CBRT surprises markets with a rate hike to 46.00%

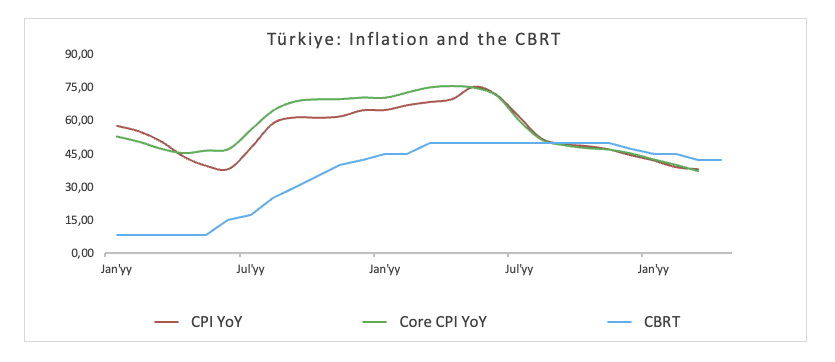

The Turkish central bank (CBRT) shocked investors on Thursday with a hefty 350 bps leap in its key interest rate to 46%, abruptly reversing its easing cycle and giving the lira a modest boost.

The surprise move, prompted by last month’s market roller‑coaster following Istanbul’s mayoral arrest, didn’t stop there: policymakers also raised the overnight lending rate from 46% to 49%, lifted the overnight borrowing rate to 44.5% from 41.0%, and suspended one‑week repo auctions. All of this unfolded against a backdrop of mounting global uncertainty, as the US‑China trade war escalates and rattles markets worldwide.

Key takeaways from the bank’s statement

- Underlying trend of inflation declined in March.

- Leading indicators point to a level of domestic demand above projections despite some loss of momentum in the first quarter.

- Potential effects of the rising protectionism in global trade on the disinflation process through global economic activity, commodity prices and capital flows are closely monitored.

- Inflation expectations and pricing behaviour continue to pose risks to the disinflation process.

- Decisiveness regarding tight monetary stance is strengthening the disinflation process through moderation in domestic demand, real appreciation in Turkish lira, and improvement in inflation expectations.

- Going forward, increased coordination of fiscal policy will also contribute significantly to this process.

- The tight monetary stance will be maintained until price stability is achieved via a sustained decline in inflation.

Market reaction

The Turkish Lira has appreciated markedly following the surprising hike by the CBRT, putting USD/TRY under decent downside pressure and dragging it to the 3800 neighbourhood on Thursday.