Forget Medtronic, Buy This Healthcare Stock Instead

Key Points

Medtronic is a solid choice for dividend investors, but Intuitive Surgical is a better option for growth-oriented investors.

Intuitive Surgical will continue dominating its niche even as Medtronic enters the market.

- 10 stocks we like better than Intuitive Surgical ›

There are compelling reasons for some investors to consider investing in Medtronic (NYSE: MDT), depending on their goals and risk tolerance. It is a well-established healthcare leader that generates consistent revenue and profits, with an impressive dividend track record, making it a good choice for risk-averse income seekers.

However, for other investors, particularly those focused on aggressive growth, Medtronic may not be a suitable choice. There are far better options on the market, including Intuitive Surgical (NASDAQ: ISRG).

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

Intuitive Surgical's terrific prospects

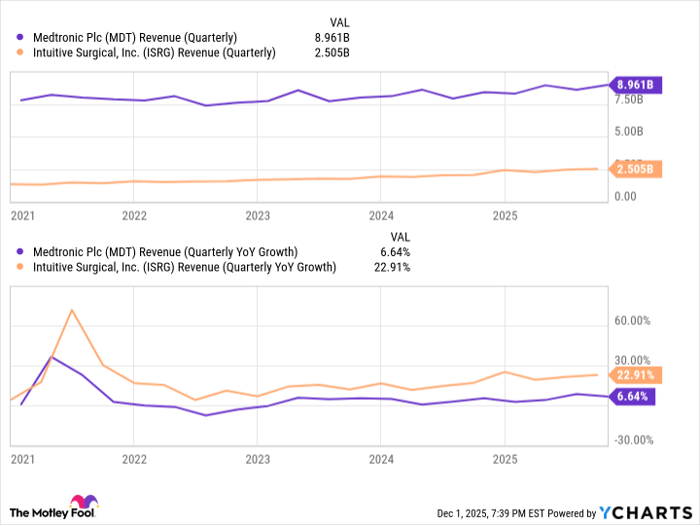

Medtronic is a larger, more mature medical device company whose quarterly revenue dwarfs that of Intuitive Surgical. However, the latter typically records stronger top-line growth.

MDT Revenue (Quarterly) data by YCharts.

Intuitive Surgical should continue doing that for a while. The company leads the market for robotic-assisted surgery (RAS) devices, thanks to its da Vinci surgical system, which is cleared for use across a wide range of procedures, including general surgery, urologic procedures, hernia repairs, mastectomies, and more. The minimally invasive procedures that the gadget enables surgeons to perform yield better health outcomes than traditional open surgeries. Here's the best part: Intuitive Surgical should ride this tailwind through the next decade.

One of the company's growth drivers will be an increase in procedure volume, driven by expansions across more indications. Intuitive Surgical also utilizes data from clinical trials and real-world use to enhance its device, resulting in increased adoption among physicians as they observe even better outcomes for their patients. Investors can rest assured that Intuitive Surgical will continue to make breakthroughs of this type, leading to stronger demand for the da Vinci system. A larger installed base means higher procedure volumes and more sales from instruments and accessories.

All these factors should enable Intuitive Surgical to continue growing its revenue at a significantly faster rate than its larger peer over the next decade -- and potentially deliver explosive returns along the way, making it a better growth stock.

Will Medtronic's entry into RAS be a challenge?

It's worth noting that Medtronic may soon launch its own RAS device, the Hugo system, in urologic procedures, where it will directly compete with Intuitive Surgical. Even if that will be an important step for Medtronic, Intuitive Surgical should remain the top player and still outpace its challenger.

For one, it will take a long time for Medtronic's Hugo to earn clearance across all of the da Vinci system's indications. It will take significantly longer for the healthcare giant to gather the same kind of real-world evidence of efficacy. And Medtronic may never catch up to Intuitive Surgical's installed base in this industry. All these reasons suggest that Intuitive Surgical will continue to dominate this field for a long time -- even as Medtronic enters it -- and deliver superior sales and earnings growth, as well as better stock market returns.

Should you invest $1,000 in Intuitive Surgical right now?

Before you buy stock in Intuitive Surgical, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intuitive Surgical wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $540,587!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,118,210!*

Now, it’s worth noting Stock Advisor’s total average return is 991% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 1, 2025

Prosper Junior Bakiny has positions in Intuitive Surgical. The Motley Fool has positions in and recommends Intuitive Surgical. The Motley Fool recommends Medtronic and recommends the following options: long January 2026 $75 calls on Medtronic and short January 2026 $85 calls on Medtronic. The Motley Fool has a disclosure policy.