2 Predictions for Novo Nordisk in 2026

Key Points

Novo Nordisk has the potential to maintain more consistent revenue growth throughout next year.

There is an indication that the company's pipeline candidates will see strong progress in 2026.

Novo Nordisk's shares appear attractive, despite the challenges it faces.

- 10 stocks we like better than Novo Nordisk ›

The past 18 months have been absolutely terrible for Novo Nordisk (NYSE: NVO). The Denmark-based drugmaker has faced poor financial results and clinical setbacks, all of which have driven its stock price down. Its stock price is barely hovering above multiyear lows at the moment. The pharmaceutical giant recognizes there is an issue, and management has made some moves to attempt a comeback.

Can Novo Nordisk get its comeback going in 2026? Let's discuss two things that could materialize for the company next year and also examine whether its shares are worth consideration at current levels.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

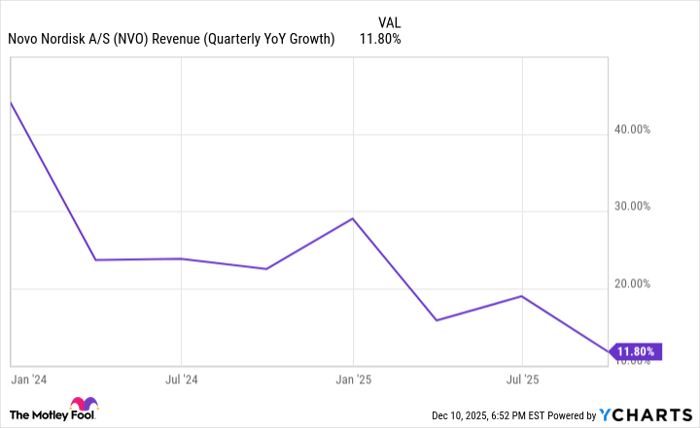

Top-line growth will stabilize

Novo Nordisk's revenue growth has dropped significantly over the past two years.

Data by YCharts.

The company was forced to revise its guidance downward several times in recent quarters. Further, its key growth drivers, weight-loss drug Wegovy and diabetes treatment drug Ozempic, which share the same active ingredient (semaglutide), were the targets of government-mandated price cuts in the U.S. As a result, they will sell for much lower prices for some eligible Medicare and Medicaid patients. And that's on top of the company's own decision to reduce the cost of Wegovy for cash-paying patients.

Image source: Getty Images.

The changes suggest that Novo Nordisk's revenue growth could slow even further in 2026. However, I expect the company's results to stabilize. Let me explain why.

For one, price was a significant barrier for many patients seeking access to these medicines, especially the weight loss brand Wegovy, which is not covered by many insurance plans. The lower price will be offset, at least somewhat, by an increase in sales volume from patients who can now afford to pay out of pocket.

Second, new indications for its use should help push semaglutide's sales higher. An oral version of the medicine is racing toward regulatory approval. Many patients prefer pills to injections. Pills are also easier and cheaper to manufacture for pharmaceutical companies. With a soaring demand for anti-obesity drugs, Novo Nordisk's oral option could be a hit. Then, there is Wegovy's approval in metabolic dysfunction-associated steatohepatitis (MASH), a liver disease with a large unmet need; it affects millions of patients in the U.S. alone.

Looking at the sales numbers for Rezdiffra (made by Madrigal Pharmaceuticals (NASDAQ: MDGL)) is instructive. Last year, Rezdiffra became the first medicine approved by the U.S. Food and Drug Administration for the treatment of MASH. Through the first nine months of 2025, it generated about $637.3 million in revenue. Yet, Wegovy's efficacy in MASH was comparable to that of Rezdiffra. Here's one significant difference: Novo Nordisk has a larger commercial footprint, more funds, and more sales reps than the smaller Madrigal Pharmaceuticals. So, Novo Nordisk could generate significant sales for Wegovy in this indication through next year, which will help boost sales growth.

Novo Nordisk is reporting significant pipeline progress

Novo Nordisk also did not perform well this year because it is losing ground to its biggest competitor in the GLP-1 market, Eli Lilly (NYSE: LLY). The good news is that the Denmark-based healthcare giant will likely make strong pipeline progress next year. It has several mid- and late-stage candidates for which we should see updated data readouts. One of the company's more advanced candidates is Amycretin, an investigational weight loss medicine.

One reason Amycretin is a promising product is that it mimics the action of two separate hormones: GLP-1 and amylin. The dual hormonal approach can confer significantly greater efficacy. That's one reason Eli Lilly's Mounjaro is so effective and is gaining market share. Further, Amycretin is being developed in subcutaneous and oral formulations. Recent mid-stage data from the medicine suggest it could also be highly effective in treating Type 2 diabetes. Novo Nordisk should update investors on Amycretin's progress next year, and positive results should jolt the stock. And Novo Nordisk has several others along those lines.

Is Novo Nordisk stock a buy?

After the beating it took this year, some may choose to stay away from Novo Nordisk altogether. However, at current valuation levels, the company's shares look attractive. True, Eli Lilly has taken market share away from it, but Novo Nordisk remains a leader in the fast-growing weight loss market and boasts a deep pipeline in this area, all of which should enable it to ride this tailwind for the next few years, at the very least. Meanwhile, shares are trading at just 12.7 times forward earnings, which is significantly lower than the average of 17.6 for healthcare stocks. Novo Nordisk could recover in the medium term, and if it does, those who initiate positions today will see superior returns.

Should you invest $1,000 in Novo Nordisk right now?

Before you buy stock in Novo Nordisk, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Novo Nordisk wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $513,353!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,072,908!*

Now, it’s worth noting Stock Advisor’s total average return is 965% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Prosper Junior Bakiny has positions in Eli Lilly and Novo Nordisk. The Motley Fool recommends Novo Nordisk. The Motley Fool has a disclosure policy.