UK CPI expected to show a mild rebound in inflation in December

- The UK’s ONR Office publishes the December CPI data on Wednesday.

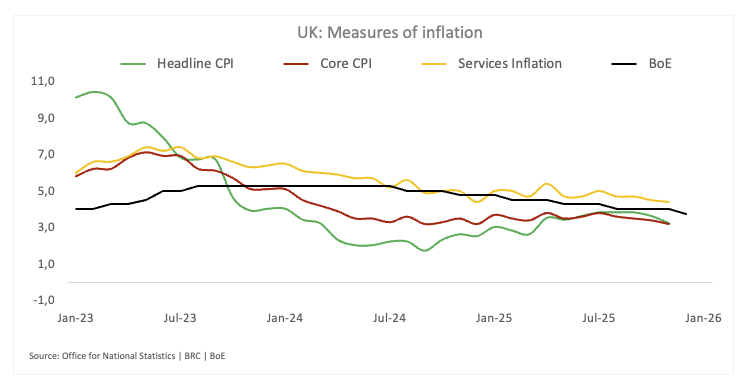

- The UK headline inflation is expected to have ticked higher to 3.3%.

- Core inflation is seen as sticky above 3.0% from a year earlier.

The UK Office for National Statistics (ONS) will release the December Consumer Price Index (CPI) figures on Wednesday at 07:00 GMT, a print that will matter for markets. Consensus expectations point to a modest re-acceleration in inflation pressures.

UK consumer inflation remains one of the most important inputs for the Bank of England (BoE) and typically carries real weight for the British Pound (GBP). With the Monetary Policy Committee (MPC) meeting on February 5, investors broadly expect the ‘Old Lady’ to keep the bank rate unchanged at 3.75%, but this week’s data will help shape the tone of that decision.

What to expect from the next UK inflation report?

Headline UK CPI is expected to have edged higher to 3.3% in the year to December, up from 3.2% in November. On a monthly basis, inflation is seen rebounding by 0.4%, reversing the 0.2% decline recorded the previous month.

Core inflation, which strips out the more volatile food and energy components and is therefore more closely watched by the BoE, is forecast to have remained unchanged at 3.2% on an annual basis. From a month earlier, core CPI is expected to have accelerated to 0.3%, after slipping 0.2% in November.

How will the UK CPI data affect GBP/USD?

The BoE’s rate-setting MPC voted 5–4 to cut the bank rate by 25 basis points to 3.75% in December, its fourth reduction in 2025. While the decision acknowledged softer inflation dynamics and early signs of cooling in the labour market, the Committee stressed that any further easing would be gradual.

The December Decision Maker Panel (DMP) survey did little to challenge the prevailing narrative around the bank’s rate outlook. In short, it leaves the status quo firmly in place, with persistent wage pressures limiting the scope for any meaningful repricing at the front end of the curve.

One-year-ahead wage expectations edged up to 3.7% from 3.6%, while realised pay growth over the past year remains stuck in the mid-4% range. Both metrics continue to sit uncomfortably above levels consistent with inflation returning sustainably to target.

The bottom line is that the survey fails to move the needle, reinforcing the case against bringing forward rate cuts.

So far, implied rates pencil in just over 42 basis points of easing this year, while the BoE is widely anticipated to maintain its policy rate unchanged next month.

Back to technicals, Senior Analyst at FXStreet, Pablo Piovano, notes that GBP/USD appears to have encountered some contention at its current yearly lows near 1.3340 (January 19). “Further weakness from here could expose a move toward the interim support at the 55-day SMA at 1.3309 ahead of the December floor at 1.3179 (December 2),” Piovano adds.

“In case bulls regain the upper hand, the YTD ceiling at 1.3567 (January 6) should emerge as the immediate up barrier. North from here, there are no resistance levels of note until the September 2025 high at 1.3726 (September 17),” he concludes.

Piovano also points out that momentum indicators remain bullish for now, as the Relative Strength Index (RSI) bounces to around 54 and the Average Directional Index (ADX) near 20 suggests a fairly firm trend.

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Economic Indicator

Core Consumer Price Index (YoY)

The United Kingdom (UK) Core Consumer Price Index (CPI), released by the Office for National Statistics on a monthly basis, is a measure of consumer price inflation – the rate at which the prices of goods and services bought by households rise or fall – produced to international standards. The YoY reading compares prices in the reference month to a year earlier. Core CPI excludes the volatile components of food, energy, alcohol and tobacco. The Core CPI is a key indicator to measure inflation and changes in purchasing trends. Generally, a high reading is seen as bullish for the Pound Sterling (GBP), while a low reading is seen as bearish.

Read more.Last release: Wed Dec 17, 2025 07:00

Frequency: Monthly

Actual: 3.2%

Consensus: 3.4%

Previous: 3.4%

Source: Office for National Statistics

The Bank of England is tasked with keeping inflation, as measured by the headline Consumer Price Index (CPI) at around 2%, giving the monthly release its importance. An increase in inflation implies a quicker and sooner increase of interest rates or the reduction of bond-buying by the BOE, which means squeezing the supply of pounds. Conversely, a drop in the pace of price rises indicates looser monetary policy. A higher-than-expected result tends to be GBP bullish.