphics processing units (GPUs), which are the most widely used parallel processing chips for training large language models and building generative AI applications.

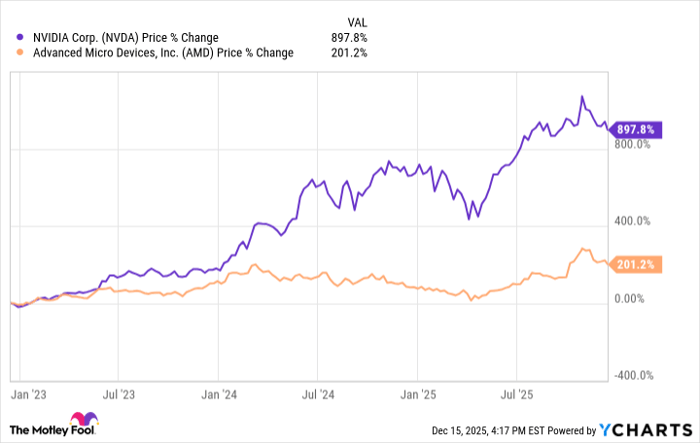

The rise of generative AI has ushered in a wave of unprecedented revenue and profit growth for chip designers. Shares of Nvidia and AMD have skyrocketed by nearly 900% and 200%, respectively, throughout the AI revolution.

NVDA data by YCharts.

Management consulting firm McKinsey & Company is forecasting that investment in AI infrastructure will reach nearly $7 trillion over the next five years -- with the majority of that spending allocated toward building data centers and chip procurement.

With that in mind, it seems likely that the hyperscalers will continue accelerating their AI capital expenditures for the foreseeable future. Given these secular tailwinds, the prospects surrounding Nvidia and AMD appear bright.

This begs the question: Does Laffont see something the rest of us don't?

Understanding Alphabet and Marvell's positions in the chip market

One of the biggest catalysts for Alphabet right now is its cloud infrastructure business. Google Cloud has attracted a number of high-profile customers, including Anthropic, OpenAI, and Meta Platforms.

Moreover, the company's custom-designed AI processors -- which it calls Tensor Processing Units (TPUs) -- are becoming a key part of the value proposition around its AI ecosystem.

While GPUs and other specialized parallel processors get most of the attention among AI investors, there's a lot more that goes into a data center. Marvell can provide much of it: The company specializes in designing architecture for high-bandwidth memory (HBM) computing stacks, as well as other networking, security, and storage hardware.

As AI workloads become larger and more sophisticated -- requiring enhanced memory and storage processes -- demand for the offerings of players like Marvell should rise further.

Image source: Getty Images.

The bottom line: The semiconductor opportunity is broadening

While analysts appear optimistic about Alphabet's TPU business, these chips are heavily geared toward custom applications such as deep learning. Meanwhile, Marvell is carving out its own pocket in the AI realm focused on data centers' memory storage needs.

In my view, Laffont's moves during the third quarter look more like a structural mix shift than a reflection of souring sentiment toward AI GPUs. What I mean by that is the billionaire smartly reduced his fund's exposure to general-purpose chip designers such as Nvidia and AMD and rotated capital into other specific segments of the AI space.

I bring this up to drive home a broader point: Laffont still has significant exposure to the GPU market. It's not as if Coatue completely dumped its stakes in Nvidia and AMD.

During the third quarter, he merely increased his bets on other areas of the chip market beyond generic accelerators. The construction of Coatue's portfolio suggests the firm is quite bullish about the continuing expansion of AI infrastructure. It appears that Laffont is trying to capitalize on this trend by building a diversified portfolio around the proliferation of chips and their various applications in AI.

At the end of the day, I think building positions in the major players across GPUs, custom chipsets, memory architecture, and more will prove to be a winning investment strategy in the long run.

Should you buy stock in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $511,196!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,047,897!*

Now, it’s worth noting Stock Advisor’s total average return is 951% — a market-crushing outperformance compared to 192% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 18, 2025.

Adam Spatacco has positions in Alphabet, Meta Platforms, and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Meta Platforms, and Nvidia. The Motley Fool recommends Marvell Technology. The Motley Fool has a disclosure policy.