Ripple Price Prediction: Crypto market stability could spark XRP price rally to $3

- XRP price gradually extends gains as the cryptocurrency market holds steady.

- XRP holds above critical support at $2.22, strengthened by the 100-day EMA.

- A breakout from the descending channel could spark significant bullish momentum, potentially driving a rally past $3.

- The surge in long-position liquidations while Open Interest remains unchanged signals declining interest and a potential pullback.

Ripple (XRP) price consolidates gains at the time of writing on Tuesday, following three consecutive daily green candles. Trading at $2.26, XRP is down over 1% on the day, mirroring the stability in the broader crypto market.

Bitcoin (BTC) remains above $94,000, with its uptrend driven by surging spot BTC Exchange-Traded Funds (ETFs) net inflows, easing trade tensions between the United States (US) and China, as well as short squeezes.

Select altcoins, including Virtuals Protocol, Floki, and Hyperliquid (HYPE), are extending their lead, suggesting that investors are shifting their attention to lesser-known coins that achieve higher profit margins.

XRP price nurtures potential breakout to $3

XRP’s price generally drops within the confines of a descending channel. However, since the cross-border money remittance token rebounded from its yearly low at $1.61 on April 7, the potential for a rally beyond $3.00 significantly increased.

Despite the rejection of $2.36, a level tested on Monday, XRP maintains its position above the 50, 100, and 200-day Exponential Moving Averages (EMAs), confirming bullish momentum. The EMAs are sloping upward, further reinforcing a strong bullish trend.

The 50-day and 100-day EMAs provide immediate support at $2.20 and $2.22, respectively. A reversal to these levels is possible, and XRP could collect more liquidity as traders buy the dip.

The Relative Strength Index (RSI) indicator’s neutral position at 58.11 could hold the scales in the bulls’ favor, especially if it stays above the midline of 50. This could increase the potential for a breakout above the descending channel.

Beyond the seller congestion at $2.40, supply zones at $2.80 and $3.00 are worth remembering as they could slow the potential XRP rally. Higher volume on upward moves will be crucial in pushing XRP toward $3.00.

XRP/USDT daily chart

Factors that could keep XRP price elevated

Several developments could support XRP’s bullish outlook in the near term, including the ongoing talks between Ripple and the Securities and Exchange Commission (SEC) regarding the settlement. Earlier this month, Ripple and the SEC were granted a temporary stay of the appeals process to allow for settlement negotiations and for the SEC’s commissioners to vote on the matter.

The recently approved futures XRP ETFs could help bolster the token’s bullish outlook over the coming months. Moreover, Ripple’s intentional push to the stablecoin market and tokenization services boosts sentiment.

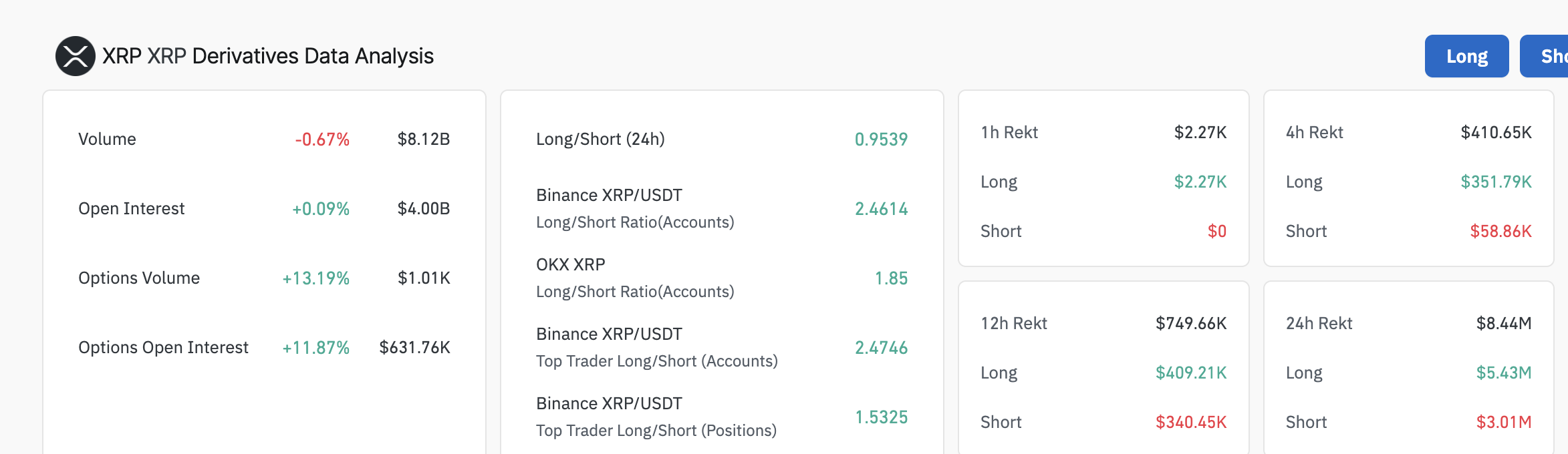

The derivatives data from Coinglass highlights a slight increase in Open Interest (OI) of 0.09% to $4 billion, indicating that new positions are being opened, which reflects growing trader interest.

The long/short ratio of 0.9559 leans towards shorts rather than longs, indicating that confidence among traders is waning. Over $350,000 was liquidated in long positions compared to approximately $59,000 in short positions in the past four hours, suggesting that bulls are being shaken out, which may potentially weaken the bullish outlook.

XRP derivatives’ Open Interest | Source: Coinglass

Beyond the support provided by the 50-day and the 100-day EMAs, XRP could extend the down leg to retest the 200-day EMA at $1.98. A deeper correction to $1.80 is possible if the broader crypto market sentiment turns bearish.

SEC vs Ripple lawsuit FAQs

It depends on the transaction, according to a court ruling released on July 14, 2023: For institutional investors or over-the-counter sales, XRP is a security. For retail investors who bought the token via programmatic sales on exchanges, on-demand liquidity services and other platforms, XRP is not a security.

The United States Securities & Exchange Commission (SEC) accused Ripple and its executives of raising more than $1.3 billion through an unregistered asset offering of the XRP token. While the judge ruled that programmatic sales aren’t considered securities, sales of XRP tokens to institutional investors are indeed investment contracts. In this last case, Ripple did breach the US securities law and had to pay a $125 million civil fine.

The ruling offers a partial win for both Ripple and the SEC, depending on what one looks at. Ripple gets a big win over the fact that programmatic sales aren’t considered securities, and this could bode well for the broader crypto sector as most of the assets eyed by the SEC’s crackdown are handled by decentralized entities that sold their tokens mostly to retail investors via exchange platforms, experts say. Still, the ruling doesn’t help much to answer the key question of what makes a digital asset a security, so it isn’t clear yet if this lawsuit will set precedent for other open cases that affect dozens of digital assets. Topics such as which is the right degree of decentralization to avoid the “security” label or where to draw the line between institutional and programmatic sales persist.

The SEC has stepped up its enforcement actions toward the blockchain and digital assets industry, filing charges against platforms such as Coinbase or Binance for allegedly violating the US Securities law. The SEC claims that the majority of crypto assets are securities and thus subject to strict regulation. While defendants can use parts of Ripple’s ruling in their favor, the SEC can also find reasons in it to keep its current strategy of regulation by enforcement.