XRP Overtakes USDT Market Cap, But Price Concerns Remain – Here’s Why

XRP recently achieved a significant milestone, pushing its market cap to $164.47 billion, making it the third-largest cryptocurrency in the world, surpassing Tether (USDT).

The altcoin has seen a surge in price, with a notable rally driving the price higher. However, as XRP climbs, the potential for profit-taking increases, as observed in the last 24 hours.

XRP Holders Secure Their Profits

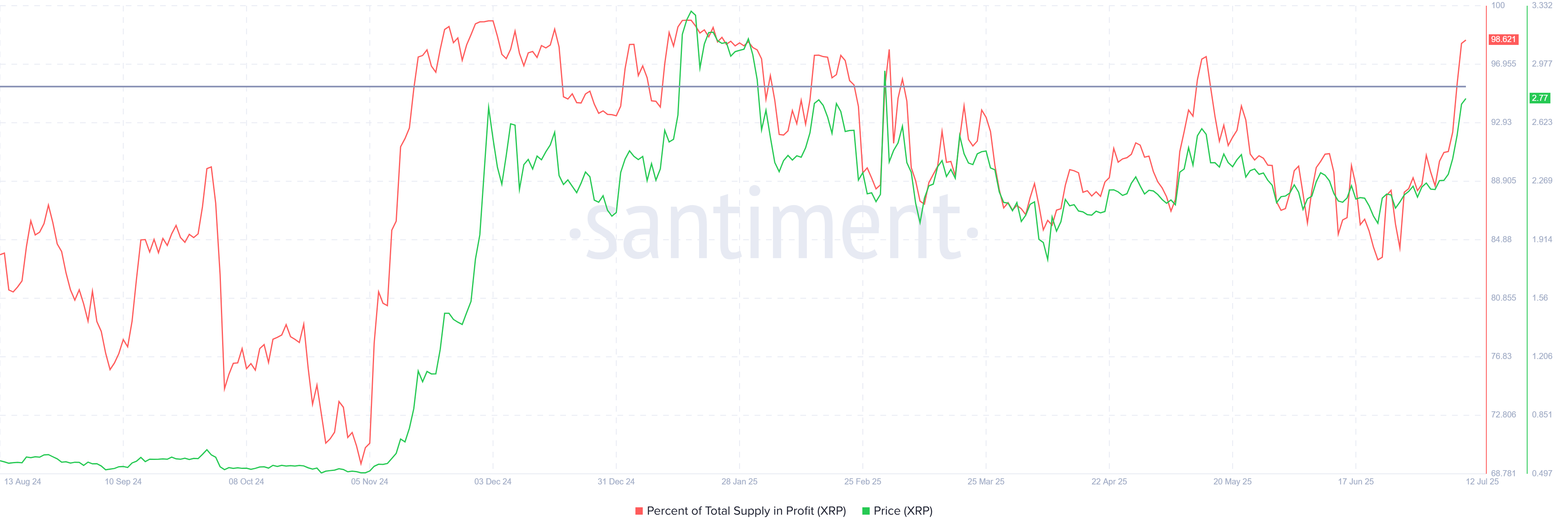

XRP’s supply in profit has recently crossed the 95% threshold, a critical level often seen as a signal of market tops. When supply exceeds this level, it usually results in a price reversal.

However, XRP has consistently reached this area over the past year and managed to maintain its price, moving sideways with occasional corrections. This historical behavior suggests that while the current rise could face resistance, it may not necessarily lead to a drastic reversal.

XRP Supply In Profit. Source: Santiment

XRP Supply In Profit. Source: Santiment

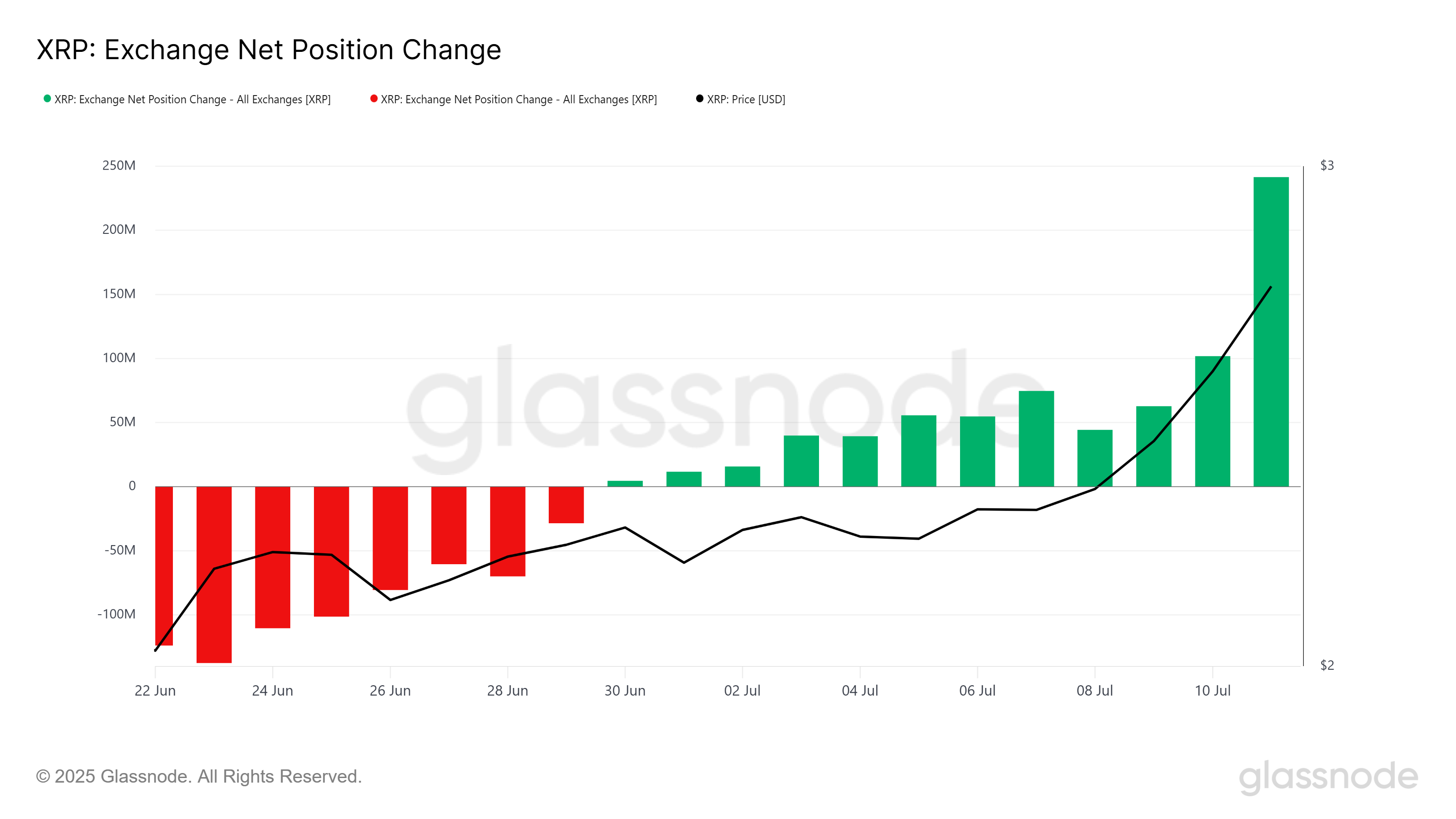

The overall macro momentum for XRP, however, raises concerns. In the last 24 hours alone, over 140 million XRP, valued at more than $387 million, have been sold to exchanges.

This large sell-off signals a lack of conviction among investors, as many appear to be booking profits.

With such a large volume of XRP entering exchanges, the market sentiment may weaken, as investors are securing gains. While this is typical in bull markets, the scale of selling in the last 24 hours could lead to a pullback, negatively impacting the price of XRP in the short term.

XRP Exchange Net Position Change. Source: Glassnode

XRP Exchange Net Position Change. Source: Glassnode

XRP Price May Face Some Troubles

XRP price has risen 9% over the past 24 hours, peaking at 16% during intra-day highs. Despite this strong performance, XRP missed hitting the $3.00 mark by inches. This rally has drawn significant attention, but the price faces challenges as it nears key resistance levels.

Trading at $2.78, XRP may struggle to reach $3.00 given the factors discussed above. If the selling pressure intensifies, a drop below $2.65 is likely, with the potential for further declines to $2.35.

This could trigger a broader market correction, wiping out the recent gains and hindering further price growth.

XRP Price Analysis. Source: TradingView

XRP Price Analysis. Source: TradingView

However, if broader market conditions remain bullish and if whales step in to absorb the sold supply, XRP could push toward $3.00. Breaching this key resistance would mark a five-month high and potentially pave the way for further gains.

The ability to break through this level will depend on continued investor confidence and market stability.