Stellar Price Prediction: XLM bulls take charge as Total Value Locked and stablecoin activity rise

- Stellar price extends its mid-week rally, gaining nearly 5% as bullish momentum builds.

- On-chain data paints a bullish picture as TVL reaches record levels and stablecoin supply rises.

- The technical outlook suggests a continuation of the rally, targeting the $0.285 mark.

Stellar (XLM) continues its upward trajectory mid-week, gaining nearly 5% so far and trading around 0.260 on Wednesday. The bullish outlook is fueled by strong on-chain data, with Total Value Locked (TVL) hitting record highs and stablecoin activity rising this week. On the technical side, XLM could be gearing up for a push toward the $0.285 level.

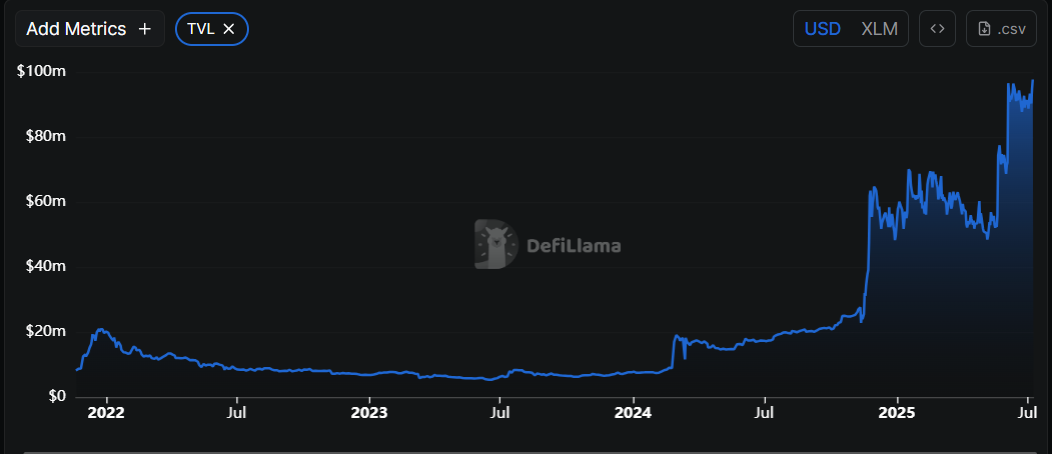

Stellar’s TVL reaches all-time highs of over $97 million

Data from crypto intelligence tracker DefiLlama shows that Stellar’s TVL increase reached a new all-time high (ATH) of $97.7 million on Wednesday. This increase in TVL indicates growing activity and interest within Stellar’s ecosystem, suggesting that more users are depositing or utilizing assets within XLM-based protocols.

Stellar TVL chart. Source: DefiLlama

Artemis terminal data show that XLM’s stablecoin market capitalization has risen sharply since mid-June and currently stands at $630.9 million as of Wednesday. Such stablecoin activity and value increase on the XLM project indicate a bullish outlook, as they boost network usage and can attract more users to the ecosystem.

-1752039803899.jpeg)

XLM stablecoins Mcap chart. Source: Artemis terminal

Stellar Price Prediction: XLM bulls are in control of the momentum

Stellar price broke above the descending trendline (drawn by connecting multiple highs since the end of November) on Sunday. It rallied nearly 9%, closing above its 50-day Exponential Moving Average (EMA) at $0.255 until Tuesday. At the time of writing on Wednesday, it continues to trade higher at around $0.265.

If XLM continues its upward momentum, it could extend the rally to retest its June 11 high of $0.258. A successful close above this level could extend the gains toward the next resistance, which is the daily resistance level of $0.356.

The Relative Strength Index (RSI) on the daily chart reads 59, above its neutral level of 50 and points upwards, indicating strong bullish momentum. The Moving Average Convergence Divergence (MACD) indicator on the daily chart also displayed a bullish crossover on July 3. It also shows rising green histogram bars above its neutral level, suggesting bullish momentum and indicating an upward trend.

XLM/USDT daily chart

However, if XLM faces a correction, it could extend the decline to retest its weekly support at 0.221.