Solana Price Forecast: SOL closes in on $200 as fund inflows accelerate

- Solana extends gains above $190, piggybacking on growing demand.

- Institutional interest in SOL bolsters capital inflow, which reached $39 million last week.

- Solana could face declining selling pressure after clearing a robust 8 million SOL supply zone at around $190.

Solana (SOL) price is upholding a robust bullish outlook, trading at $191 on Monday, following a steady near 25% increase in July. The bullish picture has been reinforced by growing demand for the smart contracts token from both institutional and retail investors. If demand continues to outpace supply, Solana could accelerate its uptrend past $200 in upcoming sessions or days.

Solana captures institutional and retail interest

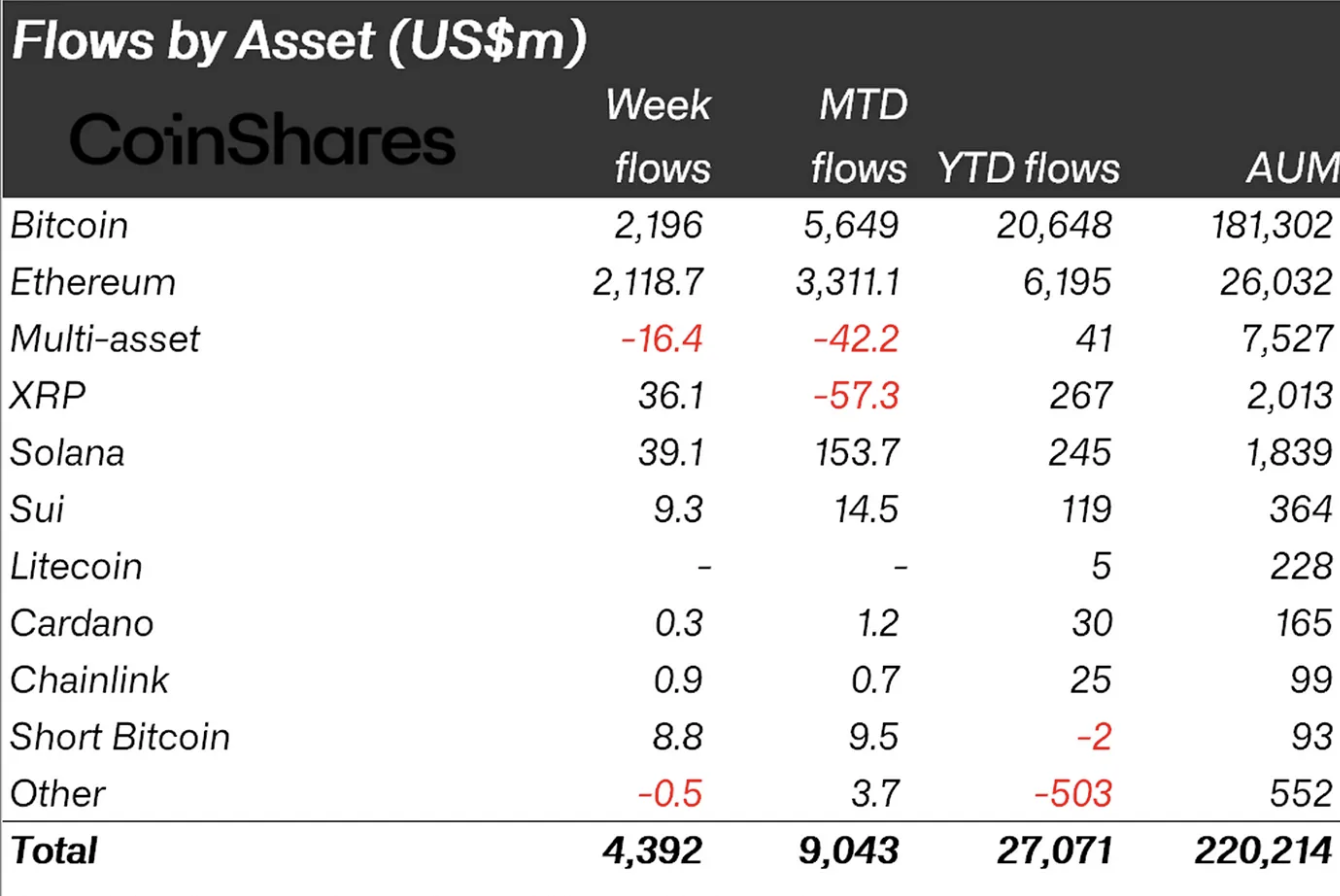

Solana garnered significant institutional interest last week, according to CoinShares' digital fund flows report. About $39.1 million capital entered Solana-related financial products last week, bringing the year-to-date (YTD) net inflow to $245 million and the total Assets Under Management (AUM) to nearly $1.84 billion.

"Solana, XRP and Sui were notable for their inflows totalling US$39m, US$36m and US$9.3m respectively," CoinShares' weekly report states.

Digital asset fund flows weekly report | Source: CoinShares

Fundamental data from CoinGlass confirms retail interest in SOL, as evidenced by the sharp increase in SOL futures contracts' Open Interest (OI) to $9.5 billion from $7.1 billion on July 1.

Open Interest refers to the total value of futures and options contracts that have not been settled or closed. A consistent increase in OI, alongside the trading volume, signals that traders are willing to bet on a short-term price increase for Solana.

The derivatives market volume has also expanded over the same period, reaching $26.3 billion after a 60% surge in the past 24 hours. Liquidations of short position holders, worth $11.4 million, compared to $4.5 million in long positions, helped fuel the price pump, targeting highs beyond $200.

Solana futures' Open Interest | Source: CoinGlass

Technical outlook: Why Solana could surge beyond $200 in the near term?

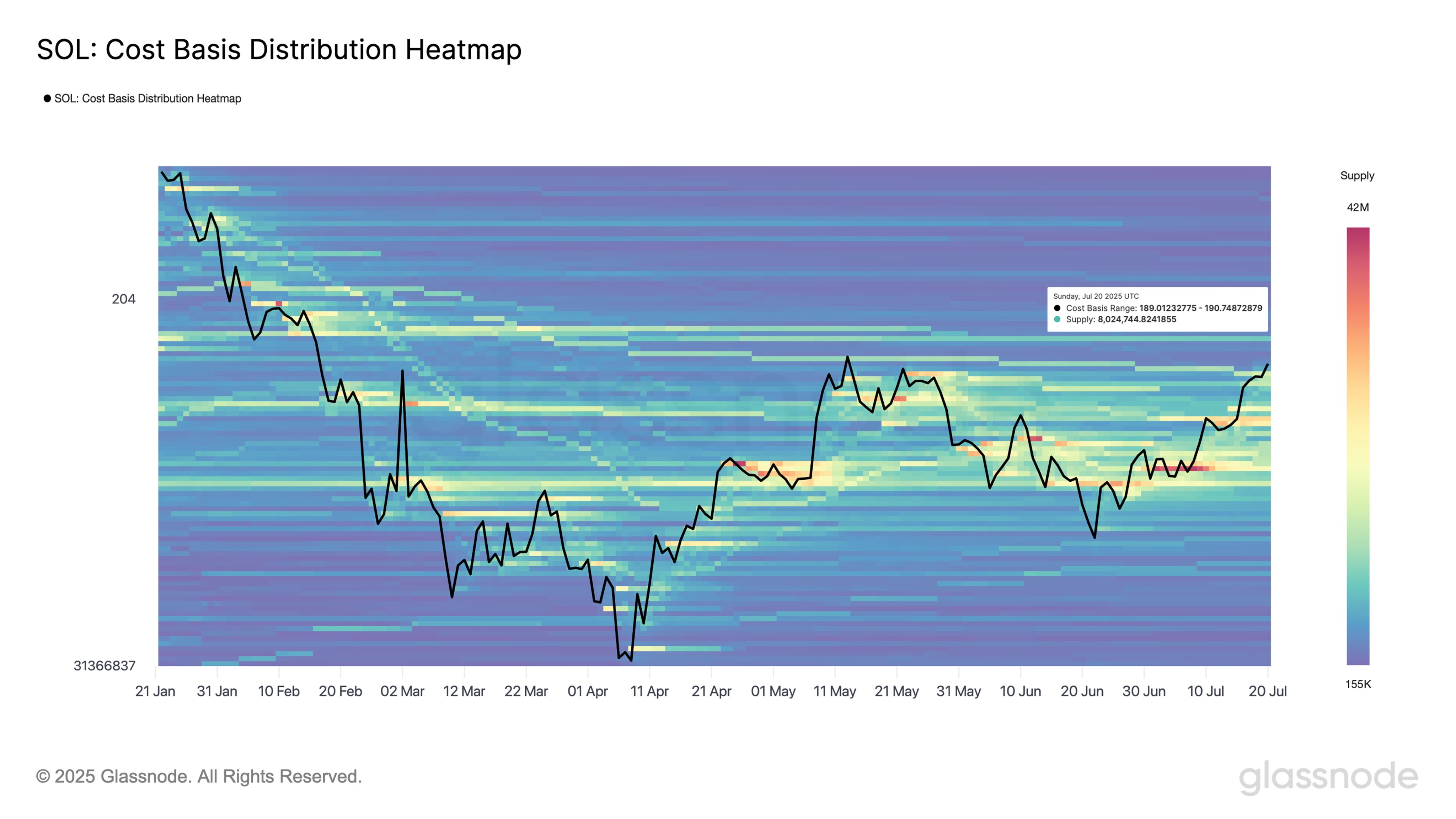

Solana's price is fostering a bullish outlook on Monday, supported by key buy signals, growing demand, and bullish market sentiment. The smart contracts token also sits above the $190 resistance-turned-support level, a point where Glassnode said investors had accumulated at least 8 million SOL.

"Above this level, supply becomes less dense - suggesting that, if demand persists, the uptrend could accelerate due to reduced overhead resistance," Glassnode said via an X post.

Solana Cost Basis Distribution Heatmap | Source: Glassnode

The bullish trend is reflected in Solana price holding above the Ichimoku Cloud indicator. When the price is above the cloud, as shown on the daily chart below, it signals bullish momentum and potential buying interest. The Ichimoku Cloud indicator also serves as support, encouraging traders to seek exposure or hold SOL.

SOL/USDT daily chart

A buy signal from the Moving Average Convergence Divergence (MACD) indicator triggered on June 28 points to bullish momentum building. As long as the blue MACD line remains above the red signal line, traders would be inclined to buy SOL rather than sell the token.

However, the Relative Strength Index (RSI), currently overbought at 77, indicates that the uptrend remains steady. However, as the RSI rises, it calls for caution, suggesting that the market could be overheating and a trend reversal in the offing.

Gauging market sentiment could help traders prepare for sudden pullbacks with support likely at $175, a level tested in mid-June as resistance and the 200-day Exponential Moving Average (EMA) at $160.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.