Why Buying This Dominant Travel Disrupter Today Will Net 200% Returns

Key Points

Airbnb's steady growth can continue because of its product expansion plans.

The company's underlying profit margin will be much higher a few years from now.

Shares of Airbnb stock look undervalued for long-term investors.

- 10 stocks we like better than Airbnb ›

It can be painful to watch a stock you own stagnate while the broad market -- and especially anything related to artificial intelligence (AI) -- soars. That is what Airbnb (NASDAQ: ABNB) shareholders have experienced in the last few years. The stock is down 46% from all-time highs set around the time it went public in late 2020.

But if you look under the hood at the underlying business of this travel disrupter, it is clear that Airbnb is doing just fine. In fact, it looks like a cheap stock today that could net investors 200% returns over the next five to 10 years. Here's why.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Airbnb's steady growth engines

Airbnb's core home-sharing platform has reached maturity in its early markets like North America and Western Europe, where close to 70% of its bookings come from today. Growth for these regions should be stable compared to the broader travel market, which tends to grow slightly above GDP over the long term. Gross booking value on the Airbnb platform was in between 5% and 10% last quarter in North America (management does not disclose an exact figure).

Other areas of the business are poised to deliver substantially higher growth in the years to come. The company is making an aggressive push to expand to new regions and grow its supply of homes, including in places like Japan and Latin America. Even emerging markets like India had a 50% increase in first-time bookers last quarter, which is a fantastic sign for the business.

Besides geographical expansion, Airbnb is expanding its product suite to include experiences such as tours or at-home services, such as chefs, to bundle with vacations. Combine this nascent opportunity with the steady growth of the core platform, and Airbnb should keep growing its revenue in the double-digits over the next five years, as it did last quarter.

Image source: Getty Images.

Margin expansion potential and returning cash to shareholders

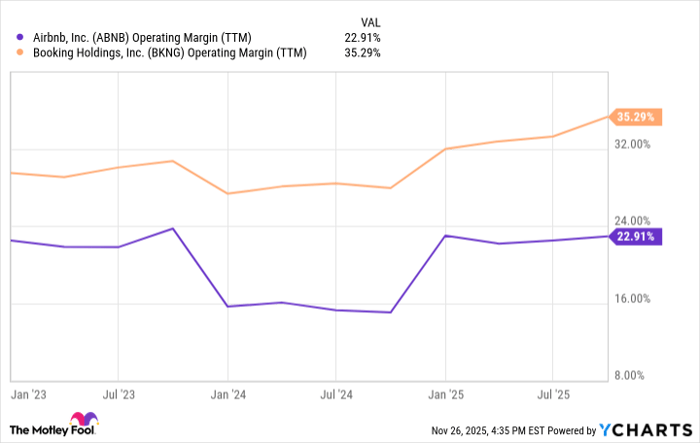

An underappreciated factor that could impact Airbnb's stock over the next five years is its bottom-line operating margin.

Over the last 12 months, Airbnb's operating margin was 23%. Its main competitor Booking Holdings had an operating margin above 35%. With similar unit economics, there is no reason that Airbnb cannot catch up to Booking's profit margin once it scales up its geographical expansion and new product opportunities.

Still, Airbnb is highly cash-generative today, with $4.5 billion in free cash flow over the last 12 months. It is using this cash to repurchase its stock, with close to $1 billion of repurchases made just last quarter.

Data by YCharts.

Why Airbnb stock can net 200% returns

Today, Airbnb generates around $12 billion in annual revenue. Five years from now, in 2030, I think this figure can at least grow to $20 billion, if not $25 billion, along with profit margin expansion.

With $20 billion in revenue and a 35% profit margin, that is $7 billion in annual earnings. Today, Airbnb stock has a market cap of $67 billion. I believe a high-quality business growing like Airbnb deserves to trade at 25 times earnings, which would bring Airbnb's market cap to $175 billion, or more than 2x times what it is today. Sprinkle in some accretive share repurchases, and Airbnb stock can generate 200% net returns for shareholders who buy at today's price.

Should you invest $1,000 in Airbnb right now?

Before you buy stock in Airbnb, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Airbnb wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $580,171!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,084,986!*

Now, it’s worth noting Stock Advisor’s total average return is 1,004% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 24, 2025

Brett Schafer has positions in Airbnb. The Motley Fool has positions in and recommends Airbnb and Booking Holdings. The Motley Fool has a disclosure policy.