Is XRP a Buy Heading Into 2026?

Key Points

XRP's price soared during the first half of 2025.

Lately, broader weakness in the cryptocurrency market has fueled a prolonged sell-off in major tokens.

XRP has a clear value proposition, but it may be years before it becomes a staple in modern financial infrastructure.

- 10 stocks we like better than XRP ›

With just a few weeks left in the calendar year, 2025 is shaping up to be yet another volatile ride for cryptocurrency investors.

Through roughly the first six months of the year, XRP's (CRYPTO: XRP) price had risen by 73%. Unfortunately, the latter half of 2025 has featured continuous selling. As of this writing (Dec. 8), XRP is about breakeven on the year.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Let's dig into the highs and lows around XRP to help determine if the token is a good buy heading into 2026.

Analyzing XRP's rise and fall in 2025

The company behind XRP, Ripple, has been under intense scrutiny from the Securities and Exchange Commission (SEC) for the last several years. Most notably, some regulators took issue with how sales of XRP were classified, contesting whether or not the token should be considered a security.

Over the summer, however, the SEC and Ripple settled their dispute. In turn, the token skyrocketed to over $3 -- a price that it had not reached since 2018.

At a macro level, XRP has also benefited from the Trump administration's pro-crypto rhetoric. While XRP itself is not currently a focal point of any crypto-related agendas in Washington, new regulations including the Guiding and Establishing National Innovation for U.S. Stablecoins (Genius) Act and the Digital Asset Market Clarity Act have been viewed positively by crypto supporters and fueled a brief rally among a number of tokens.

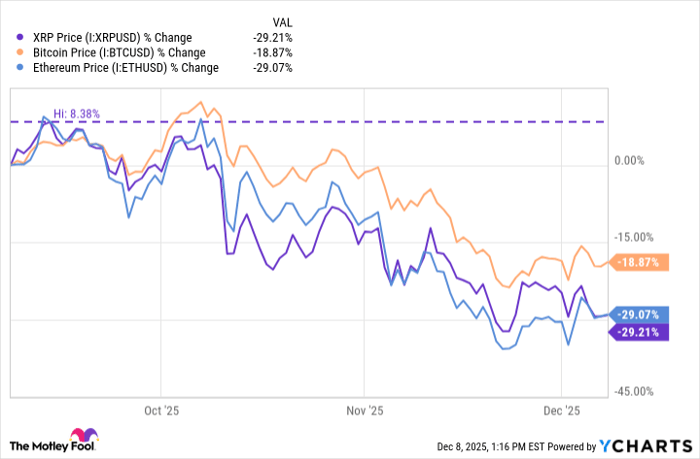

Over the last three months, prices in major cryptocurrencies -- including both Bitcoin and Ethereum -- have taken a sharp downturn.

XRP Price data by YCharts.

Perhaps the biggest contributor to the ongoing crypto sell-off is tightening liquidity. Given the Federal Reserve has pushed back potential interest rate reductions in combination with tapering its balance sheet, liquidity flows have fallen compared to historical levels.

As such, both retail and institutional investors have been wary of deploying capital into more speculative assets such as cryptocurrency.

Image source: Getty Images.

Where is XRP headed in 2026?

In theory, XRP has a number of catalysts that could revive its price action. A number of large banks and corporations are increasingly exploring the usage of stablecoins, while financial institutions continue to tinker with digital assets as part of their portfolio structure.

Should investments in these various pockets of the crypto realm accelerate, XRP could witness some new interest. With that said, I don't see any of these developments as a concrete reason to invest in the token.

To me, an investment in XRP should revolve around one thing above all else: a belief that its value proposition as a bridge currency in the cross-border transactions market will reach material adoption in the future.

Where things get complicated is that Ripple's payments network may become more widely implemented across banks and private enterprises, replacing legacy financial services infrastructure. But even if that happens, businesses do not need to denominate their transactions in XRP. In fact, they could still use fiat currency as opposed to crypto altogether.

Against this backdrop, I do not see Ripple -- and by extension, XRP -- suddenly reaching a critical mass by next year. I think an investment in XRP today still largely hinges on speculation and more of an idea that it will one day become a mainstream form of payment.

Given these dynamics, I don't see the current sell-off in XRP as an opportunity to buy the dip. I think the token could be headed for further price normalization going into 2026.

Should you invest $1,000 in XRP right now?

Before you buy stock in XRP, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and XRP wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $513,353!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,072,908!*

Now, it’s worth noting Stock Advisor’s total average return is 965% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin, Ethereum, and XRP. The Motley Fool has a disclosure policy.