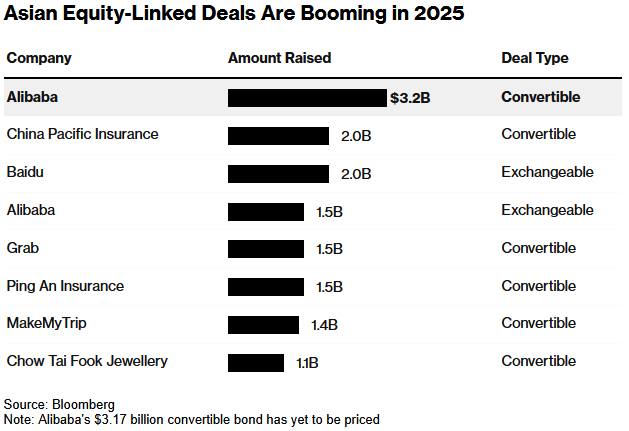

Alibaba Raises $3.2B in Second Zero-Coupon Bond of 2025, with 80% Directed Toward Cloud Infrastructure

TradingKey - On September 11, Alibaba Group announced plans to issue zero-coupon convertible senior notes with a principal amount of approximately $3.2 billion, maturing on September 15, 2032, as unsecured senior debt.

The net proceeds from this offering will be allocated specifically to its core strategic areas, with approximately 80% dedicated to strengthening cloud infrastructure, covering data center expansion, technological upgrades, and service optimization. The remaining 20% will support the expansion of international business operations through strategic investments to consolidate global market position and enhance operational efficiency.

This zero-coupon convertible bond involves no regular interest payments, with the upper limit of the conversion price set 60% higher than the previous trading day's Hong Kong stock closing price (approximately $230 based on U.S. stock closing price), reducing equity dilution risk through the higher conversion price setting.

This financing represents Alibaba's second major capital operation this year for cloud business and internationalization strategy. In July, the company issued approximately HK$12 billion in zero-coupon exchangeable bonds, with identical fund usage purposes. This continuous and substantial financing activity demonstrates its firm strategic commitment to these two core areas—cloud computing and international expansion.

“Alibaba is playing a long game — raising cheap capital, hedging dilution, and doubling down on growth,” said Ravi Wong, first vice president at Yan Yun Family Office (HK).

As early as February this year, Alibaba announced plans to invest over RMB 380 billion in cloud and AI hardware infrastructure over the next three years. According to market research firm Omdia, Alibaba Cloud currently holds the top market share in China's AI cloud market.

In the company's quarterly financial report released last month, while overall business revenue missed expectations, cloud computing revenue maintained strong growth.

Alibaba CEO Eddie Wu emphasized during the earnings call: "Our investments in artificial intelligence have begun to yield tangible results. We see an increasingly clear path where artificial intelligence drives robust growth for Alibaba."

Alibaba's frequent financing reflects the massive cash requirements of Chinese tech giants and the intensely competitive landscape within the industry. Currently, companies are pouring significant capital into cloud computing, artificial intelligence, and even local lifestyle services.

Earlier this week, another Chinese tech giant Baidu raised RMB 4.4 billion (approximately $618 million) through offshore renminbi bond issuance, having previously issued RMB 10 billion in bonds in March. Tencent is considering its first public bond issuance of the year, while Meituan is exploring potential offshore renminbi bond issuance plans.

Alibaba's Hong Kong shares rose 0.35% on Thursday, with a year-to-date cumulative gain exceeding 71%. According to TradingKey Stock Score, Alibaba currently scores 7.29, with relatively healthy fundamental data and reasonable valuation. Wall Street analysts generally maintain buy ratings, with a target average price of $163.903, indicating 16.08% upside potential from current levels.