US Economic Signals with Crypto Implications This Week

As July ends, traders and investors will keep an eye on August. They will watch several US economic signals that could influence their portfolios.

This week’s US economic signals are particularly important with Bitcoin (BTC) eyeing the $120,000 threshold.

US Economic Indicators That Could Impact Bitcoin This Week

The crypto market is up today, with Bitcoin leading the charge as it closes in on $120,000. However, whether this optimism is sustainable depends on how this week’s US economic signals unfold.

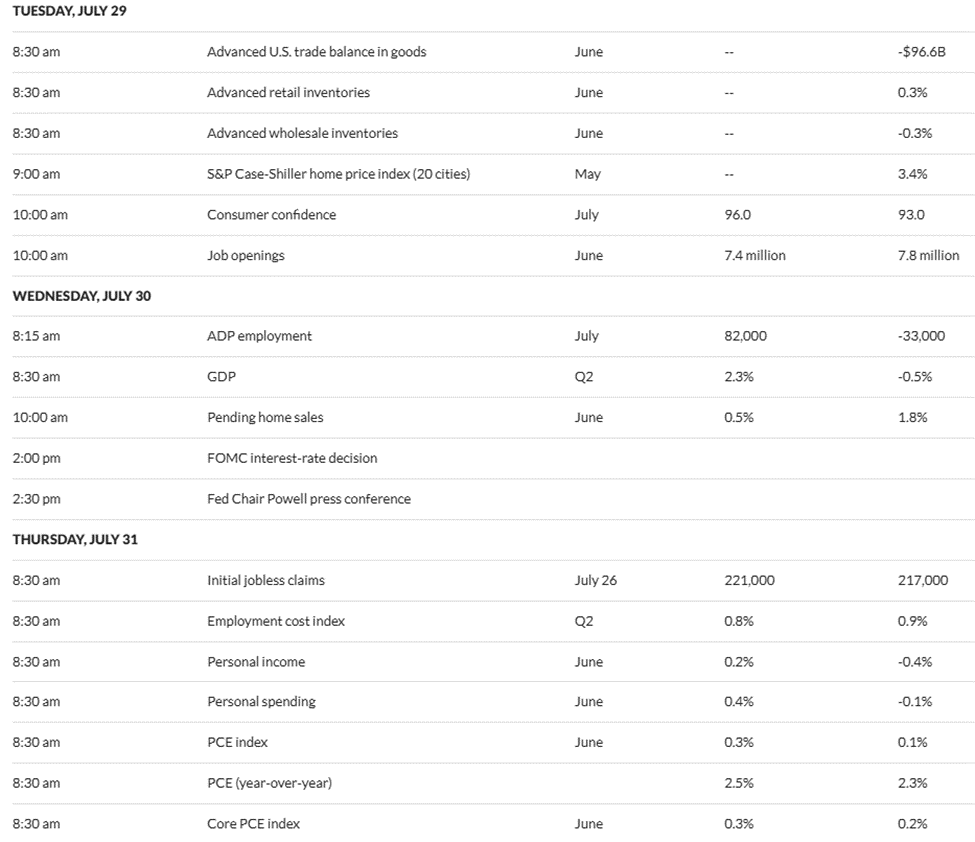

US Economic Signals this week. Source: MarketWatch

US Economic Signals this week. Source: MarketWatch

Consumer Confidence

The consumer confidence report is starting this week’s US economic signals, which are due on Tuesday. The Conference Board’s Consumer Confidence Index plummeted to 93.0 in June 2025, a 5.0-point drop from May (98.0).

According to data on MarketWatch, the median forecast is 96.0, suggesting economists are more optimistic for July. However, consumers express growing concerns amid Trump’s tariffs.

“Consumers are unlikely to regain their confidence in the economy unless they feel assured that inflation is unlikely to worsen, for example if trade policy stabilizes for the foreseeable future,” Reuters reported, citing Joanne Hsu, the director of the Surveys of Consumers.

This erosion of confidence suggests a reduced risk appetite. Pessimistic consumers are less likely to invest in speculative assets like Bitcoin, favoring safer options like bonds or cash.

If the July consumer confidence rises above expectations, it could bolster risk appetite, potentially boosting crypto.

Jobs Reports

US labor data is one of Bitcoin’s most significant macro factors in 2025. This week’s US economic signals will feature several jobs reports, positioning Bitcoin for volatility.

The Job Openings and Labor Turnover Survey (JOLTS) report and Job Openings are due on Tuesday and will be released by the US Bureau of Labor Statistics (BLS).

JOLTSThe June JOLTS report, due on Tuesday, is projected to come in lower than the 7.8 million recorded in May. According to economists surveyed by MarketWatch, data on job openings, hires, and separations in the US could come in at 7.4 million.

Despite the projected drop, a 7.4 million reading would still exceed the multi-month low of 7.192 million recorded in March. Notwithstanding, it remains the key highlight of this week’s US economic indicators.

ADP EmploymentAnother labor market data point to watch this week is the July ADP employment report. The BLS report, which is more comprehensive and widely regarded as the official measure, indicated that private-sector employment dropped by 33,000 jobs in June 2025.

The figure was significantly lower than economists’ expectations of a 95,000 job increase, with the decline suggesting a slowdown in hiring. Data on MarketWatch shows that economists projected 82,000 job increases in July, which would still be lower than the previous reading.

Initial Jobless ClaimsAnother labor market data feature among US economic signals this week is the initial jobless claims, due on Thursday. This weekly jobs data highlights the number of US citizens who filed for unemployment insurance the previous week.

Initial jobless claims came in at 217,000 in the week ending July 19, but economists anticipate better prospects for the week ending July 26 and anticipate up to 221,000 applications.

An uptick in jobless claims may signal economic weakness. This would increase the likelihood of the Fed adopting a more accommodative monetary stance.

Such a shift could lead to a weaker dollar, enhancing Bitcoin’s attractiveness as an alternative asset. However, if the rise in claims is viewed as a temporary fluctuation, the impact on Bitcoin may be limited.

Meanwhile, analysts say a resilient labor market, coupled with sticky inflation, could allow interest rates to remain elevated. However, signs of a cooling job sector could temper the Fed’s path.

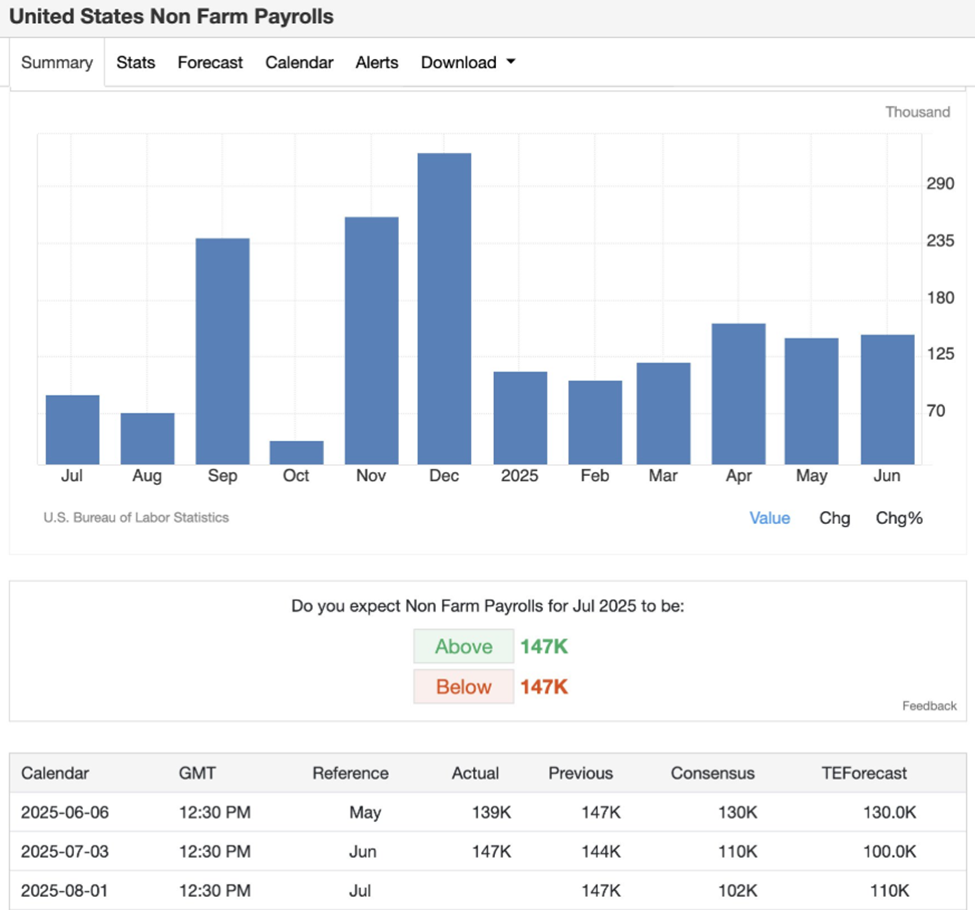

Non-Farm PayrollsThe US Employment report, or Non-Farm Payrolls (NFP) for July 2025, is scheduled for release on Friday. The economy added 147,000 jobs in June after 139,000 jobs in April. Meanwhile, the unemployment rate dropped to 4.1% in June after 4.2% in May.

Non-farm payroll and unemployment in the US. Source: Trading Economics

Non-farm payroll and unemployment in the US. Source: Trading Economics

Data on MarketWatch shows that economists anticipate an increase of 4.2% in the US unemployment rate against a slowdown in jobs to 102,000. This drop or slowdown reflects potential economic impacts from President Trump’s tariffs.

Strong job growth may lead the Fed to maintain its current monetary policy stance or even consider tightening, which could strengthen the US dollar and potentially suppress Bitcoin.

However, if underlying economic concerns prompt the Fed to adopt a more dovish approach, Bitcoin could benefit as investors seek alternative stores of value.

Analysts say tough employment conditions in the US come as employers seeking clarity around the White House’s trade policy progressively having to deal with frequent adjustments to timelines and schedules.

FOMC Interest Rate Decision

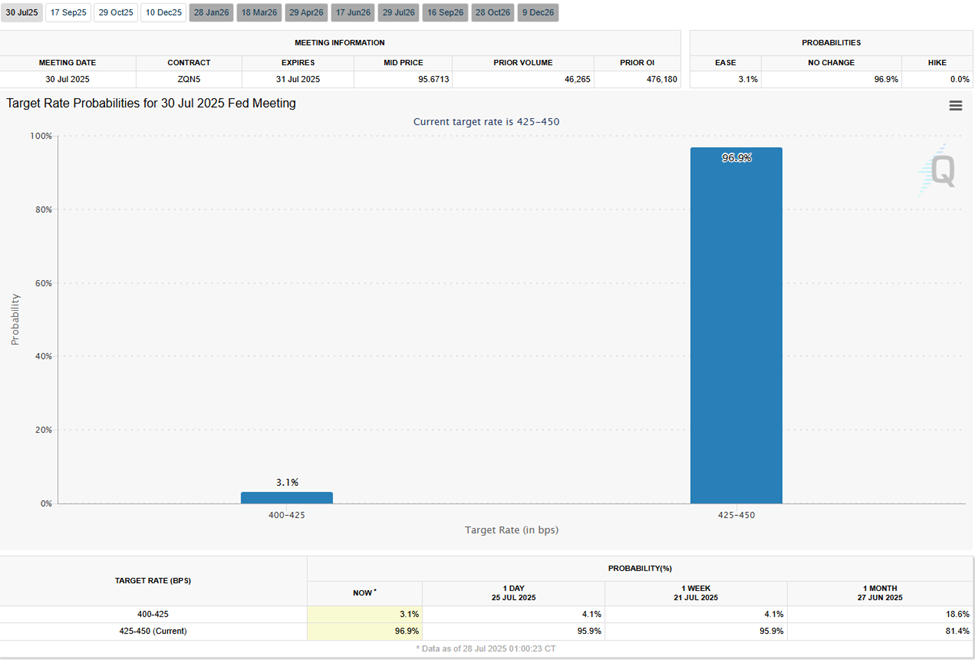

Meanwhile, this week’s US economic signals highlight the FOMC interest rate decision on Wednesday. This economic indicator comes after the US CPI (Consumer Price Index) showed inflation rose to 2.7% in June.

The FOMC minutes on July 9 suggested rate cuts this year, with policymakers agreeing inflation had eased but remained “somewhat elevated.” Additionally, uncertainty around the outlook had diminished, though not disappeared.

However, whether the Fed will cut interest rates on July 30 remains to be seen. Data on the CME FedWatch Tool shows that interest bettors see a 96.9% probability that the Fed will keep interest rates unchanged between 4.25% and 4.50%.

Fed Interest Rate Probabilities. Source: CME FedWatch Tool

Fed Interest Rate Probabilities. Source: CME FedWatch Tool

“What’s more interesting is the Powell press conference. A few days ago, Trump met Powell, and he’s expecting the Fed to be dovish. A few other Fed governors are also calling for low interest rates, so this press conference will be pivotal,” one user observed.

Indeed, beyond the FOMC interest rate decision, traders and investors will closely examine Fed chair Jerome Powell’s speech for signals into the Fed’s future outlook.

If Powell hints at rate cuts in September, it could inspire optimism in the market. However, if he sounds just like the last FOMC meetings, the crypto market might see a sharp correction.