Don't Buy Tandem Diabetes Care Until This Big Thing Happens

Key Points

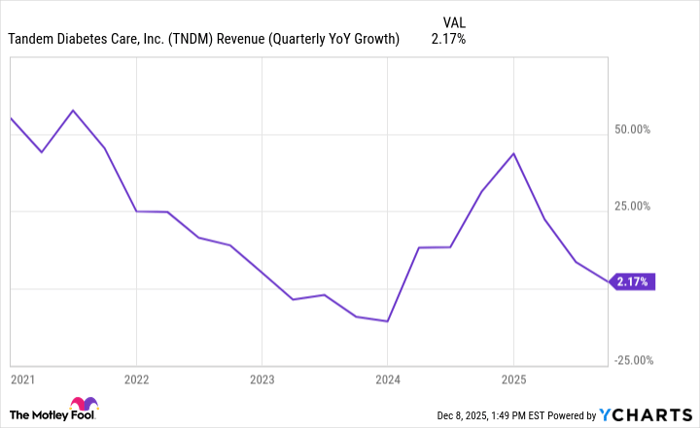

Tandem Diabetes Care's top-line growth hasn't been great over the past few years.

If it can successfully address challenges detrimental to revenue growth, it may become an attractive stock -- even with red ink on the bottom line.

- 10 stocks we like better than Tandem Diabetes Care ›

Tandem Diabetes Care (NASDAQ: TNDM), a medical device company, has had a rough year. The company's shares are down by 43%. It might be tempting to consider the stock at current levels. If it can perform well over the next few years, initiating a position today would yield excellent returns in the medium term. However, several factors need to align for Tandem Diabetes Care to become an attractive investment. Let's discuss one of those.

Image source: Getty Images.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Can it record consistent top-line growth?

Here's one thing no one can take away from Tandem Diabetes Care: It is a highly innovative company whose insulin pumps are among the market leaders. The company's t:slim X2 has been its main growth driver for a long time. This device is user-friendly, can pair with continuous glucose monitoring devices to automate insulin delivery, is significantly smaller than most competing ones, and supports remote updates. Besides its best-known product, Tandem Diabetes Care also launched the Tandem Mobi in the U.S. last year.

The Mobi is even smaller and can be fully controlled via an app from a smartphone. Despite its innovative devices, Tandem Diabetes Care's revenue growth has been mostly southbound over the past five years, partly due to competition and lower demand for insulin pumps (as they can last for a long time, many longtime patients aren't too eager to renew).

TNDM Revenue (Quarterly YoY Growth) data by YCharts.

Meanwhile, Tandem Diabetes remains unprofitable. The current uncertain and evolving global trade environment could further exacerbate Tandem Diabetes' financial situation. The company imports parts from various countries for manufacturing, including Mexico and China -- the latter of which has been one of President Donald Trump's favorite targets for steep tariffs.

This could lead to increased costs and further squeeze the operating margin and the bottom line. Where does that leave Tandem Diabetes Care? It is sometimes wise to invest in a company that isn't consistently profitable yet. However, with inconsistent revenue growth, stiff competition, and industrywide challenges that could decrease profits (or, rather, increase losses), Tandem Diabetes Care doesn't fit the profile of a non-profitable stock worth investing in.

The company needs to increase top-line growth and maintain it in the mid-to-high teens, at least. It could do so by expanding its market share through attracting new customers and enticing current pump users to purchase new ones -- perhaps with updates or new launches -- thereby initiating a robust cycle of renewals. This would help increase margins and profits, even with tariffs.

Hold off on buying, for now

Will Tandem Diabetes Care be able to achieve that? The newer Tandem Mobi could be part of the solution, and the company has several other products in development. It will be interesting to monitor its progress in these areas. But for now, the stock isn't worth buying.

Should you invest $1,000 in Tandem Diabetes Care right now?

Before you buy stock in Tandem Diabetes Care, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Tandem Diabetes Care wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $507,421!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,109,138!*

Now, it’s worth noting Stock Advisor’s total average return is 972% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.