Robinhood Stock Is Up Roughly 90% in the Last 6 Months. Can Its Run Continue in 2026?

Key Points

Robinhood stock has soared over 270% this year.

Buoyed by a resilient bull market, its core trading business is booming.

Robinhood aims to become a global financial services powerhouse.

- 10 stocks we like better than Robinhood Markets ›

Robinhood Markets (NASDAQ: HOOD) is having a stellar year, and so are its shareholders. As of Dec. 9, Robinhood shares are up nearly 90% over the past six months, and they've soared 270% in 2025. Zoom out to a three-year time horizon and Robinhood stock has rewarded shareholders with a jaw-dropping 1,400% gain.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Robinhood is coming off a monster third quarter. Revenue doubled to $1.3 billion and net income increased 271% on a year-over-year basis. After such an impressive run, investors might be wondering if Robinhood's momentum can carry over to 2026. Let's take a look at some of the factors that could have an impact on the business -- and the stock performance -- next year and beyond.

Image source: Getty Images.

Robinhood is building a financial services ecosystem

Robinhood has evolved from a trendy trading app for crypto enthusiasts into a diversified financial services platform. In addition to stock and crypto trading, Robinhood now offers IRA accounts, private banking, portfolio management, futures trading, a credit card, event contracts, and a membership service called Robinhood Gold. As of the third quarter, Robinhood had 11 business lines generating $100 million or more in annualized revenue each.

Still, Robinhood's bread and butter is its trading platform. Robinhood generates revenue from transactions through payment for order flow or bid-ask spreads. In Q3, transaction-based revenue jumped 129% to $730 million, comprising 57% of Robinhood's total revenue. Revenue from cryptocurrency transactions exploded 330% higher to $268 million, options revenue jumped 50% to $304 million, and equities revenue soared 132% to $86 million.

Robinhood's reliance on retail trading activity makes it highly sensitive to swings in market sentiment. Simply put, trading volumes spike when markets are moving higher. Conversely, user engagement tends to drop off when prices are falling or moving sideways. This correlation is even more pronounced with cryptocurrency trading, which has led to lumpy growth in Robinhood's crypto transaction revenue over the past three years.

Image source: The Motley Fool.

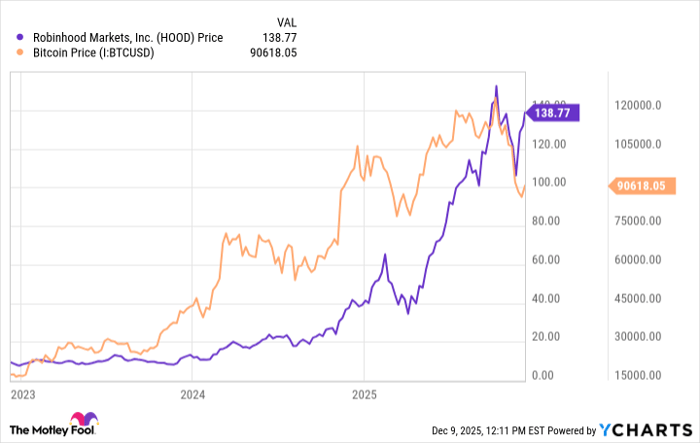

There's an interesting dynamic at play here. Because crypto trading is a major revenue driver for Robinhood -- and retail trading activity tends to ebb and flow with crypto sentiment -- Wall Street seems to view Bitcoin as a proxy for the health of Robinhood's business. In the chart below, notice the parallel movement between Robinhood stock and Bitcoin, especially over the past year and a half:

HOOD data by YCharts

If this trend continues, crypto volatility will be a key factor for Robinhood stock in 2026. Likewise, any dramatic swings in broader market sentiment -- like a shift away from high-growth tech stocks favored by retail investors -- could have an outsized impact on Robinhood's trading volumes and stock performance next year. However, if Robinhood can make progress on its diversification strategy, growth in its financial services products could help smooth out month-to-month volatility in its trading revenue.

Event contracts: a true wild card

Last fall, Robinhood dipped its toes into the newly created prediction markets by allowing users to bet on the outcome of the 2024 presidential election. An event contract is a low-cost, yes-no financial bet on whether a specific event will happen. Robinhood now offers more than 1,700 contracts, ranging from professional and college sports to politics, climate, entertainment, and economics.

Event contracts could be Robinhood's next growth engine. Contract volume has doubled every quarter, reaching 2.3 billion contracts in Q3. In October alone, volume ballooned to 2.5 billion contracts, which puts event contracts on track for a $300 million annual run rate, according to management.

Not everyone is on board with prediction markets. On Dec. 3, Connecticut's Department of Consumer Protection Gaming Division issued cease-and-desist orders to Robinhood and two other platforms, asserting that they're offering illegal sports wagering in the state. Although Robinhood insists that its event contracts are regulated at the federal level, investors might want to keep an eye on this situation -- especially if other states follow Connecticut's lead.

Can Robinhood keep rolling?

Robinhood is trading at a forward price-to-earnings (P/E) ratio of 59, more than double the S&P 500's forward P/E estimate of 24.1. That's not an outrageous valuation for a high-growth company, in my opinion. But I can see how it might give some investors pause, especially after the parabolic price gains of the past few years.

Still, if you're worried about what Robinhood's stock will do in 2026, I think you're missing the bigger picture. This is a company with ambitions of becoming a global financial services powerhouse. In 10 years, Robinhood aims to generate half of its revenue from outside the U.S. and from institutional investors. Robinhood made progress on both fronts with its recent acquisition of Bitstamp, a global cryptocurrency exchange serving institutional and retail clients. Based on market share data, there's a ton of runway for Robinhood to continue growing its core business as well.

If Robinhood is on your watch list in 2026, I would view any significant pullbacks as buying opportunities.

Should you invest $1,000 in Robinhood Markets right now?

Before you buy stock in Robinhood Markets, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Robinhood Markets wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $521,550!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,133,904!*

Now, it’s worth noting Stock Advisor’s total average return is 981% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Josh Cable has positions in Robinhood Markets. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.