Here is what you need to know on Tuesday, September 2:

Gold extended its rally into a sixth consecutive trading day in the Asian session on Tuesday and touched a new record-high above $3,500. In the European session, the preliminary Harmonized Index of Consumer Prices (HICP) data for August, the European Central Bank's (ECB) preferred gauge of inflation, will be watched closely. Later in the day, the ISM Manufacturing Purchasing Managers Index (PMI) report for August will be featured in the US economic calendar.

The US Dollar (USD) started the week under bearish pressure, even though financial markets in the US were closed in observance of the Labor Day holiday. Growing concerns over the Federal Reserve's (Fed) independence and the uncertainty surrounding the US trade regime made it difficult for the USD to find demand on Monday. The USD Index edged lower and touched its weakest level in a month near 97.50 before correcting higher early Tuesday. At the time of press, the USD Index was trading marginally higher on the day at 97.80.

US Dollar Price Last 7 Days

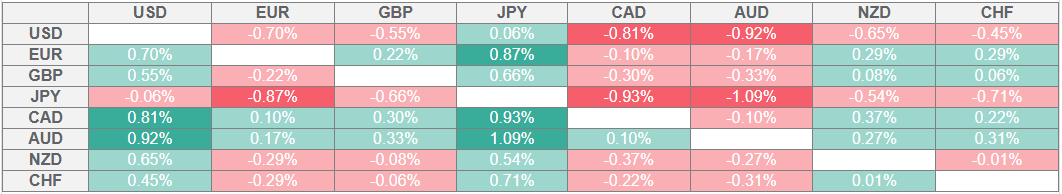

The table below shows the percentage change of US Dollar (USD) against listed major currencies last 7 days. US Dollar was the weakest against the Australian Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Gold capitalizes on safe-haven flows as geopolitical tensions continue to escalate. After Russia carried out an attack on 14 regions of Ukraine over the weekend, Ukraine responded by striking Russian oil refineries. Meanwhile, Russia's RIA state news agency reported early Tuesday that Russian President Vladimir Putin said that they prepared to support the strategic partnership with China and strengthen contacts with Beijing on a high level. Gold set an all-time-high of $3,508 during the Asian trading hours before retreating below $3,500 by the European morning.

EUR/USD stays in a consolidation phase at around 1.1700 after posting marginal gains on Monday. On a yearly basis, the core HICP is forecast to rise 2.2% in August, following the 2.3% increase recorded in July.

After ending the previous week with small losses, GBP/USD edged higher and gained 0.3% on Monday. The pair corrects lower in the European morning on Tuesday but holds comfortably above 1.3500.

Bank of Japan (BoJ) Deputy Governor Himino said on Tuesday that Japan's real interest rate is still very low, adding that it’s appropriate to continue raising interest rates if the economic outlook is met. USD/JPY gathers bullish momentum despite these comments and trades near 148.00 in the early European session, rising more than 0.5% on the day.

AUD/USD continued to push higher and registered gains for the fifth consecutive trading day on Monday. The pair edges lower in the European morning and trades below 0.6550.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.