What's Wrong With Carnival Corp Stock?

Key Points

Carnival's stock has struggled to gain momentum over the past year.

Investors are likely concerned about its high debt load.

However, the company's results have shown progress, and its interest coverage has been improving.

- 10 stocks we like better than Carnival Corp. ›

Carnival Corp (NYSE: CCL) is a leading cruise ship company that has benefited from a rise in travel demand in recent years. It has been posting record-setting numbers along the way, and the business looks to be in far better shape than it has in previous years.

But for all its progress, the stock's performance continues to be lackluster. This year, shares of Carnival are up just 3%, and its five-year gains sit at a relatively modest 28% (as of Nov. 28).

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

What's wrong with the travel stock, and why does it continually trade at a discount?

Image source: Getty Images.

Are investors too concerned about Carnival's debt load?

When the pandemic hit, Carnival and other cruise ship companies faced a dire future, with travel demand stalling. As a result, the company had to take on more debt to secure its future.

It's a problem that continues to weigh down the stock today. Although Carnival has been reducing its debt load, it may not be coming down fast enough for investors. As of the end of August, Carnival's long-term debt totaled $25.1 billion -- slightly less than the $25.9 billion it reported nine months earlier.

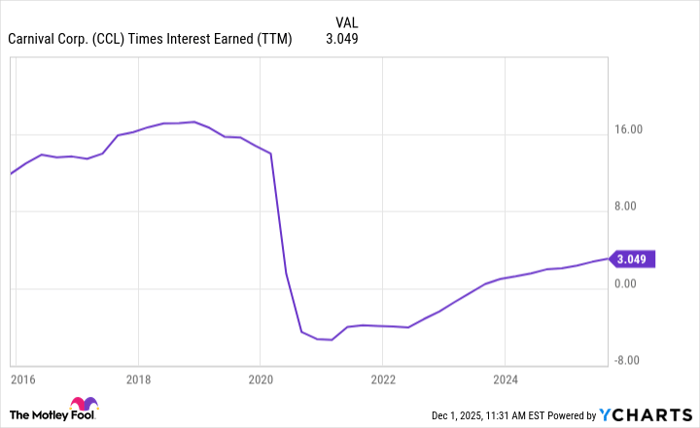

One way to gauge how much debt is impacting a business is by examining its interest coverage ratio, sometimes referred to as times interest earned, which looks at earnings with respect to interest costs. The higher the multiple, the stronger the earnings are in relation to interest, and thus, the more easily the company can cover its interest expenses.

CCL Times Interest Earned (TTM) data by YCharts

Carnival's interest coverage nosedived in 2020, and while it has been recovering, it's nowhere near where it was before the pandemic began. The positive sign for investors is that at least it's trending in the right direction. It does, nonetheless, add some risk to the equation.

Demand remains robust for Carnival cruises

When Carnival last reported earnings in September, it posted all-time highs for its financials, with the company also raising its guidance for the year. What's encouraging is that the company doesn't see any slowdown happening as it says that its advanced bookings for 2026 are similar to the levels it saw in 2025. Even as prices have risen, the demand has remained strong, with many consumers seeing cruises as affordable and convenient travel options.

Investors may, however, be worried about what lies ahead for the industry at a time when economic conditions are less than ideal, and there are still concerns about a possible recession. Carnival does have some good visibility into its future growth, but investors may be worried that sooner or later, demand will come down. While that doesn't appear to be happening just yet, when you add that risk on top of the problem of its high debt load, it starts to become a bit clearer as to why the stock hasn't taken off this year.

Carnival stock could make for an underrated buy right now

The cruise ship stock is currently trading at a forward price-to-earnings (P/E) multiple of 11, which is based on analyst expectations. That's an incredibly low valuation given that the S&P 500 average is a forward P/E of 22. Investors are severely discounting the stock, and I believe that is a mistake.

Although worsening economic conditions may weigh on its business, that may also lead to a further decline in interest rates, which would make the debt load less of a worry. And with a good value proposition for travelers, the cruise ship company may still be able to perform well even if the economy becomes more challenging for consumers.

This may not be the most exciting stock to own right now, given its performance, but Carnival could make for a great investment to hang on to over the long haul.

Should you invest $1,000 in Carnival Corp. right now?

Before you buy stock in Carnival Corp., consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Carnival Corp. wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $589,717!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,111,405!*

Now, it’s worth noting Stock Advisor’s total average return is 1,018% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 1, 2025

David Jagielski, CPA has no position in any of the stocks mentioned. The Motley Fool recommends Carnival Corp. The Motley Fool has a disclosure policy.