Looking for Top ETFs? Here's One to Consider Now.

Key Points

This ETF has been a leader in its category for a decade.

It taps into two things investors love: dividends and tech stocks.

Its screening process can help investors avoid dividend duds.

- 10 stocks we like better than First Trust Rising Dividend Achievers ETF ›

Investors shopping for top exchange-traded funds (ETFs) can't be blamed if they're focusing on funds holding equities associated with artificial intelligence (AI) and technology. After all, those have been market-leading segments for an extended period.

Still, investors shouldn't get sidetracked. In the quest to identify some of the top ETFs to buy today, the First Trust Rising Dividend Achievers ETF (NASDAQ: RDVY) merits consideration. This ETF, which turns 12 years old next month, could be a potent addition to a wide variety of portfolios, but before diving in, investors should examine the fund's plumbing.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

This tech-heavy dividend fund is one of the top ETFs to consider today. Image source: Getty Images.

This isn't your grandfather's dividend ETF

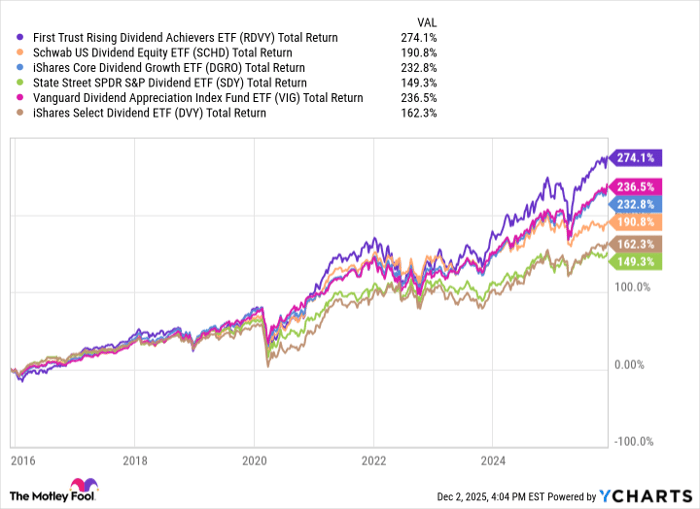

Home to $18.21 billion in assets under management (AUM) as of Dec. 1, First Trust Rising Dividend Achievers ETF is among the top 10 in terms of size in the dividend ETF category. More important is this ETF's long-running track record of outperforming peers, often by sizable margins.

RDVY Total Return Level data by YCharts

Knowing how First Trust Rising Dividend Achievers ETF generated that stellar run is important because while past performance isn't a guarantee of future returns, a fund's methodology can give investors a sense of what to expect. In the case of this dividend ETF, it focuses on four primary pillars.

First, member firms must have paid a dividend over the trailing 12 months that is "greater than the dividend paid in the trailing twelve-month period three and five years prior." Second, companies eligible for inclusion must have positive earnings over the past year, and those profits must exceed those notched in the prior three fiscal years.

Other mandates include prospective holdings must have cash-to-debt ratios of at least 50% and they can't have trailing 12-month payout ratios in excess of 65%. For some dividend-paying companies, those are high hurdles to clear, but adhering to those guidelines helps this ETF deliver a quality portfolio while steering investors away from yield traps.

The end product is something many investors may view as enticing, as this ETF allocates almost 27% of its roster to tech stocks. It's not common for dividend ETFs to feature Alphabet and Nvidia among their top six holdings, but this ETF breaks from the pack and it's worked out well for investors, helping make this fund one worth looking into.

Should you invest $1,000 in First Trust Rising Dividend Achievers ETF right now?

Before you buy stock in First Trust Rising Dividend Achievers ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and First Trust Rising Dividend Achievers ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $540,587!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,118,210!*

Now, it’s worth noting Stock Advisor’s total average return is 991% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 1, 2025

Todd Shriber has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, Nvidia, and Vanguard Dividend Appreciation ETF. The Motley Fool has a disclosure policy.