How Good Has Roku Stock Actually Been?

Key Points

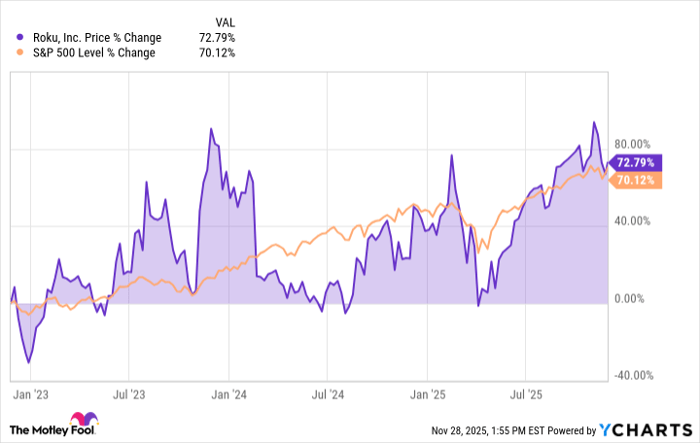

Roku's stock is up 73% over three years, roughly matching the S&P 500's gains despite massive volatility along the way.

Patient investors who bought during the 2022 crash are already seeing huge gains.

Roku doesn't compete with Netflix or Disney -- it's the neutral platform where all streaming services live and advertise.

- 10 stocks we like better than Roku ›

About five years ago, in February 2021, Roku (NASDAQ: ROKU) was riding high on pandemic tailwinds. Less than three months later, the stock topped out at $470 per share with a market cap of $60.3 billion. Life was good for the media-streaming technology specialist and its investors.

Today, after a brutal 65% drawdown, it's become something even better: a battle-tested platform trading at value prices. It took a while to disconnect from the bottom of the trough, but Roku's stock is back on track. As of Nov. 28, 2025, it's up by 73% in three years.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Behind the volatility, a growing business

The three-year performance is comparable to the S&P 500 (SNPINDEX: ^GSPC) gaining 70% over the same three-year span. Roku's chart has been much more volatile than the general market's, though:

ROKU data by YCharts

Roku is a quality company whose stock price got crushed while its business kept growing. You can see it in the financial results.

Sticking to a three-year period, trailing revenues are up by 45% while active accounts increased by more than 60%. Roku reported 89.8 million active households in Q4 2024 (the latest official figure), up from 56.4 million in Q3 2022. The account tally was rising 12% year over year at the time. All signs point to 95 million accounts in the next report, covering Q4 2025.

Recent quarters have shown positive bottom-line earnings. Free cash flows added up to $301 million in the last year. Yet the stock trades at just 3.2x sales, down from over 20x at the 2021 peak.

The platform that wins when everyone competes

This disconnect between price and progress isn't unusual in growth stock corrections, but the magnitude here is extreme. Roku got caught in a perfect storm: growth stock multiple compression, streaming sector skepticism, and advertising market weakness all hit simultaneously.

But the bears missed something important while focusing on the stock price: Roku has solidified its position as the Switzerland of streaming.

While Netflix (NASDAQ: NFLX), Disney (NYSE: DIS), and everyone else fought for subscribers, Roku quietly became the platform where all these services live. The company doesn't need to pick winners in the streaming wars -- it profits from the entire arena. Whenever Disney+, Amazon Prime Video, Netflix, Peacock, HBO Max run a marketing campaign, Roku benefits directly.

Image source: Getty Images.

Why I'm buying more Roku

Roku's three-year underperformance has created a rare opportunity to buy a category leader at a discount. The stock's brutal journey from $470 to under $40 and back to current levels tested every shareholder's patience, but those who held (or better yet, bought more during the crash) understand a fundamental truth: great businesses often make terrible investments until suddenly they don't.

Roku's 2022 felt like Netflix at the controversial streaming switch in 2011. The shares I bought in that dip are up by an eye-popping 8,919% today. Roku has a long way to go before posting gains of that caliber, but it's also earlier in its global expansion push. Stay tuned for years of high-octane growth potential.

Should you invest $1,000 in Roku right now?

Before you buy stock in Roku, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Roku wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $580,171!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,084,986!*

Now, it’s worth noting Stock Advisor’s total average return is 1,004% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 1, 2025

Anders Bylund has positions in Amazon, Netflix, Roku, and Walt Disney. The Motley Fool has positions in and recommends Amazon, Netflix, Roku, Walt Disney, and Warner Bros. Discovery. The Motley Fool recommends Comcast. The Motley Fool has a disclosure policy.