Forex Today: Markets remain focused on US-China, government shutdown news

Here is what you need to know on Tuesday, October 21:

The trading action in financial markets remains choppy on Tuesday as investors remain focused on headlines surrounding the trade talks between the United States (US) and China, as well as the prolonged government shutdown. In the second half of the day, September Consumer Price Index (CPI) data from Canada will be featured in the economic calendar.

US President Donald Trump said on Monday that he thinks that they will have a "very strong deal" with China. Trump will be meeting with Chinese President Xi Jinping on the sidelines of an economic conference in South Korea next week. Meanwhile, the US Senate rejected the stopgap funding bill for the 11th time on Monday, failing to reopen the government. Wall Street's main indexes gained more than 1% on Monday and the US Dollar (USD) Index ended the day virtually unchanged. Early Tuesday, the USD Index clings to small gains above 98.50 and US stock index futures lose about 0.1% on the day.

US Dollar Price This week

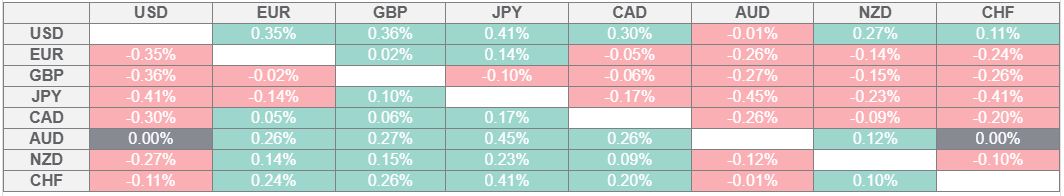

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Sanae Takaichi has won a historic vote to become Japan's first female prime minister, as she secured enough votes to gain the majority in the Lower House. USD/JPY edged higher with the initial reaction and was last seen trading in positive territory above 151.00.

Following a deep correction to end the previous week, Gold extended its slide toward $4,200 in the first half of the day on Monday. Nevertheless, XAU/USD managed to gather bullish momentum in the American session and gained more than 2% on the day. Gold stays in a consolidation phase at around $4,330 in the European morning on Tuesday.

After posting small gains on Monday, USD/CAD inches higher and trades slightly above 1.4050 early Tuesday. On a yearly basis, the CPI in Canada is forecast to rise 2.3% in September, at a faster pace than the 1.9% recorded in August.

GBP/USD struggles to hold its ground and trades below 1.3400 after posting marginal losses on Monday. In the European morning on Wednesday, the UK's Office for National Statistics will release inflation data for September.

EUR/USD stays under modest bearish pressure and trades below 1.1650 in the early European session on Tuesday. European Central Bank (ECB) President Christine Lagarde will deliver a keynote speech at Norges Bank's Climate Conference later in the day and she is unlikely to comment on the policy outlook.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.