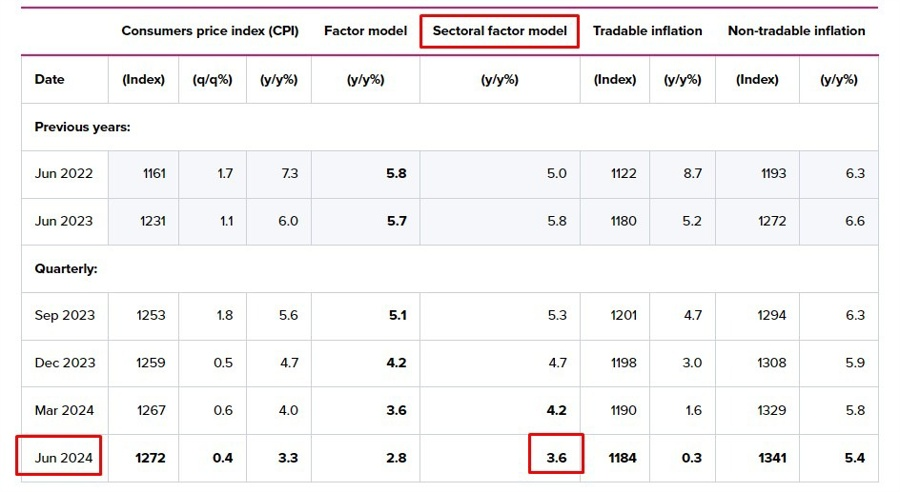

RBNZ Sectoral Factor Inflation Model rises 3.6% YoY in Q2 2024

The Reserve Bank of New Zealand (RBNZ) released its Sectoral Factor Model Inflation gauge for the second quarter of 2024, following the release of the official Consumer Price Index (CPI) by the NZ Stats early Wednesday.

The inflation measure dropped to 3.6% YoY in Q2 2024 vs. 4.2% in Q1.

The inflation measures are closely watched by the RBNZ, which has a monetary policy goal of achieving 1% to 3% inflation.

FX implications

The Kiwi Dollar holds its advance above 0.6050 after the RBNZ’s inflation data. At the time of writing, NZD/USD is adding 0.36% on the day to trade at 0.6066.

About the RBNZ Sectoral Factor Model Inflation

The Reserve Bank of New Zealand has a set of models that produce core inflation estimates. The sectoral factor model estimates a measure of core inflation based on co-movements - the extent to which individual price series move together. It takes a sectoral approach, estimating core inflation based on two sets of prices: prices of tradable items, which are those either imported or exposed to international competition, and prices of non-tradable items, which are those produced domestically and not facing competition from imports.