1 Wall Street Strategist Thinks the Poverty Line for U.S. Families Is Woefully Out of Date. You Won't Believe How High He Thinks it Should Be.

Key Points

The poverty line today is still calculated based on a 1963 formula, which Simplify Asset Management's Michael Green believes to be antiquated.

The poverty line for a U.S. family of four is roughly $32,000 per year.

Green argues that there has been a big shift in required expenses for the modern family, although his argument has also received pushback.

- The $23,760 Social Security bonus most retirees completely overlook ›

Many people are likely unaware that the formula to determine the national poverty line was actually established in 1963. Mollie Orshansky, an economist at the Social Security Administration, developed the formula, which is three times the U.S. Department of Agriculture's (USDA) Thrifty Food Plan. The White House eventually adopted the formula, and it has remained in place ever since.

Today, this formula translates to a poverty line of slightly over $32,000 per year for a family of four. One doesn't need to be an economist to see that number and think it sounds low, considering the high cost of living in America today.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Recently, a Wall Street strategist conducted an analysis of why Orshanky's formula is no longer applicable, and what he thinks the new formula for the poverty line should be. The number may surprise you.

Image source: Getty Images.

Times have changed

Michael Green, a portfolio manager and chief strategist at Simplify Asset Management, recently published a new post on Substack, which raised the topic and demonstrated why he believes the new poverty line should be significantly higher.

The foundation of Green's argument is that the old formula no longer works because food no longer consumes as much of people's budget. According to Green, the cost of food at home now accounts for only 5% to 7% of household spending, as opposed to the one-third that Orshansky estimated in 1963. Other costs now consume a significantly greater portion of Americans' budgets, as evidenced by the change in how much they pay for other essential items in their daily lives.

Green also discussed how much life has changed since the early 1960s:

Housing was relatively cheap. A family could rent a decent apartment or buy a home on a single income, as we've discussed. Healthcare was provided by employers and cost relatively little (Blue Cross coverage averaged $10/month). Childcare didn't really exist as a market -- mothers stayed home, family helped, or neighbors (who likely had someone home) watched each other's kids. Cars were affordable, if prone to breakdowns. With few luxury frills, the neighborhood kids in vo-tech could fix most problems when they did. College tuition could be covered with a summer job. Retirement meant a pension income, not a pile of 401(k) assets you had to fund yourself.

Green then took his analysis one step further by looking at the national average for key costs that families of four are dealing with, and here is what he calculated:

- Childcare: $32,773

- Housing: $23,267

- Food: $14,717

- Transportation: $14,828

- Healthcare: $10,567

- Other essential items: $21,857

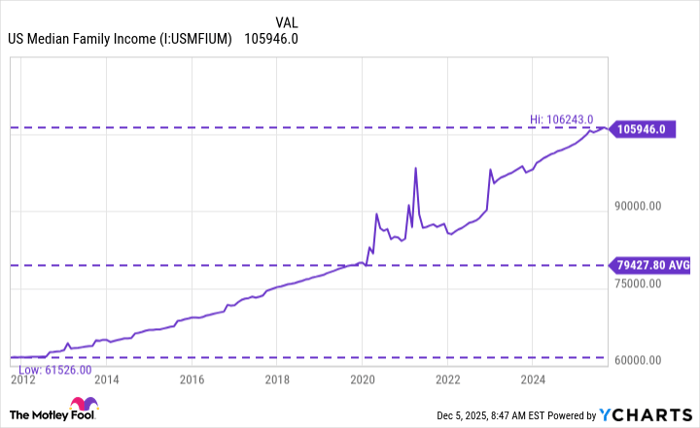

All these costs, plus federal and state taxes, resulted in Green arriving at a gross income of $136,500 for the poverty line. Meanwhile, the median U.S. household income is far below this number.

US Median Family Income data by YCharts

Now, Green acknowledges that there have been many qualitative improvements in life since the poverty line was established. However, there are additional costs that increase living expenses, such as smartphones and the cost of home internet, which children need for schoolwork and other activities, like accessing a bank account.

Green also notes that once people leave the bottom percentage of earners, they phase out of certain benefits, such as the ability to tap into Medicaid and other childcare subsidies.

Perhaps an exaggeration, but it raises interesting points

Naturally, Green's Substack has received a lot of attention. Some agree, while others think his analysis is way off the mark. In some cases, Green's claims may seem exaggerated because the poverty line is intended to be the bare minimum of money needed to meet a family's essential needs.

It's unlikely that a family's basic needs include such expensive child care, and the majority of families do not, in fact, make $136,000 per year and are still able to have enough food to eat. Many Americans also choose to live in expensive cities when they could, in fact, live somewhere else at a much lower cost. Obviously, it's easier said than done to simply uproot one's life.

Ultimately, Green's post raises interesting points about the middle class in America and whether it is waning to some degree. After all, housing has become either unaffordable or consumes a significantly larger percentage of a person's annual income, while healthcare costs are also extremely high. A middle-class person's wages certainly went much further in the 1990s than they do now.

Most people would likely agree that covering their daily expenses and saving for retirement, which has become increasingly expensive, is no easy task.

The $23,760 Social Security bonus most retirees completely overlook

If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.

One easy trick could pay you as much as $23,760 more... each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we're all after. Join Stock Advisor to learn more about these strategies.

View the "Social Security secrets" »

The Motley Fool has a disclosure policy.