Why the Best-Performing "Magnificent Seven" Stock of 2025 Is Still a Buy for 2026

Key Points

Alphabet has outperformed the other "Magnificent Seven" stocks significantly this year with a 64% gain.

Yet, even today, it's the second-cheapest stock among the group.

On the back of its improved AI offerings, Alphabet could have another year of outperformance in 2026.

- 10 stocks we like better than Alphabet ›

While the market is on pace for a strong 2025, most of the stocks in the "Magnificent Seven" merely had good, not fantastic, years. But one Magnificent Seven stock clearly took the crown in 2025: Google parent Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL).

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

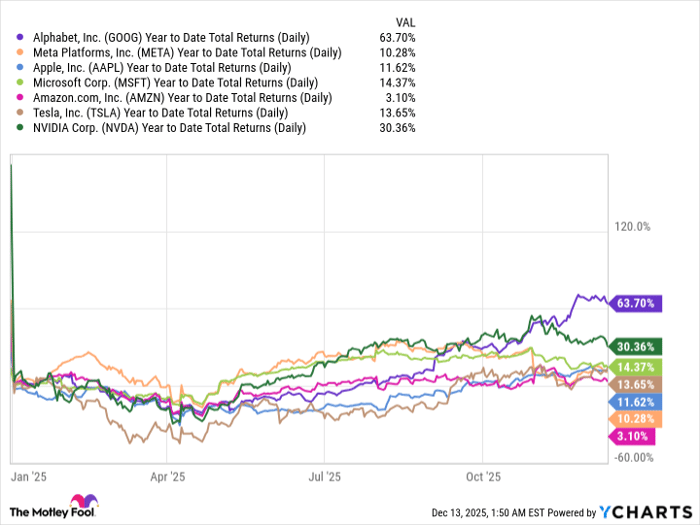

GOOG Year to Date Total Returns (Daily) data by YCharts.

As you can see, Alphabet's 64% return trounced the rest of the Magnificent Seven, beating 2025's second-best performer, Nvidia (NASDAQ: NVDA), by a whopping 33 percentage points and most of the others in the group by more than 50 points.

Here's how Alphabet did it and why the rally may very well continue into 2026.

Alphabet entered the year as the cheapest Magnificent Seven stock and still isn't expensive

Coming into the year, Alphabet had been a notable laggard, with its valuation reflecting considerable fear, uncertainty, and doubt in the age of generative artificial intelligence (AI). As a result, Alphabet began the year at the lowest valuation of the group. At one point, its price-to-earnings (P/E) ratio even touched the high teens -- below the average valuation of the S&P 500.

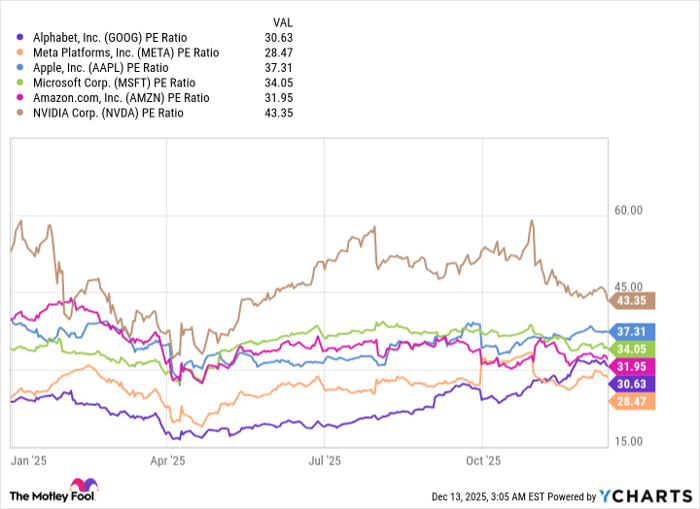

Yet, as you can see, even with this year's vast outperformance, Alphabet retains the second-lowest P/E ratio of the group at 30.6 times trailing earnings, barely beating out Meta Platforms.

GOOG PE Ratio data by YCharts. PE Ratio = price-to-earnings ratio.

Alphabet engineered a turnaround, and Buffett saw it coming

The primary concern entering the year was that AI chatbots might eventually disrupt Google Search, which is still Alphabet's largest profit center. It's also true that, early in the year, Google Search showed a concerning deceleration in paid clicks. Yes, there was still growth, but by the first quarter, paid click growth had fallen to just 2%, with concerns that it might eventually go negative.

However, on its second-quarter earnings, Alphabet began to prove that narrative wrong, as Search paid clicks reaccelerated to 4% growth. That might have been when Warren Buffett or his lieutenants decided to buy Alphabet stock for the Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) portfolio. Whatever the reason, the buy proved prescient, as Search paid click growth accelerated yet again in the third quarter to 7%.

Image source: Getty Images.

AI improvements bolstered Search and Gemini

It wasn't just a matter of luck that Alphabet was able to reaccelerate Search paid clicks. The reacceleration of Search happened just after Google introduced AI Mode in May, giving Search users the option of a chatbot-like experience powered by Alphabet's own homegrown large language models (LLMs). It appears the improvement, combined with 2024's introduction of AI Overviews, caused Search users to reengage.

Of course, all of that AI infusion into Search would have been for naught if Alphabet's AI models weren't competitive. However, Alphabet has clearly upped its AI game over the past year. The vast improvement was confirmed by the November introduction of Gemini 3, Alphabet's latest LLM, which rapidly climbed to the top of several industry benchmarks, beating out even the latest ChatGPT model on many important tasks.

The introduction of Gemini 3 appears to signify at least a near-term changing of the guard in the AI race, as ChatGPT had pretty much retained its first-mover advantage since introducing LLM chatbots to the world in late 2022. Subsequent to Gemini 3's launch, OpenAI CEO Sam Altman issued a "code red" memo to OpenAI's employees.

Alphabet can maintain its new lead in the AI race

Years ago, Alphabet had a virtual monopoly on artificial intelligence research before OpenAI was formed to challenge its industry-leading research lab. In fact, Alphabet's researchers were the first to innovate transformer technology, which is the backbone of modern-day LLMs.

Not only does Alphabet have a longer history of deep AI research than even OpenAI, but it has also designed its own proprietary AI chips for the past decade. Alphabet trained Gemini not on expensive Nvidia chips but on its in-house-designed Tensor Processing Units, or TPUs. That's a proprietary technology of Google and a point of differentiation.

Proprietary AI research and in-house chips have enabled Google to become a vertically integrated AI player with the most extensive collective experience in the field. And although OpenAI clearly caught Alphabet off guard when it unveiled ChatGPT three years ago, it appears that Alphabet has now caught up and surpassed OpenAI, at least for now.

Given Alphabet's significantly greater financial resources, more years of AI research experience, and its own proprietary chips, Google may even continue to augment its new lead.

Why things could get even better for Alphabet in 2026

Not only that, but Alphabet also has several businesses it can infuse with its newfound AI leadership. For instance, many of the most reputable private AI labs conduct their research on Google Cloud, thanks to its proprietary TPU option alongside the standard GPU formats. Google's cloud business is accelerating and could become a meaningful new profit center in the years ahead.

Additionally, Alphabet's self-driving unit, Waymo, appears to be growing by leaps and bounds. This past spring, Waymo reached one million autonomous rides per month, and it surpassed 14 million rides in 2025 as of December -- more than triple the number of rides delivered the previous year. Waymo also just began delivering autonomous rides on freeways, and Alphabet plans to expand Waymo services in 20 cities in 2026.

Autonomous robotaxis could become a significant business in a few years, and Waymo has a substantial first-mover advantage in this space. That could add still another leg to Alphabet's burgeoning empire across Search, AI services, YouTube, Cloud, hardware, subscriptions, and other next-generation technology bets.

In other words, with the big looming fear regarding Search seemingly quelled for now, one could argue that Alphabet should be priced higher than its other Magnificent Seven peers today, rather than the second-cheapest of the bunch.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $513,353!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,072,908!*

Now, it’s worth noting Stock Advisor’s total average return is 965% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Billy Duberstein and/or his clients have positions in Alphabet, Berkshire Hathaway, and Meta Platforms. The Motley Fool has positions in and recommends Alphabet, Berkshire Hathaway, Meta Platforms, Nvidia, and Tesla. The Motley Fool has a disclosure policy.