Canada CPI expected to rise in September, adding pressure to BoC easing plans

- Canadian inflation is expected to pick up pace in September.

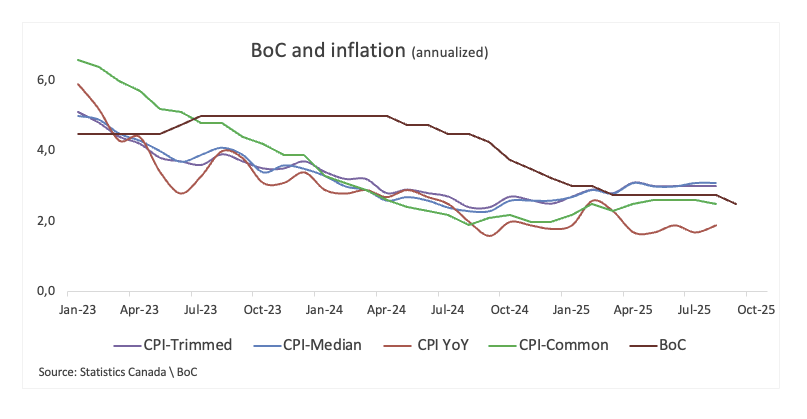

- The core CPI is still seen well above the BoC’s 2% goal.

- The Canadian Dollar depreciates to multi-month lows vs. the US Dollar.

Statistics Canada will publish September’s inflation figures on Tuesday. The numbers will give the Bank of Canada (BoC) a fresh read on price pressure as the central bank weighs its next move on interest rates. The BoC is expected to trim the interest rate by 25 basis points to 2.25% at its meeting on October 29.

Economists expect the headline Consumer Price Index (CPI) to rise 2.3% in September, surpassing the BoC’s target, following a 1.9% annual gain in August. On a monthly basis, prices are forecast to drop by 0.1%, matching the contraction recorded in the previous month.

The BoC will also be watching its preferred core measure, which strips out the more volatile food and energy components. In August, that gauge rose 2.6% from a year earlier and came in flat for July.

Analysts remain wary after inflation picked up pace in August. The threat of US tariffs pushing up domestic prices looms large, adding uncertainty to the outlook. For now, both markets and policymakers are likely to exercise caution.

What can we expect from Canada’s inflation rate?

The Bank of Canada lowered its benchmark rate by 25 basis points to 2.50% in August, a decision that lined up with market expectations.

At that gathering, Governor Tiff Macklem struck a cautious tone at his usual press conference. He said the inflation picture hasn’t changed much since January, noting mixed signals and a more data-dependent stance as the bank takes decisions “one meeting at a time.” He also acknowledged that inflationary pressures look a little more contained but reiterated that policymakers remain ready to act if risks tilt higher.

For markets, the headline CPI print will be the immediate focus. But at the BoC, attention will remain squarely focused on the details: the Trimmed, Median, and Common measures. The first two have remained near the 3.0% level, feeding concern inside the bank, while the common gauge has ticked a tad lower, albeit still above the bank’s goal.

When is the Canada CPI data due, and how could it affect USD/CAD?

Markets will be watching closely on Tuesday at 12:30 GMT, when Statistics Canada publishes the inflation report for the month of September. Traders are alert to the risk that price pressures could flare up again.

A stronger-than-expected reading would reinforce concerns that tariff-related costs are beginning to filter through to consumers. That could make the Bank of Canada more cautious in its policy stance, a scenario that would likely lend short-term support to the Canadian Dollar (CAD), while keeping attention fixed on trade developments.

Senior Analyst Pablo Piovano from FXStreet notes that the Canadian Dollar has moved into a consolidative theme in the upper end of its recent range, slightly above the key 1.4000 hurdle. In the meantime, further gains appear likely while above the key 200-day SMA around 1.3960.

Piovano indicates that the resurgence of a bullish tone could motivate USD/CAD to challenge the October ceiling at 1.4080 (October 14), prior to the April high at 1.4414 (April 1).

On the other hand, Piovano suggests that key contention emerges at the critical 200-day SMA at 1.3963, ahead of the provisional support at the 55-day and 100-day SMAs at 1.3861 and 1.3781, respectively. The loss of this region could spark a potential move toward the September base at 1.3726 (September 17). A deeper retracement could prompt a test of the July valley at 1.3556 (July 3) to re-emerge on the horizon.

“Furthermore, momentum indicators lean bullish: the Relative Strength Index (RSI) hovers near 66, while the Average Directional Index (ADX) is beyond 36, indicating a strong trend,” he says.

Economic Indicator

BoC Interest Rate Decision

The Bank of Canada (BoC) announces its interest rate decision at the end of its eight scheduled meetings per year. If the BoC believes inflation will be above target (hawkish), it will raise interest rates in order to bring it down. This is bullish for the CAD since higher interest rates attract greater inflows of foreign capital. Likewise, if the BoC sees inflation falling below target (dovish) it will lower interest rates in order to give the Canadian economy a boost in the hope inflation will rise back up. This is bearish for CAD since it detracts from foreign capital flowing into the country.

Read more.Last release: Wed Sep 17, 2025 13:45

Frequency: Irregular

Actual: 2.5%

Consensus: 2.5%

Previous: 2.75%

Source: Bank of Canada

Economic Indicator

BoC Consumer Price Index Core (YoY)

The BoC Consumer Price Index Core, released by the Bank of Canada (BoC) on a monthly basis, represents changes in prices for Canadian consumers by comparing the cost of a fixed basket of goods and services. It is considered a measure of underlying inflation as it excludes eight of the most-volatile components: fruits, vegetables, gasoline, fuel oil, natural gas, mortgage interest, intercity transportation and tobacco products. The YoY reading compares prices in the reference month to the same month a year earlier. Generally, a high reading is seen as bullish for the Canadian Dollar (CAD), while a low reading is seen as bearish.

Read more.Next release: Tue Oct 21, 2025 12:30

Frequency: Monthly

Consensus: -

Previous: 2.6%

Source: Statistics Canada