PDD Launches "Billions in Subsidies" Campaign, Offering iPhone 17 with ¥1,000 Discount

TradingKey - Just three days after the iPhone 17 series opened for pre-orders on September 12, price softening has already appeared on e-commerce platforms. PDD's "Billion-Yuan Subsidy" section has taken the lead with significant discounting, with some models seeing post-subsidy prices nearly 1,000 yuan lower than Apple's official pricing — the largest price reduction among all launch channels currently available online.

The subsidy extends beyond just smartphones, reaching ecosystem products including the Apple Watch Ultra 3 (5,999 yuan after coupon, 500 yuan discount) and AirPods Pro 3 (1,599 yuan after coupon, 300 yuan discount), forming a full lineup of discounted new products.

The intensity of pre-order demand became evident immediately on the first night, with Apple's official website and major platforms like JD experiencing system lag due to surging traffic. JD platform data shows that the total reservation numbers for the three pre-order models have exceeded 7.5 million, with the more mass-market standard iPhone 17 model accounting for 3.43 million reservations.

Strong demand is directly reflected in delivery timelines, with initial delivery dates for the iPhone 17, iPhone 17 Pro, and iPhone 17 Pro Max on Apple's official website now scheduled after October 15 (excluding the iPhone 17 Air, which has been delayed due to eSIM support issues).

Years in the Making, Apple's Big Year Arrives

2025 is viewed by the industry as Apple's "major year." The company has not only upgraded the design of its main smartphone product line but also introduced the exploratory new Air series. Additionally, it has deployed more self-developed chips across core devices like smartphones and smartwatches, demonstrating its strategic intent to deepen autonomous control in key component areas.

Meanwhile, teasers about next-generation products have surfaced. Supply chain sources reveal that Apple is expected to launch its first foldable smartphone next year. In fact, Apple has been researching foldable form factor products for many years, with potential future expansion beyond smartphones to include tablets and other form factors.

However, Apple has not rushed to follow the foldable screen trend. Industry analysts point out that this aligns with Apple's consistent strategy of entering markets only when they are relatively mature and the ecosystem is more developed. Leveraging its strong brand power and integration capabilities, Apple often quickly captures core industry profits upon entry.

Apple Faces Significant Pressure in China

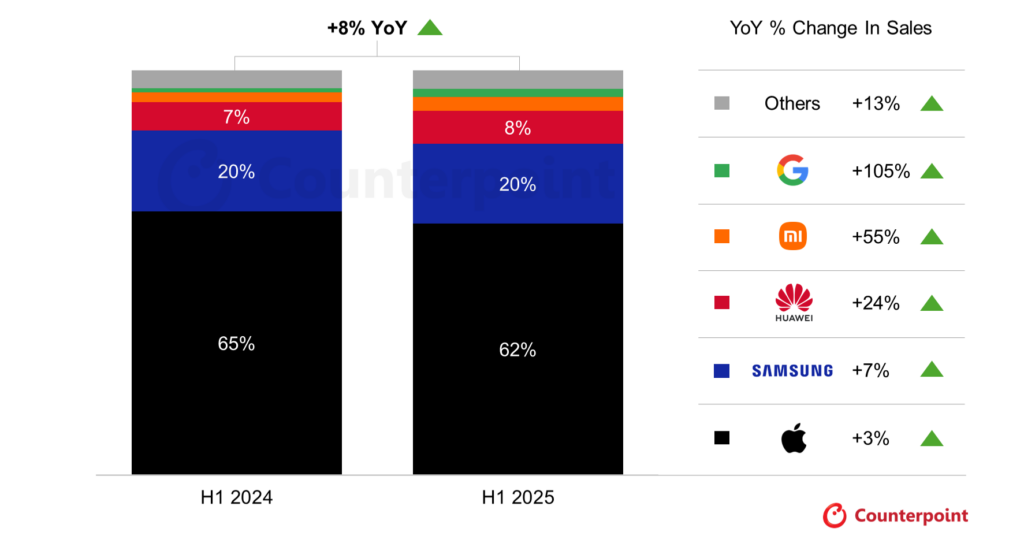

Counterpoint Research's latest "Handset Model Sales Tracker" report shows that in the first half of 2025, Apple still occupied the top position in the global premium market (wholesale price ≥ $600) with a 62% share. Samsung, Huawei, Xiaomi, and Google followed closely behind.

However, the report also notes that due to faster growth from other OEMs, Apple's market share has declined. While the company has seen improved performance in some emerging markets, it is losing ground in the crucial Chinese market to local rivals like Huawei and Xiaomi.

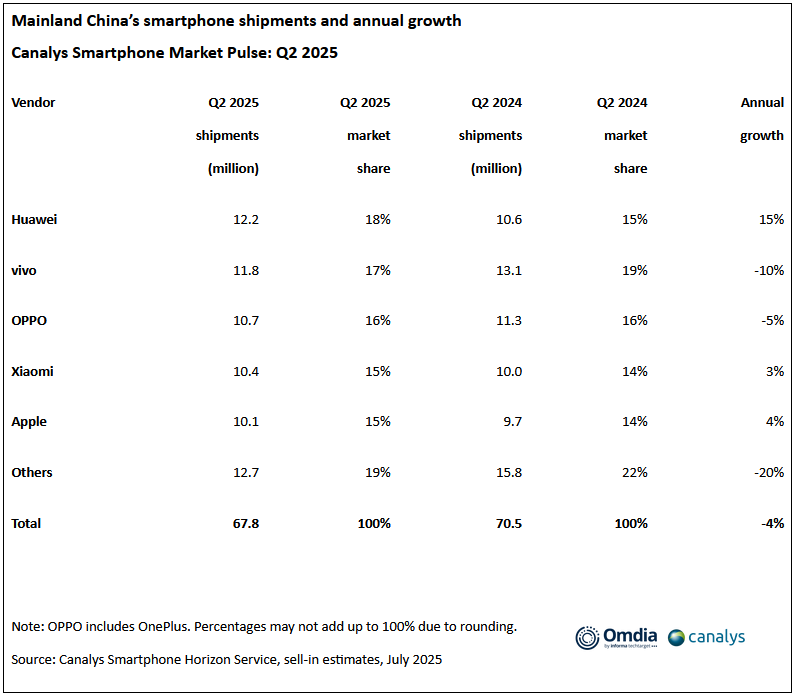

Canalys data shows that in the second quarter of 2025, Apple's smartphone shipments in the Chinese market were approximately 10.1 million units, with a 15% market share — down 1 percentage point year-on-year and ranking fifth.

During the same period, Huawei reclaimed the top spot in the Chinese market with 12.2 million units shipped, followed by vivo, OPPO, and Xiaomi. The narrow gap in market share among the top five players fully reflects the intense competition in China's smartphone market.

Regarding Apple's future trajectory in the Chinese market, Counterpoint senior analyst Ivan Lam noted that sales may face single-digit percentage decline pressure in the fourth quarter (which includes the iPhone 17 series launch period).

Despite fierce competition in the Chinese market, Apple's latest financial report still released some positive signals, with Greater China revenue reaching $15.369 billion in Q3 of fiscal 2025, up 4% year-on-year, indicating some market recovery.

Apple's stock has risen over 9% in the past six months, with TradingKey Stock Score giving it a 7.26 rating, indicating very high institutional approval.