Ripple Price Forecast: Could open interest, buy signals, Coinbase Derivatives-backed XRP futures drive price to $3?

- XRP regains momentum above $2 as Bitcoin recovers past $87,000 during the Asian session on Monday.

- Coinbase Derivatives’ XRP futures could start trading on Monday, potentially driving institutional adoption and trading volume.

- The MACD validates a buy signal, and the RSI reinforces the bullish momentum.

- Downside risks at $2 remain, and if volatility spikes, XRP price could extend losses to $1.96 before $1.62.

Ripple (XRP) edges higher on Monday, climbing 1.54% on the day to trade at $2.11 at the time of writing. Bulls have shown resilience and determination in the last week, upholding XRP above the $2.00 level. Several factors that could be contributing to the token’s bullish momentum include the launch of XRP futures trading by Coinbase Derivatives, a spike in open interest and technical indicators flashing buy signals amid improving sentiment across the crypto market.

The largest cryptocurrency by market capitalization, Bitcoin (BTC), steadied movement during the Easter weekend, which continued on Monday with a 2.71% daily increase to $87,440. Ethereum (ETH) responded to the improving outlook, climbing 3% to $1,636, while Solana (SOL) broke above $140 resistance at the time of writing.

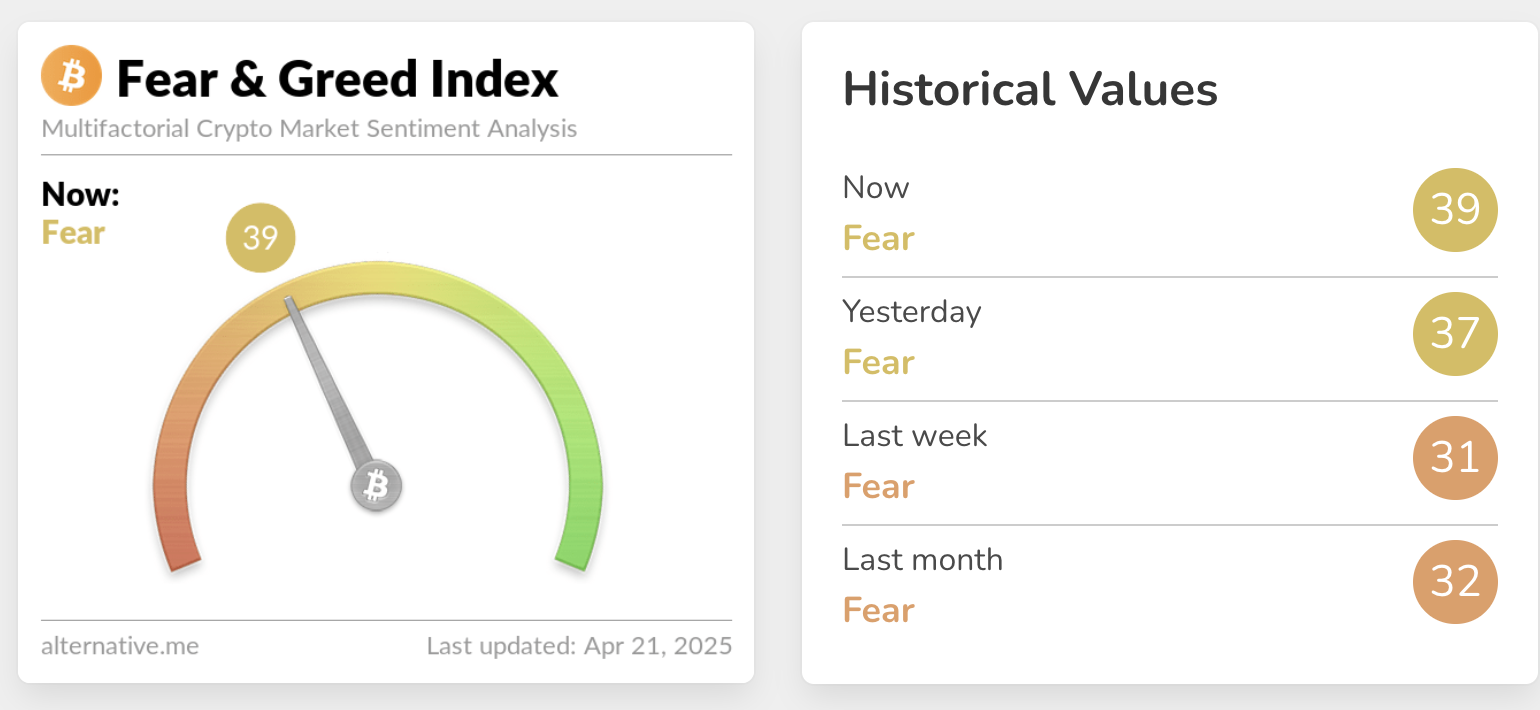

According to Alternative.me, the fear and greed index is regaining momentum at 39, indicating a significant jump from the extreme fear conditions witnessed ahead of United States (US) President Donald Trump’s reciprocal tariffs on April 9. In addition to the 90-day tariffs’ pause, various factors encourage risk-on sentiment, such as oversold conditions and an improving regulatory environment in the US.

The fear & greed index | Source: Alternative.com

Coinbase Derivatives’ XRP futures could launch on Monday

Coinbase Derivatives, a subsidiary of Coinbase cryptocurrency exchange, could launch XRP futures contracts trading on Monday. As FXStreet reported, Coinbase Institution announced on April 4 that Coinbase Derivatives had filed with the Commodities Futures Trading Commission (CFTC) to “self-certify” XRP futures.

If approved, the development would support institutional adoption of XRP, ensuring investors have access to a regulated instrument to one of the industry’s most liquid digital assets.

Coinbase Derivatives expects to kick off XRP futures trading on Monday, with more information regarding launch timelines and availability provided to investors beforehand.

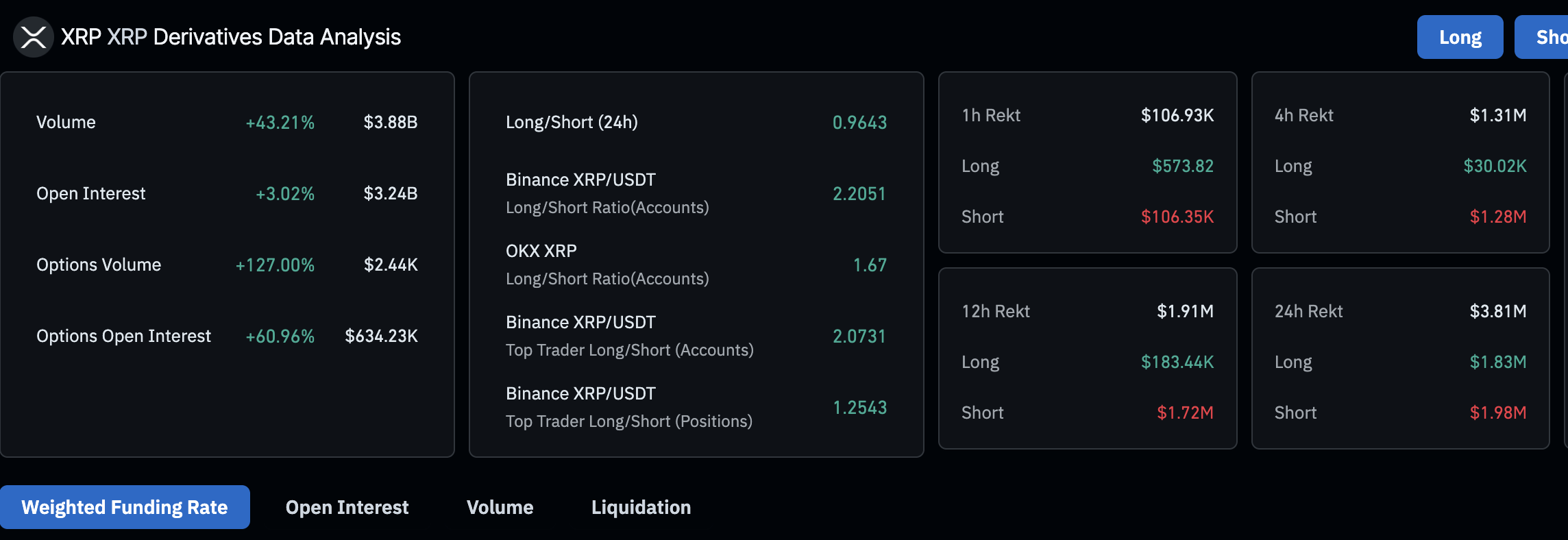

Coinglass data on XRP derivatives suggests sentiment is improving, which may elevate the digital asset to higher levels in the coming days. A 3% increase in the open interest to $3.24 billion suggests that new capital is entering the derivatives market due to growing trader interest or confidence in the direction of the XRP price.

XRP derivatives data | Source: Coinglass

Similarly, declining liquidations to $3.81 million in the last 24 hours implies that fewer traders are being wiped out, which may result in lower short-term volatility. For traders, this could mean a stable environment to hold positions longer, anticipating further price action in the same direction.

Can XRP bulls shape the trend to $3?

XRP stabilized at the time of writing on Monday after support at $2.00 reduced downside risks during the weekend, calling traders to seek exposure to the cross-border money remittance token. A buy signal from the Moving Average Convergence Divergence (MACD) indicator alongside the green histograms affirms the bullish outlook.

Moreover, conservative traders may wait until the MACD indicator crosses above the center line before going all in on XRP. However, it is worth noting that the Relative Strength Index (RSI) has recently broken the descending trendline resistance, hinting at a change of guard in favor of the bulls.

Traders may want to pay attention to other key levels, including the resistance posed by the 50-day and 100-day Exponential Moving Averages (EMA) around $2.22, support at $2.00 and the 200-day EMA at $1.96. Breaking the two hurdles would culminate in a path with the least resistance towards $3.00.

XRP/USD daily chart

On the other hand, losing support at $2.00 could accelerate losses to the 200-day EMA at $1.96. XRP price may drop to retest April’s lowest level at $1.62 in case of heightened volatility, triggering liquidations and profit-taking.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.