Will Alphabet Overtake Nvidia as the Largest Company in the World in 2026?

Key Points

Investors are beginning to appreciate Alphabet's position in the artificial intelligence landscape.

The company is benefiting greatly from strong demand in its cloud segment and the successful launch of its Gemini model.

Alphabet looks poised to continue generating strong revenue and profit growth.

- 10 stocks we like better than Alphabet ›

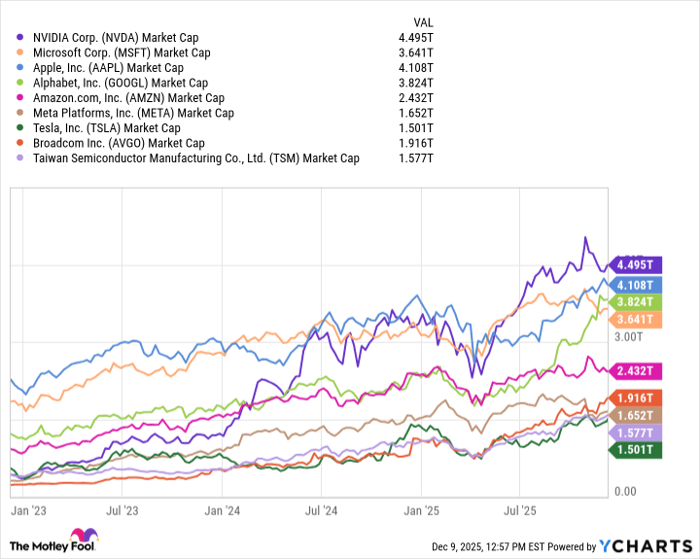

No company in the technology industry has benefited from the rise of artificial intelligence (AI) as much as Nvidia (NASDAQ: NVDA). Over the last three years, shares of the semiconductor giant have soared by more than 970% -- propelling its market cap to $4.5 trillion and making it the most valuable company in the world.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

NVDA Market Cap data by YCharts.

By contrast, Alphabet's (NASDAQ: GOOGL) (NASDAQ: GOOG) price action was fairly muted throughout much of the AI revolution -- up until recently. Investors were initially concerned that the rise of large language models (LLMs) and chatbots posed an existential threat to the crown jewel of Alphabet's business empire: its Google Search business.

Yet Alphabet appears to have put these worries to rest, and the stock's recent rally has put a $4 trillion market cap in sight. So could Alphabet be on its way to eclipsing Nvidia?

Alphabet is a one-stop-shop AI ecosystem

When OpenAI released ChatGPT three years ago, many analysts on Wall Street almost immediately bought into the idea that the chatbot would make Google Search into a relic. For a while, this sentiment appeared realistic.

Growth in Alphabet's advertising segment -- primarily stemming from Google and YouTube -- was failing to impress investors. Moreover, few were giving the company credit for its cloud computing business, which until the first quarter of 2023 was unprofitable.

Fast-forward to 2025, and the narrative around Alphabet seems to have completely flipped. Advertising revenue is growing at a respectable double-digit percentage clip. Meanwhile, Google Cloud Platform (GCP) has proven a formidable peer to Microsoft Azure and Amazon Web Services (AWS).

Alphabet's own LLM, Gemini, has become a fixture on Google Search -- providing AI-powered summaries to queries that are similar to what users would get from ChatGPT. Moreover, Gemini has also been integrated into the company's Android consumer electronics devices.

One key differentiator for Google Cloud is that Alphabet can offer access to its custom chips, called Tensor Processing Units (TPUs). These chips are specifically designed for AI workloads, and can outperform graphics processing units (GPUs) such as those made by Nvidia for some types of computations. TPUs are still a niche product compared to Nvidia's ubiquitous GPUs, but Google Cloud has won over the likes of Apple and Anthropic, and it's rumored to be circling a deal to sell a quantity of TPUs to Meta Platforms.

Beyond its core services, Alphabet is also quietly investing in emerging AI applications, including quantum computing and autonomous driving.

Image source: Getty Images.

Alphabet's business model could fuel further valuation expansion

Alphabet has put on a master class in building a vertically integrated business model. All of the company's core products now share one DNA strand: artificial intelligence.

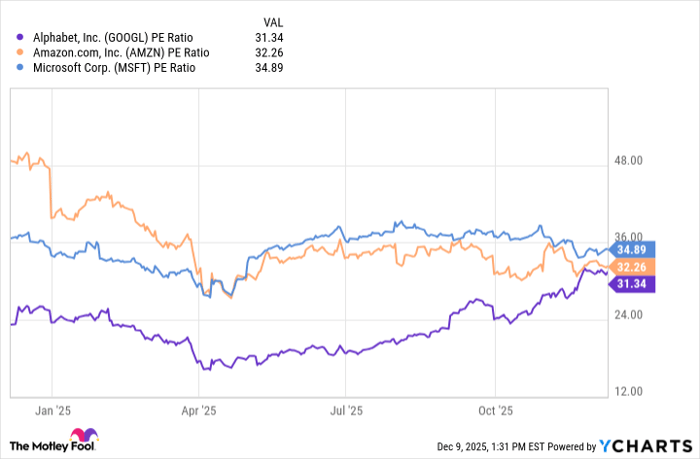

While it took a couple of years for this concept to materialize, Alphabet has ushered in a period of impressive revenue acceleration and profit margin expansion. Nevertheless, its price-to-earnings ratio of 31 lags its hyperscaler peers.

GOOGL PE Ratio data by YCharts.

To me, these dynamics suggest that even though Alphabet stock has been rallying, it is poised for further valuation expansion as its AI roadmap continues to materialize.

What's in store for Nvidia in 2026?

In order for Alphabet to reach the same market value as Nvidia, its stock would need to rise by another 18%. Of course, this assumes Nvidia stock stays the same for the time being.

While the bear case against Nvidia revolves around rising competition from Advanced Micro Devices and custom chip designs from the hyperscalers, I think Nvidia is still well positioned heading into next year.

The only way I see Alphabet overtaking Nvidia by next year is if investors suddenly grow tired of the narrative around data centers and start demanding that the chip king start demonstrating growth in other markets.

Considering that investment in AI infrastructure is expected to be a $7 trillion opportunity through 2030, the reality is that a good portion of big tech's capital expenditure budgets will be captured by Nvidia for the foreseeable future. Against this backdrop, I think investors will continue to appreciate Nvidia's data center chip dominance for quite some time.

With all that said, I view Alphabet as a good value in an otherwise frothy stock market and a buoyant AI space. While it may not dethrone Nvidia in 2026, Alphabet looks like a compelling buy-and-hold opportunity for investors with long-term horizons as we head into the new year.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $507,421!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,109,138!*

Now, it’s worth noting Stock Advisor’s total average return is 972% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Adam Spatacco has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.