The Real Winners of AI Infrastructure Spending May Surprise Investors

Key Points

One company helps chipmakers design power-efficient chips and gets a nice royalty for its intellectual property.

The other company enables fast data transmission in data centers, which explains why it shot up remarkably in the past year.

- 10 stocks we like better than Arm Holdings ›

A lot of money has been spent on setting up artificial intelligence (AI) infrastructure in the past three years, and it looks like the spending spree will continue. AI pioneer Nvidia recently forecast that another $3 trillion to $4 trillion is likely to be spent on AI infrastructure by 2030 to support the shift toward accelerated computing, the rapid growth in agentic AI, and the integration of AI in physical applications such as robotics, factories, and others.

Some of the popular names that are likely to benefit from this massive outlay include Nvidia itself, along with other semiconductor industry players such as Advanced Micro Devices, Broadcom, Taiwan Semiconductor Manufacturing, and others.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Those are all big names in computer chips, but there are other companies expected to benefit from the massive spending on AI infrastructure, too. Here are two companies that may seem like surprising bets on the AI infrastructure market, but that are playing an important role in this space.

Image source: Getty Images.

1. Arm Holdings

British technology company Arm Holdings (NASDAQ: ARM) saw strong demand for its chip architecture design and related intellectual property (IP) thanks to the advent of AI. Though Arm doesn't manufacture its own chips, it licenses its architecture to customers for a fee and also gets a royalty from each chip that's made using its IP.

As it turns out, Arm counts some of the biggest names in tech as customers. Its client list includes the likes of Nvidia, Apple, Microsoft, Samsung, TSMC, Amazon, Alphabet's Google, and others. These companies license Arm IP to manufacture central processing units (CPUs), graphics processing units (GPUs), and other kinds of chips.

The adoption of Arm's chip designs has picked up the pace because of their power efficiency, which is turning out to be critical in AI data centers. Arm points out that its architecture can help make AI data centers 15% more power efficient. That's a big number when investors consider that data center power consumption could rise to 25% of global power requirements by 2030, as compared to just 4% last year.

As a result, it is easy to see why more and more companies are adopting Arm's IP to design data center chips. The company pointed out in July that its data center customers have jumped 14-fold since 2021. Even better, the royalties that Arm gets from its latest AI-focused architecture are reportedly double those of the previous generation.

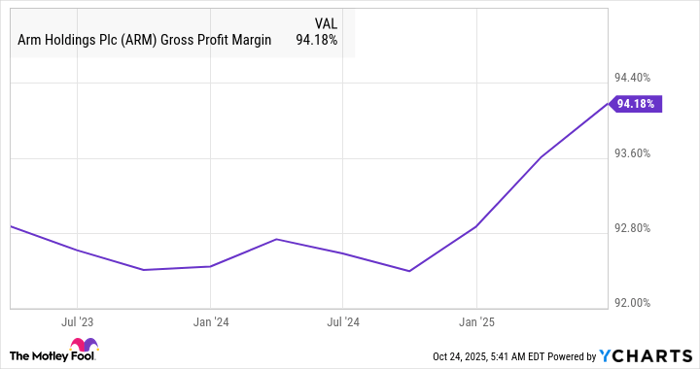

This is the reason why the company's margin profile has been improving for the past year.

Data by YCharts.

Arm's architecture is expected to gain more ground in the data center market. IDC estimates that the value of AI accelerators based on Arm architecture could jump from $32 billion last year to $103 billion in 2029. Meanwhile, the low power consumption of Arm's chip designs makes them ideal for edge AI applications, which should open up another big growth opportunity for the company.

All this suggests that Arm Holdings could witness remarkable growth in its earnings in the long run. In fact, analysts expect its bottom-line growth to accelerate to 32% in the next fiscal year, following a 4% jump in the current one, and there is a solid chance that it can sustain such impressive growth rates in the long run, considering the lucrative AI infrastructure opportunity on offer.

2. Lumentum Holdings

Another key requirement in AI data centers is high-speed networking. That's because large amounts of data need to be transported with low latency in AI clusters for model training and AI inference applications. This is where Lumentum Holdings (NASDAQ: LITE) steps in.

The company manufactures optical and photonic components that enable high-speed data transmission in data centers and communication networks. Not surprisingly, the demand for Lumentum's components used in cloud computing and networking has shot up incredibly. The company's revenue in the final quarter of fiscal 2025, which ended on June 28, increased by 56% year over year to $481 million.

What's more, Lumentum saw a much stronger year-over-year increase. It reported a non-GAAP (adjusted) profit of $0.88 per share as compared to a loss of $0.13 per share in the year-ago period. The company's production lines are running at full capacity, leading to an improvement in its utilization rates and margins that led to the sharp bottom-line spike.

It plans to ramp up its production capacity to meet the solid AI-fueled demand. Even then, Lumentum believes that the demand for its high-speed laser components will outpace supply in fiscal 2026. Lumentum says that it expects further growth in its business owing to the growing deployment of cloud and AI applications.

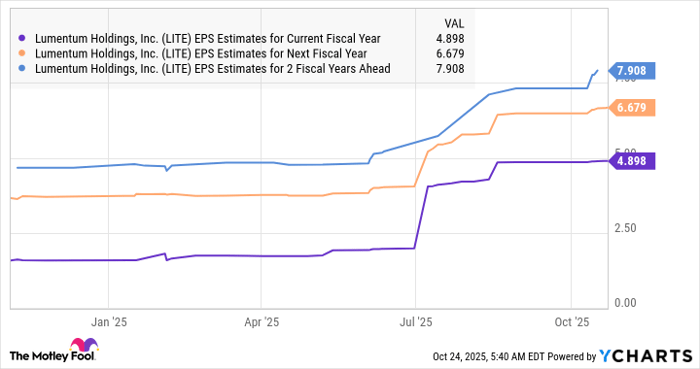

This explains why analysts expect a 40% increase in its revenue in the current fiscal year to $2.3 billion. Additionally, Lumentum's bottom line could jump by 137% in fiscal 2026 to $4.89 per share, followed by impressive growth over the next couple of years as well.

Data by YCharts.

With the demand for data center networking expected to jump fourfold by 2033, Lumentum seems to have a bright future. What's worth noting is that the stock trades at an attractive 7 times sales and 34 times forward earnings even after rising 157% in the past year. These multiples indicate that Lumentum is a no-brainer buy to capitalize on the global AI infrastructure demand, considering the pace at which it has been growing.

Should you invest $1,000 in Arm Holdings right now?

Before you buy stock in Arm Holdings, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Arm Holdings wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $590,357!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,141,748!*

Now, it’s worth noting Stock Advisor’s total average return is 1,033% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 27, 2025

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom and Lumentum and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.