US yields surge as traders await data, Fed cuts priced out on tariffs uncertainty

- Treasury yields climb post-CPI; 10-year up 5.5 bps, 2-year up 3 bps on firm inflation outlook.

- Fed’s Jefferson says policy is well-positioned but notes tariffs could cloud inflation trajectory.

- Market trims 2025 Fed cut expectations to 49.5 bps, down from 76 bps in early May.

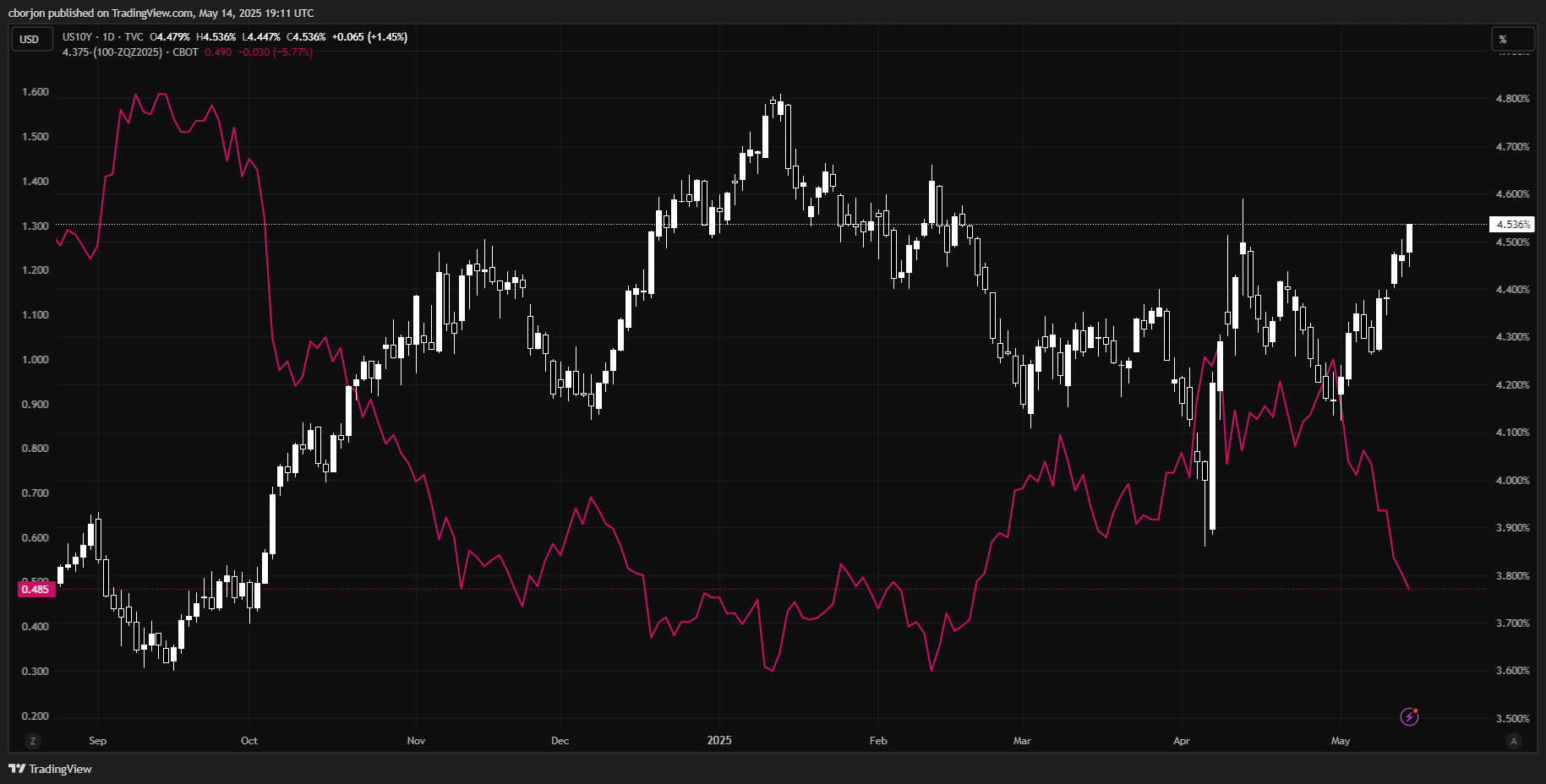

US Treasury yields are climbing across the entire yield curve as market participants digest Tuesday’s US inflation data on the consumer side, with traders awaiting the release of the Producer Price Index (PPI) April figures and Retail Sales. At the time of writing, the yield on the US 10-year benchmark note has edged up five and a half basis points to 4.525%.

10-year yield rises to 4.525% while real yields surge to 2.21%, as Fed officials flag tariff risks and easing bets fade

The two-year US T-note treasury yield, which usually moves in tandem with interest rate expectations, edges up three bps at 4.049%

US Treasury yields remained within the week's highs as market mood shifted positively on news that the US and China had agreed on a 90-day pause in tariffs and reduced duties by over 115%. The White House decided to impose 30% tariffs on Chinese products and the latter 10% on US goods.

Fed Vice Chair Philip Jefferson stated that the current monetary policy stance is well-positioned to respond to economic developments, noting that inflation data is consistent with further progress toward the 2% goal, but the future path remains uncertain due to the impact of tariffs.

Jefferson added that tariffs could stoke inflation, but it is uncertain whether they would be temporal or persistent.

Trump’s budget bill approved by US Congress

Republicans advanced elements of Trump’s sweeping budget package on Wednesday, approving tax cuts that would add trillions of US Dollars to the US debt.

Investors are eyeing the release of inflation figures on the producer side, alongside Retail Sales and job market data.

US real yields are also climbing, capping Gold’s advance

The US 10-year real yields, which are the difference of the US 10-year nominal yield minus inflation expectations for the same period, surge three basis points at 2.21%.

Traders priced out one interest rate cut by the Fed, as market participants expect only 49.5 basis points (bps) of easing, contrary to the 76-bps scheduled on May 7.

US 10-year Treasury yield chart / Fed interest rate probabilities

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.