Ethereum Price Forecast: ETH ETFs total net assets plummet over 60%; Justin Sun says he won't sell ETH

Ethereum price today: $1,580

- Ethereum ETFs have seen over a 60% decline in total net assets.

- Justin Sun said Tron will not sell its ETH holdings amid a drop in prices.

- Galaxy Digital has deposited $79.37 million worth of ETH to Binance and Coinbase over the past five days.

- ETH has maintained a downtrend since December amid oversold conditions in technical indicators.

Ethereum (ETH) traded just below $1,600 on Thursday following a 60% plunge in the total net assets of US spot Ether ETFs. Meanwhile, Tron founder Justin Sun said that he won't sell his ETH holdings despite the sustained downtrend in the top altcoin’s price.

Sun weighs in on Ethereum's decline amid heightened ETH ETF outflows

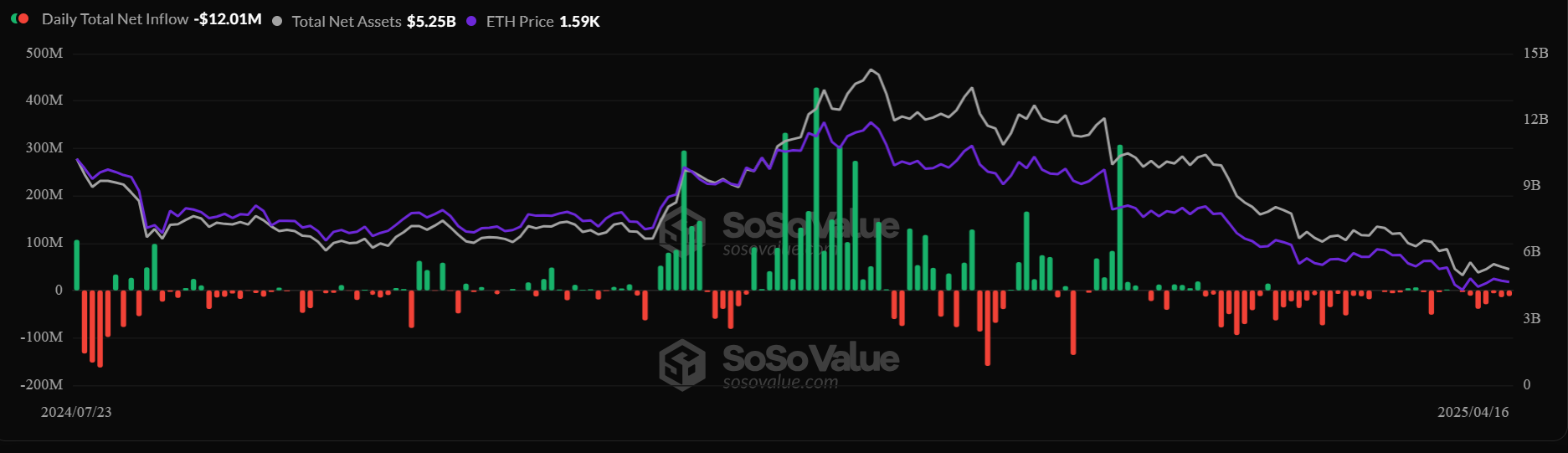

US spot Ether exchange-traded funds (ETFs) continued their negative flows on Wednesday after shedding $12.01 million, per SoSoValue data.

Since Trump’s tariffs went live, ETH ETFs have seen a net outflow of $909 million. ETH's weak price has also caused their total net assets to plummet by over 60%, going from an all-time high of $14.28 billion in December to $5.25 billion on Wednesday. The sustained outflows signal increased institutional risk-off sentiment, hampering ETH's price growth.

US Spot ETH ETF Net Flows. Source: SoSoValue

This comes as issuers, including Fidelity, Bitwise, Grayscale and 21Shares, are seeking approval from the Securities and Exchange Commission (SEC) to allow staking within their ETH ETF products. Approval from the SEC will see investors earning ~3% yield on their ETH ETF holdings, potentially slowing down selling pressure on the products.

Meanwhile, in an X post on Thursday, Tron founder Justin Sun noted that he will not sell its ETH holdings despite the top altcoin's weak price action in the past few months. Instead, he highlighted that Tron will continue collaborating with Ethereum developers.

"ETH is currently at a low price, but we have no intention of selling our ETH holdings," Sun wrote on X.

Sun has been a major investor in ETH, increasing his holdings on several occasions in the past year. While Sun reportedly transferred a huge amount of ETH to his HTX exchange in Q4' 24, he still holds a fat ETH balance across several staking protocols. One whale wallet potentially belonging to Sun holds over 168,000 stETH, per Arkham's data.

Sun's remark follows potential selling activity from digital asset firm Galaxy Digital, which has deposited 49,681 ETH worth about $79.37 million into Binance and Coinbase over the past five days, per wallet tracking platform Lookonchain’s data. Several ETH whales also capitulated within the past month following Trump's tariff impact on the market.

Ethereum Price Forecast: ETH continues downtrend amid oversold conditions in technical indicators

Ethereum saw $23.10 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of long and short liquidations is $12.52 million and $10.58 million, respectively.

ETH has been on an extended downtrend since December 16, stretching its move within a key descending channel beyond four consecutive months. This marks ETH's longest multi-month downtrend since it launched in 2017.

ETH/USDT weekly chart

A breakdown below the channel's lower boundary could accelerate ETH's decline and cause immense capitulation. However, a breakout above the channel's upper boundary and reclaim of the $2,000 key level could flip ETH into a bullish trend.

The Relative Strength Index (RSI) is on the verge of entering the oversold region, while the Stochastic Oscillator (Stoch) has remained oversold since late February. The Moving Average Convergence Divergence (MACD) posted two consecutive receding histogram bars, indicating a slight weakness in the bearish momentum.