BoC expected to keep rates paused in July after similar pauses in April and June

- FXStreet expects the Bank of Canada to maintain unchanged rates on July 30.

- The Canadian Dollar maintains a positive tone vs. the US Dollar.

- The July meeting could be the fourth consecutive decision with rates at 2.75%.

- US tariffs would remain in the spotlight at Governor Macklem’s press conference.

As the Bank of Canada (BoC) gets set to issue a new interest rate decision on Wednesday, July 30, there is a growing sense that the cutting cycle might have already ended.

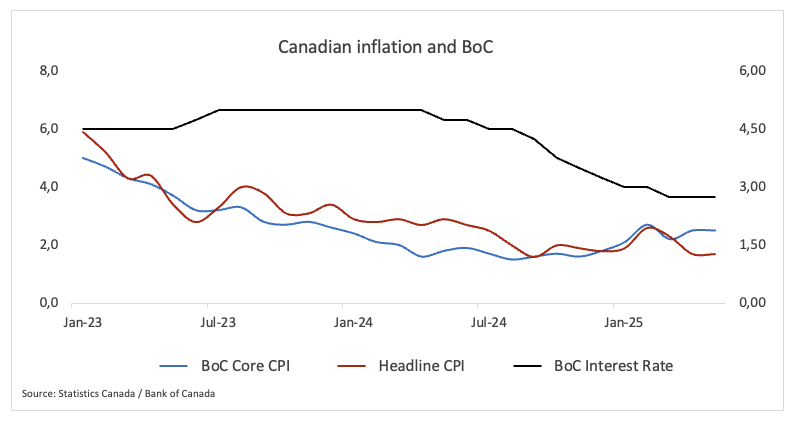

The BoC decided to keep rates steady in June, citing a Canadian economy that is "softer but not sharply weaker" and noting "firmness in recent inflation data." Indeed, the policy rate stands at 2.75%, which remains within the bank’s estimated neutral range for interest rates, set between 2.25% and 3.25%.

President Donald Trump's tariff agenda continues to be a significant global influence. Since his January return to the White House, he has dangled a slew of new levies that could ripple through global supply chains, and those threats will likely dominate Governor Tiff Macklem’s post‑meeting press conference.

The BoC's Q2 Business Outlook Survey (BOS), out on July 21, indicated that Canadian firms are worried about the worst-case tariff situation but are still hesitant to hire and invest. The BOS revealed that companies' short-term inflation predictions have returned to where they were a year ago, and businesses now see a recession scenario as less likely. Earlier this year, businesses were worried that US tariffs would hurt the economy, but so far the effects have mostly been seen in the steel, aluminium, and vehicle industries.

Consumers are feeling the economy’s slowdown in their own pay cheques, the latest Survey of Consumer Expectations shows. With the job market looking softer, more people say they’re uneasy about hanging on to their positions. This anxiety is permeating everyday life as households are reported to be tightening their budgets and altering their shopping habits as the trade war noise intensifies. While they don't anticipate a surge in prices in the near future, many express concern that a new set of tariffs could hinder the central bank's ability to control inflation.

Previewing the BoC’s interest rate decision, analyst Taylor Schleich at the National Bank of Canada noted, "There’s growing momentum around the idea that the easing cycle is over. We disagree, and we don’t expect the Governing Council to validate this more hawkish view. Instead, they’re likely to keep guidance unchanged, reiterating that they’re proceeding carefully and monitoring the same four indicators: export demand; tariff impacts on investment, employment, and spending; inflation; and inflation expectations.”

When will the BoC release its monetary policy decision, and how could it affect USD/CAD?

The Bank of Canada will publish its policy decision on Wednesday at 13:45 GMT alongside its Monetary Policy Report (MPR). After that, Governor Tiff Macklem will attend a press conference at 14:30 GMT.

Most economists expect the Bank of Canada (BoC) to keep its policy rate anchored at 2.75% on July 30, extending the pause begun in May and June. The decision arrives as the Canadian Dollar quietly grinds higher, rebounding from winter lows near 1.4800 vs. its American counterpart to the current vicinity of 1.3700.

Pablo Piovano, a Senior Analyst at FXStreet, said that "USD/CAD maintains its rebound from the area of yearly in the 1.3550-1.3540 range. While below its key 200-day Simple Moving Average (SMA) at 1.4038, the bearish scenario is expected to prevail.”

"USD/CAD hit a new YTD bottom of 1.3538 on June 16. Once this level is cleared, more losses could go all the way down to the September 2024 floor of 1.3418 (September 25)," Piovano said.

Piovano adds that "on the upside, the pair should run into initial resistance at its June ceiling of 1.3797 set on June 23, prior to the May peak of 1.4015 reached on May 12.”

The Relative Strength Index (RSI) has rebounded beyond the 52 level, which means that further upside appears on the cards over a short-term horizon. Piovano ends by saying, "The Average Directional Index (ADX) below 15 also shows that the trend lacks conviction."

Economic Indicator

BoC Interest Rate Decision

The Bank of Canada (BoC) announces its interest rate decision at the end of its eight scheduled meetings per year. If the BoC believes inflation will be above target (hawkish), it will raise interest rates in order to bring it down. This is bullish for the CAD since higher interest rates attract greater inflows of foreign capital. Likewise, if the BoC sees inflation falling below target (dovish) it will lower interest rates in order to give the Canadian economy a boost in the hope inflation will rise back up. This is bearish for CAD since it detracts from foreign capital flowing into the country.

Read more.Last release: Wed Jun 04, 2025 13:45

Frequency: Irregular

Actual: 2.75%

Consensus: 2.75%

Previous: 2.75%

Source: Bank of Canada

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.