The Best Stocks to Invest $1,000 in Right Now

Key Points

Two of these tech players make great buys for growth investors, while the third player is well-suited to any stock portfolio.

These companies may benefit as the AI boom marches on.

- 10 stocks we like better than Palantir Technologies ›

Artificial intelligence (AI) stocks have driven gains in the technology industry -- and the overall stock market -- over the past few years. The S&P 500 today is heading for its third straight double-digit annual increase thanks to this momentum. Investors have rushed to get in on these players amid excitement about the potential of AI to make companies more efficient and supercharge earnings performance.

But in recent weeks, some market participants have shied away from AI players with the idea that they may have advanced too far, too fast. Still, many signs point to a very bright long-term AI story: from ongoing demand for AI products and services to soaring revenue that we've seen at many AI companies. This suggests that some price declines may represent buying opportunities.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Here, I'll talk about two stocks to buy on the dip and another tech player that hasn't benefited as much as others from the AI boom -- but could do so in the coming year. The first two are best suited to growth investors who can handle a bit of risk, while the third stock makes a fantastic addition to any portfolio. And with $1,000 or even less, you could get in on just one or all three. Let's check out the best stocks to invest $1,000 in right now.

Image source: Getty Images.

1. Palantir Technologies

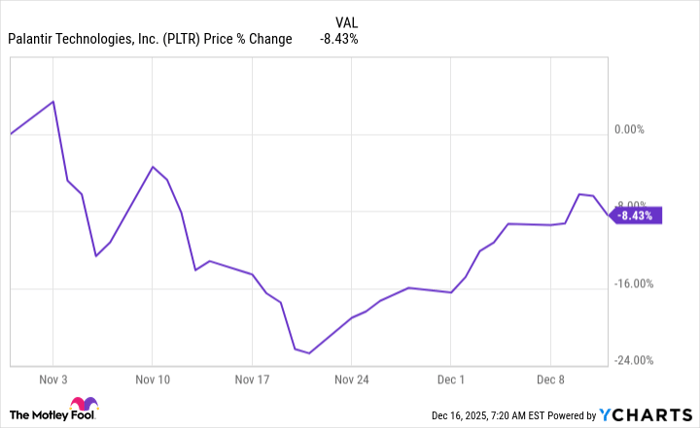

Palantir Technologies (NASDAQ: PLTR) has wowed the market with its earnings and stock price performances. The software company has seen revenue soar in the double digits quarter after quarter, profit also has advanced, and the stock has climbed 2,500% over the past three years.

The reason for all of this is simple: Palantir offers customers a way to apply AI to their needs almost overnight. The company's software aggregates and analyzes a customer's data, so the customer can then make use of that data. Two years ago, Palantir launched its Artificial Intelligence Platform (AIP), an AI-driven system, and since that moment, demand has skyrocketed. All of this has spurred growth in Palantir's government and commercial businesses.

The problem these days is Palantir's lofty valuation, 253x times forward earnings estimates, but it's important to remember that such a measure doesn't take into account earnings potential years down the road. So, even though Palantir looks expensive by that measure, the stock still may have plenty of room to run over the long term -- and this makes it a great buy on the dip for growth investors.

PLTR data by YCharts

2. CoreWeave

CoreWeave (NASDAQ: CRWV) offers something that AI customers need right now -- and probably will need well into the future. I'm talking about access to high-powered graphics processing units (GPUs) to power their workloads. CoreWeave is a cloud player that specializes in the compute for AI, renting it out for a few hours or a day or for a long period of time.

The company offers customers options -- and saves them money because, in many cases, renting access to GPUs may be a lot cheaper than investing in a fleet of GPUs.

CoreWeave works closely with top GPU designer Nvidia, which also owns a 7% stake in the company. This vote of confidence from Nvidia is important since the chip leader has its finger on the pulse of the AI industry. Though CoreWeave isn't yet profitable, revenue has exploded higher -- for example, it more than doubled in the recent quarter.

CoreWeave stock has lost 60% from its peak, but it's still heading for a double-digit gain this year. As customers continue to seek compute to advance their AI projects, CoreWeave could be in the early days of its revenue growth story -- so if you're an aggressive investor, the best time to get in on this player may be now.

3. Apple

Apple (NASDAQ: AAPL) has become a household name, with many of us owning at least one of its famous products -- from the iPhone to the Mac. But this tech giant hasn't been a big winner of the AI boom so far, as it's taken a longer time than others to roll out an AI platform. It's progressively launched Apple Intelligence, a family of AI features for its products, over the past year, and the process should continue into next year.

As investors consider shifting out of some of the biggest AI gainers, they now may think of rotating into Apple. The tech powerhouse offers us a long track record of earnings strength, and in the coming months, its presence in AI could add to its growth.

Apple may also benefit from another very important trend that's been unfolding quarter after quarter. And this is growth in services revenue. Now that Apple has a massive base of active devices out there, it can count on them for recurring revenue. This is as Apple users sign up for services such as cloud storage or digital entertainment. In recent quarters, services revenue has reached record levels.

This year, Apple has underperformed the S&P 500, but that may not continue for long, as it soon may be Apple's turn to benefit from the AI boom.

Should you buy stock in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $505,695!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,080,694!*

Now, it’s worth noting Stock Advisor’s total average return is 962% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 16, 2025.

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Nvidia, and Palantir Technologies. The Motley Fool has a disclosure policy.